How to Google Gender Bias

March 14, 2017

How a Cherry Orchard is About More Than Fruit

March 16, 2017A week ago, Treasury Secretary Steven Mnuchin sent a letter to Speaker of the House Paul Ryan. The letter said we will have maxed out our borrowing at midnight tonight. Having reached its “statutory limit,” the outstanding debt of the U.S. cannot go any higher unless Congress says yes.

Where are we going? To the debt ceiling and good credit.

Why We Borrow

We need to borrow because government spending exceeds its revenue. On the first of every month Medicare checks go out and then on the third of the month, it’s Social Security. Together, that’s maybe $46 billion. Also, the government pays for submarines and highway maintenance and soldiers’ salaries. It owes the President his paycheck. And still there is much more.

And that is why Steve Mnuchin wrote his letter. It is time for the Congress to give the Treasury permission to borrow more money. Otherwise, the Treasury Secretary said he will take “extraordinary measures” to prevent a default.

How We Borrow

Discussing the debt ceiling, we should first take a look at the debt. Whenever the U.S. borrows, someone, somewhere buys a Treasury security such as a bond. The U.S. gets the money. The lender gets the bond–an IOU– and the promise that it will be repaid with interest (for most types of securities).

So who has close to $20 trillion in government securities?

Actually, we do. The bonds are held by the public and in government accounts. The U.S. government lends to itself when the Social Security trust fund or Medicare swap their extra cash for bonds. In addition, individuals, businesses, state governments, local governments, pension funds–the list is long–buy U.S. Treasury securities.

The rest of the U.S. debt is held by foreign governments, businesses and citizens with Japan first and China next at the top of the list. Ireland, the Cayman Islands, Brazil follow them, and then a long list with Israel at the bottom for December 2016.

Borrowing History

We have a debt ceiling because of a 1917 law. At the time, the Congress decided it was losing control of the volume of borrowing. To regain power over the federal purse and fiscal policy, they said, “We will decide the maximum amount the U.S. can borrow.” And from that day onward, whenever necessary, they voted to raise the debt ceiling.

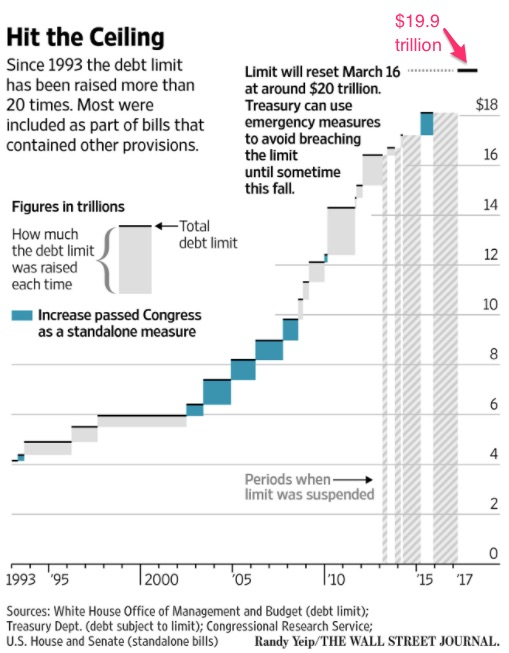

Since 1993, the debt ceiling has gone up more than 20 times:

It sounds rather simple. But the politics have been unbelievable (actually believable). Repeatedly, different law makers have tried to attach conditions to debt ceiling legislation such as Social Security changes, bombing Cambodia, voluntary school prayer and even a nuclear freeze.

What Happens Now?

During 2015, lawmakers avoided a political showdown by creating what they called a debt ceiling “suspension.” Instead of a new ceiling, they just suspended the old one. At midnight tonight, whatever the Treasury borrowed during the suspension will be added to the previous ceiling. The result? A new ceiling that we have already touched.

Recognizing the gravity of the situation, Secretary Mnuchin concluded his letter to the Congress with, “…honoring the full faith and credit of our outstanding debt is a critical commitment. I encourage Congress to raise the debt limit at the first opportunity…”

Our Bottom Line: Good Credit

Our first Secretary of the Treasury Alexander Hamilton believed that a national debt, as long as it was manageable, was beneficial. Reading about his plan to fund and refinance the United States’ revolutionary war debt reveals his commitment to establishing our good credit. His approach was varied, including issuing new bonds to pay for those outstanding and servicing the interest promptly on the foreign debt.

It worked. Even those in Holland, then the financial capital of the world, displayed confidence in our public credit. Adhering to the Hamiltonian philosophy, the United States has never defaulted on its debt.

As did Hamilton, we need to borrow to uphold our obligations.

My sources and more: There are so many ways to look at the national debt. We can consider the current situation and see Steve Mnuchin’s letter. Then this blog provides congressional insight and the CBO analyzes the numbers. You can also check the current foreign holders of the debt.

Please note that this entry is an updated version of past notes on the debt ceiling.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)