The Message That a Mail Truck Delivers

October 28, 2021

October 2021 Friday’s e-links: A Bad Bet

October 29, 2021Wednesday, Chicago’s city alderman gave the okay for a basic income program. With no strings attached, the plan is to give a monthly $500 check to 5,000 low income households for one year. Rather than local dollars, federal COVID-19 money will cover the $31.5 million cost.

Chicago is not alone. There have been many universal basic income experiments:

https://www.vox.com/future-perfect/2020/2/19/21112570/universal-basic-income-ubi-map

Universal Basic Income Experiments

Alaska started its UBI program in 1982. Based on the state’s oil revenue, each year households have received somewhere between $1,000 and $2,000. Much more, annual dividends sent to tribal members from North Carolina’s “Eastern Band of Cherokee Indians” casinos have averaged $4,000 to $6,000.

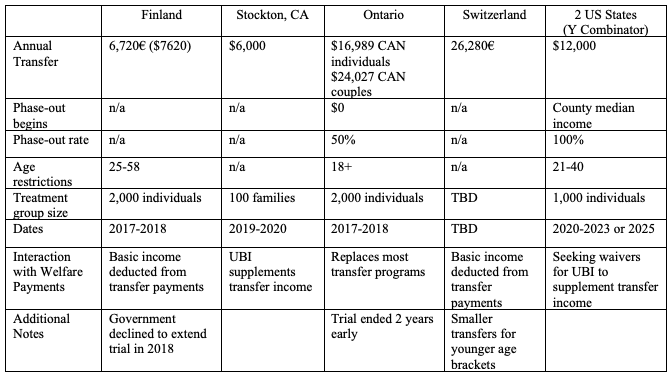

As you can see below, other UBIs have come, gone, and remain:

https://www.brookings.edu/wp-content/uploads/2019/08/UBI-ESG-Memo-082319.pdf

Stockton

During March 2021, a preliminary report on the Stockton experiment was published. Privately funded, the Stockton plan gave its 125 participants unconditional cash transfers. In the program, there were more women than men, more renters than homeowners, and the majority were unmarried. Each participant got a prepaid $500 debit card near the 15th of each month. Their median neighborhood income cap had to be $46,033.

To see the impact, we can look at spending and beyond. The SEED (Stockton Economic Empowerment Demonstration) recipients spent more than half of their money on food, merchandise, and utilities. They were able to catch up with dental care and cover unexpected expenses. At approximately three percent or less, self-care and recreation were close to the bottom of the list. Meanwhile, anecdotal evidence indicated that diminished anxiety over finances strengthened family relationships. The quantified results included a jump from 28 percent (in 2019) to 40 percent (in 2020) of the recipients having full time employment. They also cited less income volatility, enhanced wellbeing, and more willingness to take risks and set goals.

Our Bottom Line: Transfer Programs

As economists, we can say that the universal basic income is a transfer program. When we receive transfer payments, the reason is our age or income or some other qualifying status. Because the checks are not payment for work that produces a good or a service, they are not included in the GDP. However, the money does enter GDP totals when it is spent.

Other transfer programs include the pay-as-you-go approach of Social Security whereby current workers’ payroll taxes go to recipients. We also have Supplemental Nutrition Assistance (SNAP) and a Supplemental Security Income Program. And, to our list, we could add the earned income tax credit.

The one common thread that links transfer programs is redistribution. Typically funded by taxes, it requires government to receive money from one group and give it to others. Chicago’s funding came from federal redistribution.

My sources and more: The Washington Post alerted me to the Chicago vote while the Tribune had the results and Vox had the overview. Then, for the academic perspective, do take a look at this Aspen Institute paper and SEED’s preliminary assessment. In addition, this debate is a possibility as is this opposition article from Project Syndicate.

Please note that our Vox map is from October 2020 and our Stockton facts are from a past econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)