How the Risks of Investing and Covid Are Similar

September 6, 2021

How the ATM’s Twenty Dollar Bills Affect Us

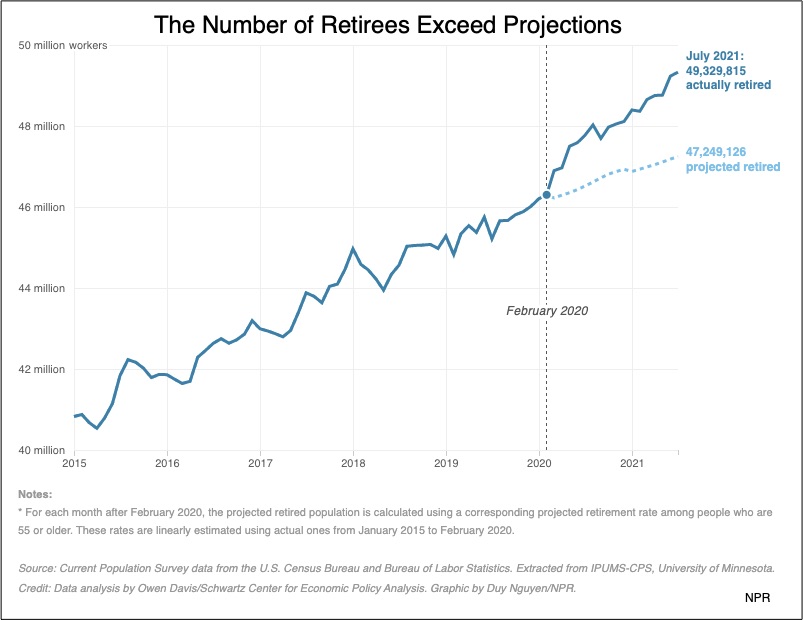

September 8, 2021More than we expected, the number of retirees has increased:

https://www.npr.org/2021/08/23/1028993124/these-older-workers-hadnt-planned-to-retire-so-soon-the-pandemic-sped-things-up

As a result, the future of Social Security has been affected.

Baby Boomers and Working Moms

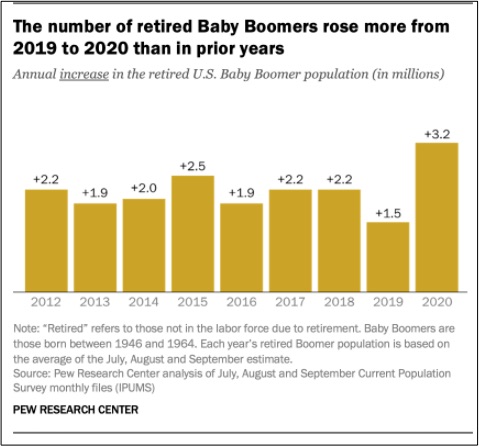

Looking at the current crop of retirees, we see a rising number of Baby Boomers. In a November 2020 report, Pew showed the acceleration:

https://www.pewresearch.org/fact-tank/2020/11/09/the-pace-of-boomer-retirements-has-accelerated-in-the-past-year/

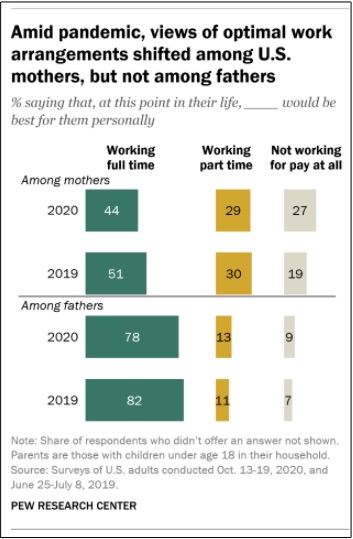

At the same time, we have more U.S. mothers leaving the labor force:

https://www.pewresearch.org/fact-tank/2021/08/31/covid-19-pandemic-saw-an-increase-in-the-share-of-u-s-mothers-who-would-prefer-not-to-work-for-pay/

To Baby Boomers and working moms, we can add Covid survivors and a GDP dip. We also could include the possibility of inflation. Together, all affect the future of Social Security.

The Future of Social Security

Oversimplifying a bit, we can say that Social Security is mostly a retirement program that also supports people with disabilities. In this year’s annual report, the Social Security Trustees changed some predictions for retirees. They expect the reserves in the (retirement and survivors) Trust Fund will run out in 2033, a year sooner than previously expected. Because the program’s expenses will exceed revenue, they won’t be able to pay a full benefit. Then, the average monthly Social Security check could shrink from $1556.72 to $1214.24–down by 22 percent. The cutbacks for people with disabilities would not kick in until 2057.

The pandemic is one reason that Social Security’s financial woes worsened. With more retirees, fewer working women, and the recession, payroll tax revenue took a hit. In addition, boosting the payout, those Baby Boomer retirees will be collecting Social Security benefits as might people with Covid related disabilities. And finally, looking ahead, we can worry that inflation would create rising COLAs (Cost of Living Adjustments) that balloon Social Security checks.

So yes, the pandemic made Social Security sicker.

My sources and more: Always useful for federal budget insight, the Concord Coalition had comments about the newest Trustees report. Meanwhile, WSJ and the PennWharton Budget Model summarized the impact of the pandemic and then Pew added the retirement numbers. And finally, I hope you will take a look at one of our many Social Security posts.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)