Econlife Quiz: TikTok

March 15, 2021

What We Can Learn From Used Car Prices

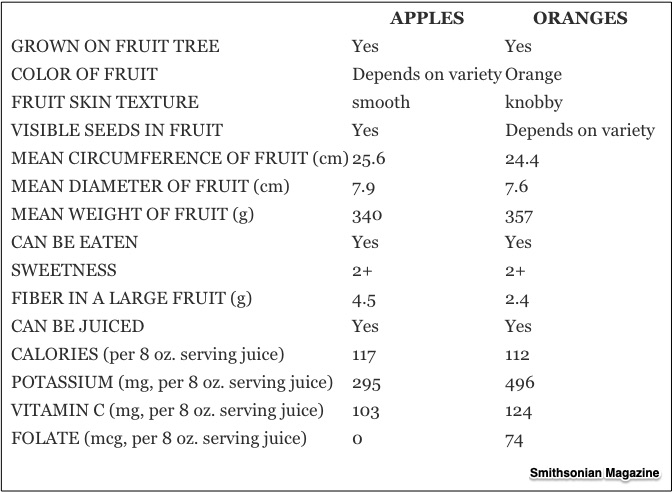

March 17, 2021Trying to compare the incomparable, we sometimes say it’s like apples and oranges because they are so different.

It turns out that they aren’t that different but they’re not really similar either:

The same is true for the Covid-19 fiscal response.

The Covid-19 Fiscal Response

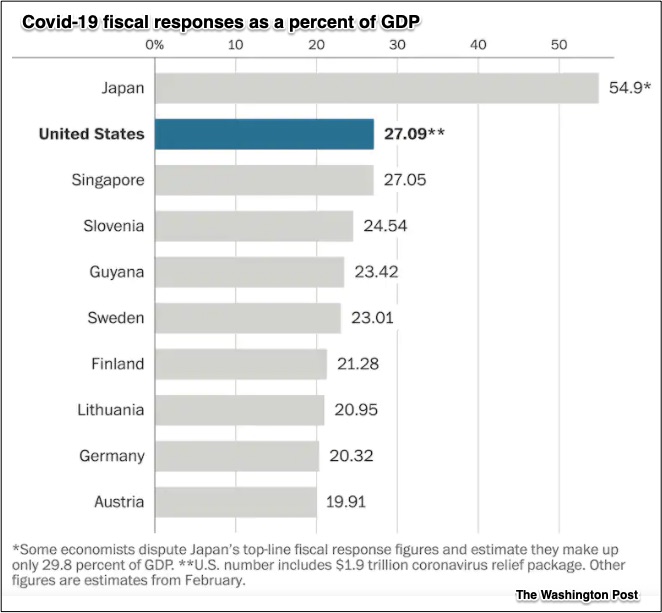

Looking through a GDP lens, we would see that Japan leads the world in Covid-19 spending:

However, even when we refer to similar spending totals, it is tough to compare them.

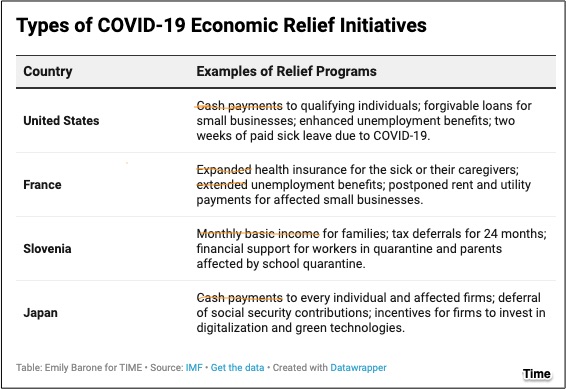

Below, I highlighted cash payments, expanded, extended, and monthly basic income to show how four examples display four different approaches:

Including the March 2020 CARES Act, December 2020 legislation, and March 2021 ARP, U.S. spending exceeded everyone’s. More than anything else, the focus of the U.S. support and stimulus was direct payments and loans.

Next, for spending totals, Japan comes in second. With three stimulus bills that total close to $2.2 trillion, they too targeted direct payments–$900 to each citizen.. But their bills included carbon neutrality provisions and obligations from the private sector.

In Europe, we have somewhat of a different story where entirely new legislation was unnecessary. Many EU nations already had existing income and a health safety-net infrastructure that enabled companies to retain workers and provide support payments. They could expand existing furlough systems and loans to businesses without driving national debt sky high.

And then, beyond all of this, to compare the Covid-19 fiscal response, we need to consider borrowing power in global credit markets (where the U.S. tops all others), whether legislation appropriately targeted economic vulnerabilities, and the developing world. We also can take a closer look at where you count the spending. What some economists have called fiscal obligations, others attribute to monetary policy.

Our Bottom Line: Fiscal and Monetary Policy

We can conclude with just a traditional definition and then some new territory.

Always, fiscal policy refers to the spending, taxing, and borrowing that Congress and the President oversee. At the same time, monetary policy used to take us to the Federal Reserve and their policies for the supply of money and credit. Now though, their definition of monetary policy focuses on how interest rate policy shapes economic health. Then, from there, since the Great Recession, we have a much more active Fed. Not only are they keeping interest rates low through their overnight loan policies to banks but now they are directly sending money to businesses. Buying commercial securities and bonds, the Fed does quantitative easing and, as we described here, has three buckets of relief activities.

At the IMF’s Covid-19 fiscal and monetary response directory for 197 countries, not one country was identical to another. So, returning to where we began, maybe we need many more kinds of fruit to compare than apples and oranges.

My sources and more: Together, a Washington Post article and Time provided the perfect foundation for comparing the Covid fiscal response. At the other extreme, the IMF has an avalanche of statistics for 197 economies as of March 10. And then for a bit of fun, as a springboard, I wanted to compare apples and oranges.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)