At 1 am or so, in Boston, in 2012, Uber saw that many of its drivers were heading home just when party goers needed them. I guess someone had an “Aha” moment and suggested that drivers be paid more to stick around. With drivers earning more and customers getting the transportation that had previously been unavailable, it was win-win. And that was how Uber’s dynamic pricing began.

Where are we going? To how dynamic pricing based on current supply and demand has spread to cyber shopping.

Dynamic Prices

Dynamic pricing has been around for a long time. In movie theaters midweek matinee patrons pay less than Saturday night movie goers. Somewhat similarly, tickets to more popular sporting events are priced higher as are Saturday reservations at some restaurants. Coke has even experimented with raising vending machine soda prices when the temperature hits a certain high but stopped because of customer anger.

Airline dynamic pricing began after the industry was deregulated in 1978. Faced with young upstart discount competitors like People Express, American Airlines said there had to be a better way than giving everyone a bargain. So, they started charging less to travelers who stayed over a Saturday, who were willing to buy non-refundable tickets, and who could book months in advance. They didn’t say that they had discovered how to separate the business traveler who was price insensitive from the vacationer who pinched pennies. And instead of telling the business traveler the tickets were more expensive, they sugar coated the discretionary traveling experience by saying we got a discount.

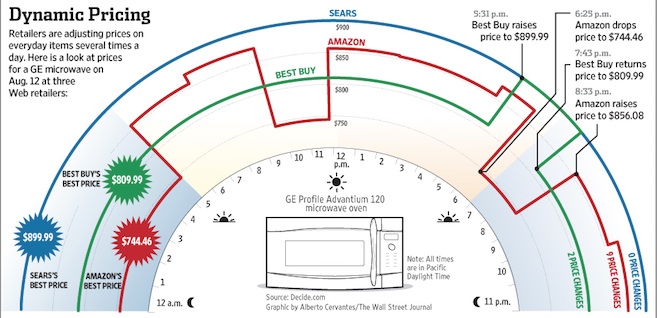

With the holiday season here, Black Friday behind us and cyber Monday morphing into several weeks of online shopping, I was curious about Amazon’s dynamic pricing. It turns out that they could be changing prices 2.5 million times during one day according to internetretailer.com. From item to item though, the activity varies with power tools’ prices fluctuating much more then apparel.

While this WSJ graphic is from 2012, recent articles in internetretailer indicate it remains accurate.

Our Bottom Line: Pricing Power

Pricing power is shaped by the market in which a firm competes. Whereas farmers in perfectly competitive markets are price takers because the market dictates what they charge, in monopolistic competition, firms have some power. For that reason, in many of the markets where we find Amazon and Uber, they engage in dynamic pricing because they have some price making capability. By contrast, as an oligopoly with considerable price making power, Apple does not engage in dynamic pricing.

And finally…dynamic pricing has hit bricks and mortar. I just read about one store in Great Britain that experimented with dynamic pricing for each customer. They did it with personalized prices next to items still on the shelves. Still though, stores say they worry about the wrath of customers who discover they paid more for an item this morning than someone else, this afternoon.