Why It’s Tough to Solve Traffic Congestion

June 7, 2017

Solving a National Parks Problem

June 9, 2017Today’s #TBT will look back at the Glass-Steagall Act of 1933.

But first…

Financial Trust

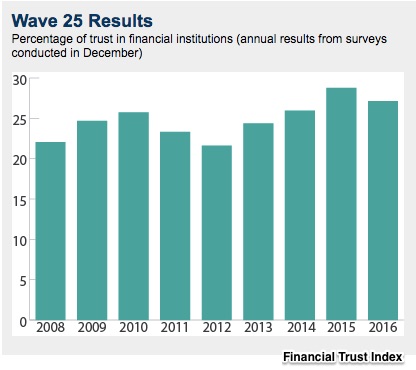

The Chicago Booth/Kellogg School Financial Trust Index is a trust yardstick. Answered by approximately one thousand participants, the Index survey touches topics that range from the Federal Reserve to political loyalties. Its goal? To connect changes in public opinion with financial attitudes.

Since the Index began, trust has remained rather elusive. The average (below) has been just 20% to 30%:

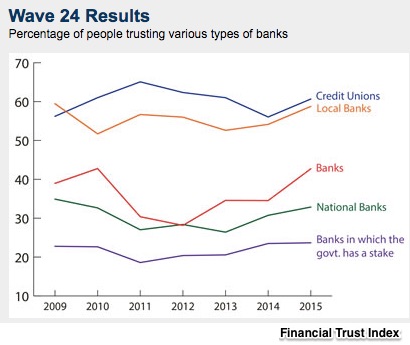

With the 2015 Index, they published a breakdown of banking sentiment. You can see that people had much more faith in local banks than national institutions:

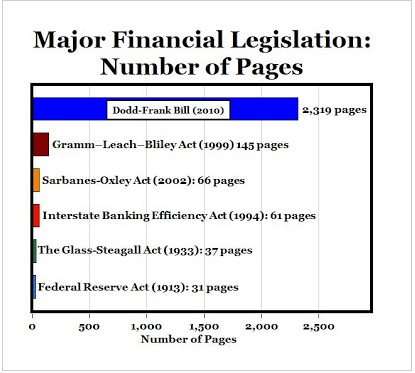

We could say that recent banking legislation reflects our lack of trust. Passed after bailout became a household word, the 2010 Dodd-Frank Act was supposed to remedy regulatory “flaws.” And now the proposed version of the Financial CHOICE Act is supposed to remedy Dodd Frank’s “flaws.”

The “gold standard” though for trust-generating financial legislation was the 37 page 1933 Glass-Steagall Act.

Glass-Steagall

Responding to bank runs and failures that threatened the entire financial system, Glass-Steagall separated investment and commercial banking, gave the Federal Reserve more power, and created deposit insurance through the FDIC (Federal Deposit Insurance Corporation). J.P. Morgan knew, for example, that it had to divide itself into a commercial bank and an investment bank. Two separately owned firms, Morgan Guaranty, a commercial bank and Morgan Stanley, an investment bank were the result.

With interest rate ceilings, the departure from investment banking, and a spate of limitations, commercial banks became bastions of conservatism because of 1930s regulation. For the 40 years that followed, a failure was an anomaly. Many predicted the world of Glass-Steagall would last forever.

But then the 1970s arrived. High interest rates, money market funds and globalized banking made Glass-Steagall inoperable. Its demise was formalized by the Gramm-Leach-Bliley Act in 1999.

And now, we are back to where we started.

Recent Financial Legislation

Dodd-Frank

Composed of 2,310 pages, the Dodd-Frank Wall Street Reform and Consumer Protection Act describes approximately 398 rule-making requirements. Since July, 2010, regulators have been making those rules. They have not quite finished.

Oversimplifying, we can say they had two goals…

- Risk: Lawmakers wanted to diminish the risks taken by financial institutions.

- Protection: Lawmakers hoped to protect consumers from making unwise financial decisions.

For four groups:

- Government: More government regulatory authority.

- Banks: More trading restrictions and capital requirements.

- Consumers: More protection.

- Investors: More rules for hedge funds, investment advisors, insurance companies, and those who create securities packages.

Financial CHOICE Act

Currently being considered by the House of Representations, the Financial CHOICE Act is 600 pages long. Also chock full of rules that need to be articulated, it is supposed to replace Dodd-Frank.

Our Bottom Line: Simplicity

From: Carpe Diem, Mark Perry Blog

I suspect that if more people read the Davis Polk summaries of Dodd-Frank and the Financial CHOICE Act, their trust would plunge.

My sources and more: Do check out the Financial Trust Index to see the details. Then, for the Financial CHOICE Act, I suggest the Cliff Notes 35 page summary chart at Davis Polk. More than three times as long, they also did a Dodd-Frank summary. Econlife though did have a more compressed version.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)