A Surprising Way to Ration Education

May 23, 2017

The Problem With Sand

May 25, 2017Imagine for a moment that you can choose your parking lot payment plan. It could cost you $10 every time you use the lot or $200 per month. Because the lot is located near your job, you need it every weekday–at the least, a $200 expense.

More than money though, the decision is really about incentives.

Paying daily means you will want to use the lot less. You might skip a Saturday visit to the office or avoid driving to a lunch date and then bringing the car back to work. You could car pool, take the bus or Uber.

The monthly payment encourages entirely different behavior. Because your visits are unlimited, they result in using the parking lot more frequently.

Healthcare and Capitation

During the mid to late 1990s, healthcare plans experimented with a capitation approach. In 1999, one third of all doctors had a capitation contract.

The capitation concept resembles the single monthly parking lot charge. Healthcare providers agree to a lump sum that covers an individual’s healthcare expense for a certain time period.

One alternative, like the per use parking lot payment, is fee for service. Every time a patient visits a provider, that person pays.

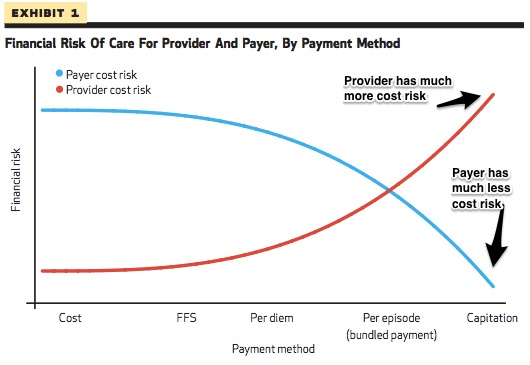

Health economists like to point out that the payment method is all about risk. With capitation, the provider bears the cost risk. For fee-for-service, it is the patient.

Below, you can specifically see the payment method/risk connection. Fee-for-service risk is much more for the payer and less for the provider. Moving to capitation, we have the reverse:

And that takes us to incentive. Because risk varies, so too does the behavior of the payer and the provider. With fee-for–service, the provider could offer more time and procedures. For capitation one result was “stinting” or transferring patients elsewhere.

Our Bottom Line: Thinking at the Margin

Rather than explore the pros and cons of different payment methods for parking lots and healthcare, our real goal is to see how we think at the margin.

Defined as something extra, the margin is where we make our decisions. We are always asking “how much more?” Awakening, we have to decide whether to sleep a bit longer. Running, we might be considering another mile.

With parking lots and healthcare, the margin is the next payment. But the next payment depends on your plan. Payers and providers can ask if they will pay for each visit or select a larger payment with unlimited use. Making a choice, they are thinking at the margin and determining the incentives that will shape their behavior.

My sources and more: This Austin Fract and Rick Mayes article details capitation (and was the source of my graph) while this Economix column places it within the larger healthcare landscape. Then, if we add Adam Davidson’s recent New Yorker discussion and Timothy Taylor’s lecture on 19th century economist Alfred Marshall’s marginalism, we can gain new insight about the future of healthcare costs.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)