When a Score is Not About a Game

May 9, 2017

An Olympics Proposal That Could Make a Match

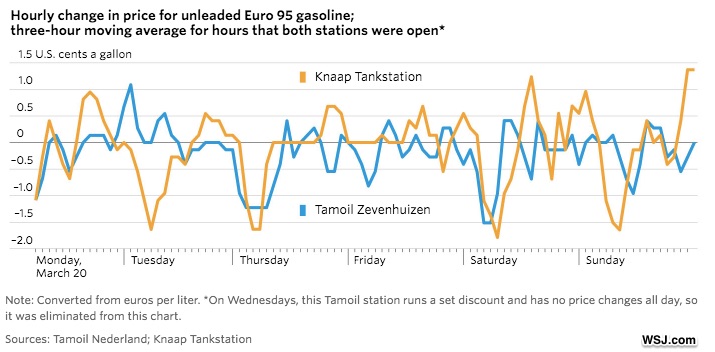

May 11, 2017At two gas stations near Rotterdam, price is constantly changing. Using software that recognizes buying behavior, the retailers try to match the price to the customer. Those who are willing to pay more and those who cannot will each get appropriate price points. Done right, sales rise.

The software is sold by a2i Systems. As their data base grows, they are increasingly able to figure out when a higher price retains customers and when it scares them away. One of their customers once complained because the algorithm raised prices when a nearby competitor lowered them. But then he realized that the long lines across the street were driving traffic to his station.

Below, you can see close to a 3-cent per gallon “spread” as price fluctuated:

Where are we going? To price elasticity.

But first…

Price Sensitivities

There are different ways to cater to price sensitive shoppers. Coupons give discounts to people who spend the time “clipping” them. Since others don’t want to bother, the seller can avoid giving everyone a price cut. Meanwhile, Starbucks’s founder Howard Schultz has used the extras strategy. Make the basic cup of coffee cheap but charge a lot for the shot, the mocha flavor, and all the additions.

Dynamic Pricing

Called dynamic pricing, some airlines charge each of us a different fare based on why and when we travel. But how to find out? That’s where the weekend comes in handy. Travelers who stay over a Saturday night–vacationers– get the lower fares.

Similarly, some restaurants charge more for a Saturday night reservation and less for Tuesday. Zoos lower the price when it rains and sports events are sometimes cheaper when less popular teams play. Meanwhile, Amazon might change a price many times during one hour. And we all know about Uber’s price surges.

The Price Tag

Before the 1870s, a different price for each customer had been the norm. Trained to haggle, clerks knew what was high, what was low and what would generate a profit. But then we had the invention of the 19th century department store. Think New York’s Macy’s. It would have been impossible and impractical to train hundreds of employees to negotiate a price for thousands of items.

The result? The price tag.

Could we say that a2I Systems algorithms take us back to where we started? Varying from customer to customer, price is individualized.

Our Bottom Line: Price Elasticity

We are really just telling an elasticity story.

On a demand curve, each of us has our own own elastic and inelastic region. In our elastic region, we react to an increase or a decrease in price by spending much more or less. However, with inelasticity, price changes make little difference. Up or down, we still buy the milk, the bubble gum, or the concert ticket. (More precisely, an economist is comparing the percent change in quantity to the percent change in price.)

So, isn’t the a2i Systems algorithm really about customized elasticity?

My sources and more: Yesterday’s WSJ had the gas station algorithm story on the front page. It was the perfect update to past posts on dynamic pricing here, and here, and here. Please note that the price tag part of this post was previously published at econlife.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)