Why It’s Not Easy to Design a New Animals Crackers Box

August 23, 2018

Our Weekly Economic News Roundup: From Corporate Taxes to Ant Economics

August 25, 2018Referring to “The Son of Man,” Belgian surrealist artist René Magritte said, “Everything we see hides another thing.”

Instead, Magritte could have been describing corporate taxes.

The U.S. Corporate Tax Cut

National

The Tax Cuts and Jobs Act of 2017 (TCJA) pulled the corporate tax rate down from 35% to 21%. But behind those numbers, much more is hidden.

Although the statutory rate was 35%, a typical mining firm paid an 18% rate, a farmer, 33%. Why? We could cite hundreds of pages of strategies that relate to income deferral (moving revenue to another time), deductions, credits, and your industry that determine your effective tax rate (ETR).

With the new law, the average corporate rate could plunge as low as 9%. Again though, your industry makes a difference because those that are capital intensive like utilities, and transportation are going to benefit the most. Also, your state matters.

And it’s still not that simple. By 2027, the law’s provisions change and so too do the beneficiaries.

International

Meanwhile, when one country lowers its corporate taxes, other get caught in the downdraft. An economist would call it the spillover. A spillover from the U.S. could be rather substantial because of the size of the change.

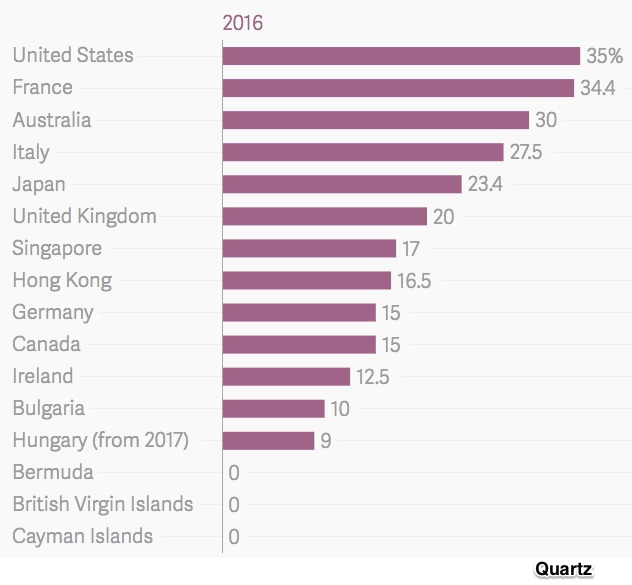

So again, we can just look at the rates and see how much the U.S. rate has dropped:

We can also compare the level of the U.S. rate to other countries:

Before the TCJA:

After the TCJA:

Intuitively, we could hypothesize that the lower U.S. rate will lure multinational investment back to the U.S. And yes, generally, recent studies arrive at that conclusion. But again, it is not quite that simple.

Among the staggering number of issues cited in those studies, three considerations are easier for us to ponder. We can just say that the lower rate affects where a multinational will locate its factories and report its profits.

Then, for each country, we can ask if the U.S. decision nudges them to lower their corporate rates. After all, when firms opt to move more to the U.S. then other nations get less revenue from large corporations. One report theorizes that Mexico, Japan and U.K. are most vulnerable.

Our Bottom Line: Externalities

As the most comprehensive tax reform since 1986, the Tax Cut and Jobs Act will affect other economic and financial decision-making entities.

- The Federal Reserve’s monetary decisions will be affected by the act. Certainly their interest rate deliberations will involve new tax legislation.

- States will have to decide if and when to adjust their individual and corporate income tax because of the new law.

- Other countries will respond to the new low-tax image of the U.S. Some could lower their own tax rates in what has been called a “race to the bottom.” Others could even draw the WTO into the picture if they perceive certain provisions as tariff or subsidy equivalents.

- And yes, the the federal government will experience positive and negative externalities. Whether looking at administrative problems, unexpected interpretations, revenue shortfalls, or the debt, the federal government will surely be revisiting the legislation.

- Finally, we will be observing the impact of a change in perspective. Our past corporate tax system was “Worldwide” because the U.S. said revenue was due on profits made abroad. Now the system is more “Territorial.” We are looking within our borders more so for corporate tax revenue.

So, perhaps the only sure thing is René Magritte’s insight. “Everything we see hides another thing.”

My sources and more: The IMF and WSJ had the tax spillover story while Penn/Wharton had the specifics on the U.S. law. In addition, my Bottom Line list of externalities and my familiarity with a slew of details came from this Brookings paper. Do visit all if you want a taste of the complexities of the JCTA.

Please note that we’ve begun other discussions of taxation with the Magritte image and reference.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)