Why NYC Could Have a (Small) Baby Boom in Nine Months

July 15, 2019

Why We Want Sneakers Made From Coffee

July 17, 2019When Georgia farmer David Reed talks about the summer of 2018, he recalls expecting the best peanut crop in 50 years, But then, Hurricane Michael hit several peanut fields and China responded to President Trump’s new tariffs with rates as high as 25% on the peanut butter that it imports.

Usually when supply decreases, prices rise. However, in world markets, peanut prices were down by 30% and orders were plunging because China wanted much less peanut butter.

Some say that U.S. tariff revenue on Chinese imports is the bright side. So let’s take a look.

Tariff Revenue

High Income Countries

When we consider the revenue a country gets from tariffs, income matters. In the High Income Countries (HICs), tariffs provide a small proportion of the money they need to run the country. For a low income nation though, it is a different story. With less ability to collect tax revenue from individuals and businesses, developing nations tend to depend more on tariffs for the revenue government needs to run the country.

Below in red you can see that LICs (low income countries) have the highest trade revenue numbers (as a % of GDP) and relatively less total tax revenue:

The United States

As an HIC, the U.S. follows the pattern. The total tax revenue received by the U.S. government should be in the vicinity of $3.7 trillion for FY2020. Approaching $80 billion, tariffs could compose close to 2% of that total. So yes, recently tariff revenue has gone up but the total still remains proportionally small:

Farmers

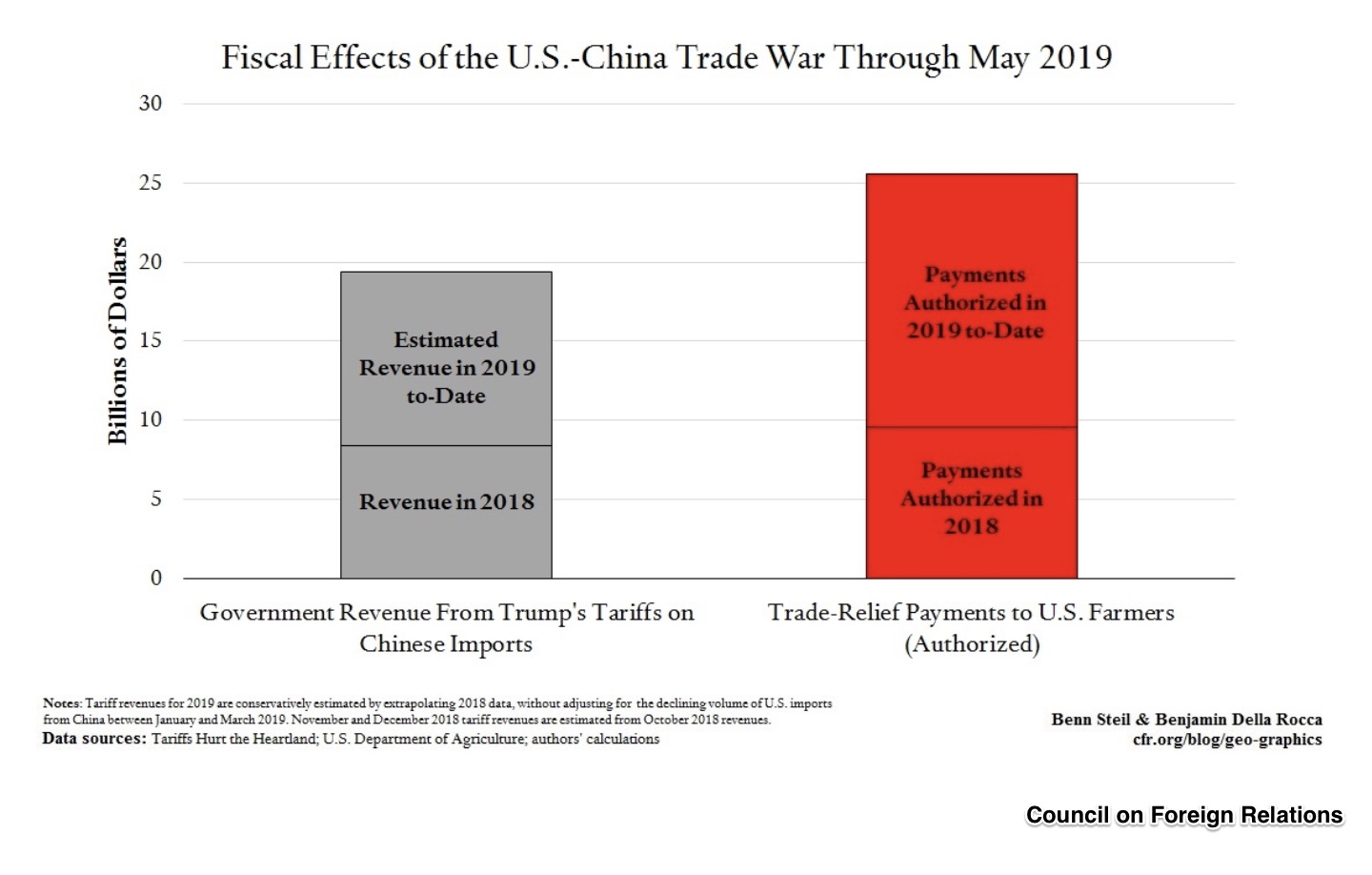

And we can also ask where that tariff revenue is going. According to the Council on Foreign Relations, 130% of the tax on Chinese imports is being paid to farmers. Furthermore, also from government coffers, peanut farmers can receive a subsidy of $341.19 an acre because of the 2014 Farm Bill:

And, who is paying these tariffs?

Consumers

The consumer is paying the tariff. According to a Federal Reserve paper, as consumers, each of us, including our peanut farmer, is paying $831 more annually. That $831 includes $211 directly from tariffs and $620 from the higher prices that tariffs create.

Our Bottom Line: Tariff Revenue

So yes, tariff revenue is all about peanuts.

- The revenue from tariffs is small–it’s peanuts.

- Peanut farmers, like other exporters have diminished business because of tariffs.

- And like all consumers, peanut farmers are paying higher prices.

My sources and more: It is always such a delight when two sources have some synergy. For today, the connection was between this Trade Talks podcast on tariff revenue and this NPR piece from a peanut farmer. From there, i took a look at this paper on the history of tariffs, the congressional research on farm subsidies, and an Atlantic article on tariffs. As a final step, for even more, you might like to look at this Federal Reserve paper on consumer price hikes.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)