Comparing state taxes, the differences are astounding.

Income Taxes

As you might expect, the largest amount of state tax revenue comes from individual income taxes. But seven states–Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming–do not even have one. By contrast, Massachusetts, New York, Oregon and Virginia primarily depend on what people earn for revenue.

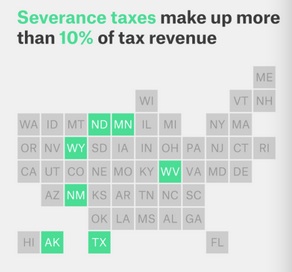

Severance Taxes

You might be wondering where a state gets money if it does not tax incomes. One source is oil. Although the following infographic refers to 10 per cent of tax revenue, for Alaska, North Dakota and Wyoming we are looking at more than 50 percent.

Sales Taxes

The second most bountiful source of state revenue is sales taxes. Here too we have a massive divergence. Alaska, Delaware, Montana, New Hampshire and Oregon get no money from a general sales tax (though all except Alaska tax several specific items). With no income tax, for Florida, Nevada, South Dakota, Texas and Washington and a tiny income tax in Tennessee, the tradeoff was the sales tax.

Our Bottom Line: Tradeoffs

The common denominator is revenue. All states need money to provide the goods and services we need like roads and law enforcement. But because they can choose among income and corporate taxes, sales and severances and then property and license taxes, states have opted for different tradeoffs. Choosing more of one revenue source means less of another and the incentives that accompany those tradeoffs.

With Alaska having no income nor sales tax, the incentive to move there could be compelling.