A Surprise in the Federal Budget

March 4, 2015

Some Federal Reserve (Gallows) Humor

March 6, 2015The year was 1969 and the place, a Chemical Bank in Rockville Center NY. As Wired explained, only six weeks after taking our first big leap for mankind on the moon, we took a second step with the first ATM. Called the Docuteller, the machine was the first to work with a reusable magnetically coded card.

Fast forward to 2015. Walking into a new Chase branch near my home, I was greeted by a bank rep who took me straight to a freestanding circular express banking kiosk in the center of the room. No longer was the only ATM in the parking lot or near the front door. A kiosk of ATMs was supposed to offer the up-to-date banking experience.

So, more ATMs and fewer tellers. Yes?

Not necessarily.

Where are we going? To how new technologies can affect jobs.

ATMs and Bank Tellers

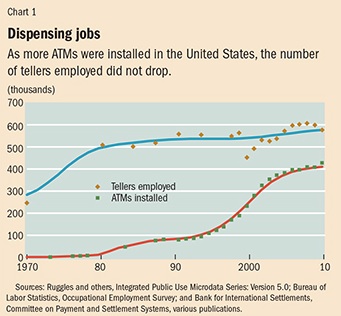

I know that it sounds counterintuitive but the ATM increased the number of bank tellers. Between 1985 and 2002, the number of ATMs had grown from 60,000 to 352,000. Meanwhile, up from 500,000 to 527,000, we also had more bank tellers.

Comparing ATM installations and bank teller numbers, you can see below that both increased.

From: “Toil and Technology”

What happened? Because ATMs lowered the cost of operating bank branches, more opened up. So, though you needed fewer tellers per branch, there were lots more branches. Correspondingly, now that the number of bank branches has dipped to a ten year low, we have fewer tellers. However–and this may be the key–their job description is changing. Banks need people to sell new and traditional high margin financial products.

Banks also need people to manufacture and maintain their ATMs. In 2013 the BLS says there were 110,850 “computer automated teller and office machine repairers.” (They have some great maps showing where you can find them.)

Our Bottom Line: Creative Destruction

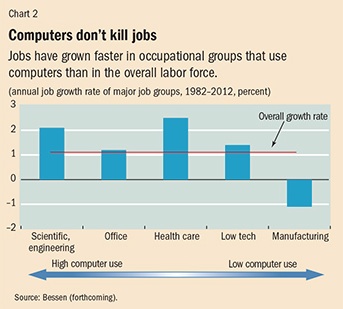

As you can see below, new machines can create new jobs.

From: “Toil and Technology”

They can also remind us of Joseph Schumpeter (1883-1950).

An academic superstar, an Austrian finance minister, and a Harvard professor, economist Joseph Schumpeter once proclaimed that he aspired to become the world’s greatest economist, horseman and lover. His biographer said he then said, “Things are not going well with the horses.”

In 1883, Joseph Schumpeter was born in Austria. After working in government, business and academia, he went to Harvard in 1932–a perfectly timed departure from Europe. Explaining the evolution of capitalism, he attributed its growth to entrepreneurs and its eventual demise to the resentment that would build against its elite.

Schumpeter tells us that entrepreneurs are the source of “creative destruction” because their businesses render others obsolete. With their new products and processes, entrepreneurs create jobs, progress and productivity. They change consumer habits, develop new means of production and new forms of economic organization.

Beyond bank tellers, ATMs transformed the character of banking. We will save that story for another day.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)

1 Comment

It will definitely be interesting to see what the future of banking and ATMs will be. Thanks for sharing.