It was logical to expect that internet search technologies would depress prices as markets gathered large numbers of bargain hunters and competing sellers. Through price transparency, we could get the best deals. Meanwhile, with less dispersion, one price would replace many.

It has not quite happened that way.

Internet Markets

Pokemon

One surprise is the impact of decision fatigue. Online, there are countless product options to choose among and discount plans. At the same time we have inflation, pandemic shortages, and Amazon’s algorithms changing prices regularly. Called dynamic pricing, a Pokemon box, for example, had 14 Amazon price changes that spanned $40, from $49.99 to $89.99. Indeed, with the onset of decision fatigue, some of us stop searching for the best price.

Used Books

In addition, used book markets can reveal what we don’t expect. Before the internet, hoping to find a used book title, we could leave a book store disappointed that it was not there. At the same time, elsewhere, attracting no interest, that same book sat on a shelf for years. With the internet, all changed. Online, Amazon could match us with a bookseller that had what we wanted. According to two economists, where “match quality” mattered, the result was higher prices. They told the story of a book they had wanted for which they paid $20 online. Inside the cover, they saw that its $.75 store price had been erased. The low price reflected the absence of demand.

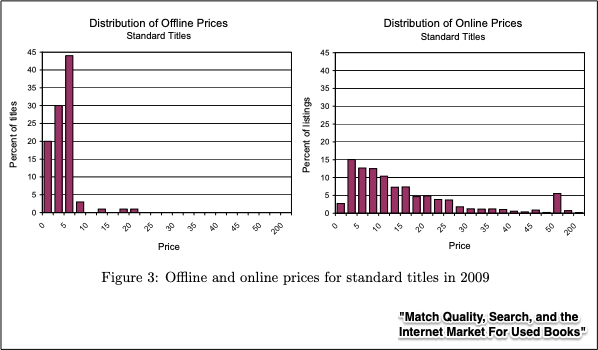

Correspondingly, you can see below that brick and mortar prices are low and less dispersed. Researchers said that 20 of the books sold for less than $2.50, and only six had prices at $7.50 or more. Meanwhile, to the right, online, more than a quarter of the prices are above $20 and there is more variety:

Researchers conclude that prices demonstrate the importance of “match quality” more than competition. They also remind us that their hypotheses might not be limited to used books. Any “match quality” market with unique items like antiques and collectibles could display the same phenomena.

Our Bottom Line: Demand and Supply

As economists we are just talking about demand and supply.

The first surprise where prices failed to drop and converge reflects a lack of information. The MIT researchers blamed it on seller obfuscation. As we have seen, prices are messengers. But when sellers prevent those messages from being communicated, we get unintended consequences.

With the second surprise, we have a higher price when an online search enables a consumer to find a relatively obscure item. We could say that online activity for that item increases its demand. Consequently its demand curve shifts to the right. At the same time though we are dealing with inelastic supply. By inelasticity, we just mean a minimal response to a price change. Here, price rises but the market has no more supply to offer.

This graph illustrates the demand increase, supply inelasticity, and a higher price:

So, higher prices make buyers and sellers smile.

My sources and more: For today’s post, three articles converged in rather interesting ways. I started with this NY Times article on prices and wound up at an MIT economists’ blog and an academic paper on used book markets.