Several years after the 1978 Airline Deregulation Act, one Delta executive became horrified that his reservations staff had lowered fares for the Atlanta/Washington D.C. route as the departure date approached.

I suspect I would have lowered those fares also. If you have empty seats, it makes sense to attract more fliers by lowering the price. The right approach though was precisely the opposite. The airline should have been increasing fares because last minute fliers are willing to pay much more.

Where are we going? To the messages we get from prices.

Airline Deregulation

Because of deregulation, airline decision makers had a new world of fare making to navigate. Whereas previously government’s Civil Aeronautics Board let airlines preserve a healthy bottom line, now competition and markets would set prices. Quickly moving to a dynamic pricing model and a different price for each flier, the airlines had to determine whether the flier was discretionary or business, if the flight was departing in days or months, and how many seats remained.

Haggling

Sort of like the airlines, before the 1870s, a different price for each customer had been the norm. Walking into a small London store during the early 19th century, you were prepared to bargain. Trained to haggle, clerks knew what was high, what was low and what would generate a profit. The process was time consuming and it meant the seller and buyer became adversaries.

Price Tags

But then we had the invention of the 19th century department store. Think New York’s Macy’s. It would have been impossible and impractical to train hundreds of employees to negotiate a price for thousands of items. The result? The price tag.

With single prices, customer service could blossom as would customer loyalty. We could also have price wars, money-back guarantees, pricing economies of scale, loss leaders and promotional pricing, Today’s auto dealers tell us that fixed prices for cars cuts buying time by 82 percent from more than four hours to 45 minutes. The same change transformed the retail experience so compellingly that by 1890, one price for each item had become the norm.

Variable Pricing

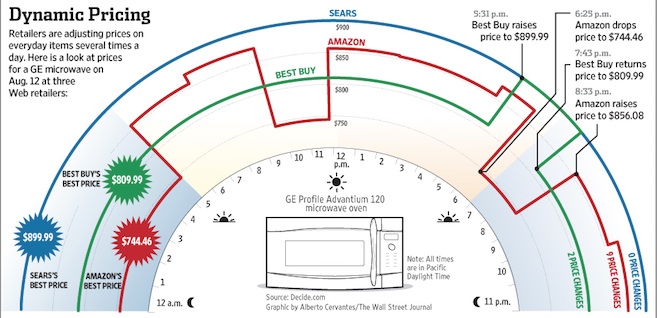

Now though we are almost back to where we started. While we have not returned to haggling, we do have different prices for the same item from the same seller. In the following graphic, the price of a GE microwave oven changed multiple times from 12 am to 12 pm on August 12, 2012. Although the graphic is three years old, a recent Forbes article indicates its message remains accurate.

Our Bottom Line: Price

Prices are pretty amazing. Like solving a mystery, we can investigate each price for information about social norms, efficiency, technology and quality.

We can even use a price to solve the mystery of why an airline charged you more than your neighbor.

Nice article. Here’s another mystery solved. There is no such thing as “the invisible hand” or “the market sets the price”. People (like me) set prices for a living. But price elasticity is a mystery. Its like the abominable snowman: no ones really sure if they’ve seen it or not!