3 Myths About Flight Cancellations

March 15, 2015

The Reason This Winter Was Not So Bad

March 17, 2015Today, we’ve hit the debt ceiling for the 44th time since 1980.

Illustrating debt ceiling history from 1980 to February 11, 2013, this graphic predates #43.

From: The Washington Post

An Explanation

Discussing the debt ceiling, we should first take a look at the debt. Whenever the U.S. borrows, someone, somewhere buys a Treasury security such as a bond. The U.S. gets the money. The lender gets the bond–an IOU– and the promise that it will be repaid with interest (for most types of securities).

So who has close to $18 trillion in government securities?

Actually, we do. We owe approximately two-thirds of the debt to ourselves. The U.S. government lends to itself, for example, when the Social Security trust fund swaps its cash for bonds. In addition, individuals, businesses, state governments, local governments, pension funds–the list is long–buy U.S. Treasury securities.

The rest of the U.S. debt is held by foreign governments, businesses and citizens, with China and then Japan at the top of the list. Next is Belgium (surprising), Caribbean Banking Centers, Oil Exporters, Brazil and then a long list with Uruguay at the bottom for December 2014.

History

We have a debt ceiling because of a 1917 law. At the time, the Congress decided it was losing control of the volume of borrowing. To regain power over the federal purse and fiscal policy, they said, “We will decide the maximum amount the U.S. can borrow.” And, from that day onward, whenever necessary, they voted to raise the debt ceiling.

It sounds rather simple. But the politics have been unbelievable (actually believable). Repeatedly, different law makers have tried to attach conditions to debt ceiling legislation such as Social Security changes, bombing Cambodia, voluntary school prayer and even a nuclear freeze.

What Happens Now?

And that takes us to February 2014. Having hit the debt ceiling, lawmakers decided on a new approach. Rather than selecting an amount, they avoided a political showdown by creating what they called an “extension.” Actually a sliding ceiling that would move upward, the extension stopped its ascent yesterday, March 15, 2015. The new debt ceiling is whatever we owe this morning.

For that reason, Secretary of the Treasury Jack Lew sent a letter to House Speaker Boehner saying, “I respectfully ask the Congress to raise the debt limit as soon as possible.” Awaiting their action, he has temporarily stopped issuing some bonds. The Congressional Budget Office said that without a new debt ceiling we could run out of cash next fall.

Our Bottom Line: The Debt and the GDP

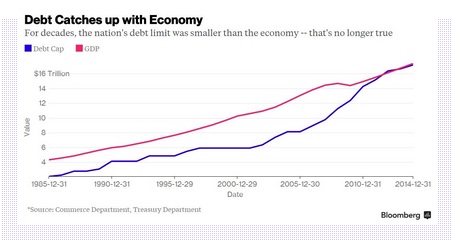

If you are concerned with the size of the debt, it is helpful to compare it to the GDP–sort of like deciding whether your mortgage is too big by comparing it to your income. When the debt and the GDP are equal, many people become concerned.

So, the problem with hitting the debt ceiling again is that this time our debt (+/-$18.2 trillion) has surpassed the 4th quarter 2014 GDP ($17.7 trillion).

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)