When Taylor Swift Caused An “Earthquake”

January 18, 2024

January 2024 Friday’s e-links: Learning About the Houthis

January 19, 2024Saying “No” to a JetBlue Spirit match, a judge worried that we would have lost the opportunity to fly cheap.

Including “pre-reclined seats,” we could have lost much more.

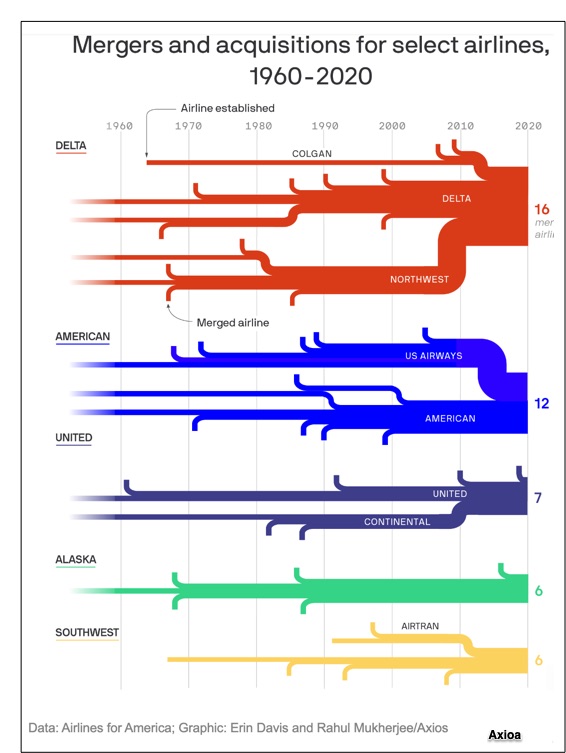

Airline Matches

Mergers and acquisitions helped American, Delta, Southwest and United get to the top:

With a JetBlue and Spirit combination, together, the sixth and seventh largest airlines would have had a bit more than a 10 percent market share. (I modified the Statista graph to display what the acquisition would have meant.):

However, because the judge vetoed the deal, fliers retained the tradeoffs that low fares create.

As an ultra low-cost discount airline, Spirit has charged $46 for a Newark NJ /Fort Lauderdale Florida round trip ticket. But it’s just for the seat. From there, it can cost you much more.

The carry on? Either $43.00 when you book online or $73.00 at the airport. To print your boarding pass at an airport kiosk is another $2.00 and $10.00 if an agent does it. Some water ($3.50) and pretzels ($4.50) during the flight? Another $8.00.

Below, you can see two pages from the Spirit inflight menu:

The word minimal describes everything from inflight service to legroom and seat size. Because Spirit Airlines “pre-reclines” seats, they can fit more people on a plane. For us, it’s a half-size tray table, less legroom. In addition, Spirit has been known for its “bad business” behavior. Some compare the experience to the NY subway.

Our Bottom Line: Airline Competition

As the year that airline deregulation began, 1978 was revolutionary. Instead of the federal government saying who could fly where, the airlines decided. Whereas previously, government’s Civil Aeronautics Board let airlines preserve a healthy bottom line, now competition and markets would set prices. As a result, we had companies like Southwest nationally spreading “a Southwest effect” of low-price fares. Responding, the airlines moved to a dynamic pricing model that selected a different price for each flier, depending on whether they were discretionary or business, if the flight was departing in days or months, and how many seats remained.

They also had to decide if the competition was a discount airline that should be acquired unless a judge said, “No.”

My sources and more: It’s always interesting to see the impact of shifts in the airline industry. For more about the end of the JetBlue/Spirit duo, Reuters had some details. But the best read was this economic professor’s description of his Spirit experiences. Please note that several of our Spirit stories were in a past econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)