Global Economic Growth: Hoping For a Soft Landing

April 14, 2022

April 2022 Friday’s e-links: The Story of Venezuela’s Decline

April 15, 2022Wage transparency will soon be better in NYC.

After May 15, if you are looking for a job in the city, you will know the maximum and minimum salary for all advertised positions. It’s the law.

The new mandate will enable everyone to know if their pay is fair. Those of us with a job will know what others are paid. Similarly, switching jobs, we can negotiate more knowledgeably for a salary.

It is also possible that the new law added to an already high switch rate.

Job Switchers and Job Stayers

In a fluid labor market, New York City could have added to the churn.

Now, with historically low unemployment rates, there were 1.8 jobs available (February 2022) for every person looking for a job. Knowing other jobs are available, we have more incentive to switch.

Equally important, the switchers have more of a chance of hiking their pay than the stayers. For March 2022, we are comparing a 5.3 percent increase to 4 percent:

![]()

Our Bottom Line: Labor Markets

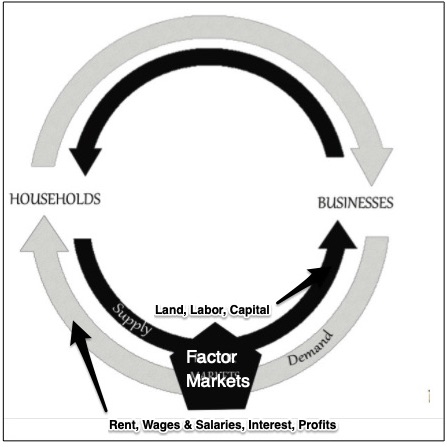

Contemporary labor markets have become rather busy. With historically high quit rates, there are more people (actively or passively) negotiating wages and salaries in factor markets.

In a circular flow model of the market system, goods and services move between businesses and households in the upper loop. At the same time, in the lower loop, you can see that labor leaves households. Then, in return, they take wages and salaries back home.

A process rather than a place, factor markets composed of land, labor, and capital are “where” labor and businesses determine wage levels:

Meanwhile, further demonstrating a strong labor market, at 4.5 percent, wages and salaries were up substantially more for the 12 month period ending December 2021 than the 2.6 percent increase for the previous year.

My sources and more: Thanks to economist Ed Yardeni for showing me the job switcher and job stayer comparison in his daily letter. From there, the statistics were at FRED, the Federal Reserve Bank of Atlanta, and the BLS.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)