One Reason We Think a High Price Looks Low

January 22, 2015

Weekly Roundup: From Hot Hands to Sunk Costs

January 24, 2015All too frequently, I am asked to hold for a moment during a phone call. Five minutes pass. No one returns. Then, I consider hanging up but think, I’ve already waited five minutes. So, I stay on for another five minutes. Still no one.

Like me, do you start fixating on the time you have already invested? And perhaps wait another five minutes?

Sadly though, by not hanging up, we are ignoring what we could be doing. Maybe instead of looking back, we should decide what hanging up gains in the future.

Where are we going? To the sunk cost fallacy.

But first, Greece.

Is Greek Eurozone Membership a Sunk Cost?

Having borrowed far beyond its means, Greece received two bailouts totaling close to €240 billion ($307 billion) from the ECB, the EC and the IMF (the troika). The deal was to get their fiscal house in order.

So, they cut pension payouts by 40 percent and prohibited hairdressers and other people in hazardous occupations from retiring at 50 with government support. The government payroll shrunk, unemployment benefits were reduced to 12 months and previously subsidized prescription drug prices climbed 30 percent. The list of spending cuts and revenue raisers could go on and on.

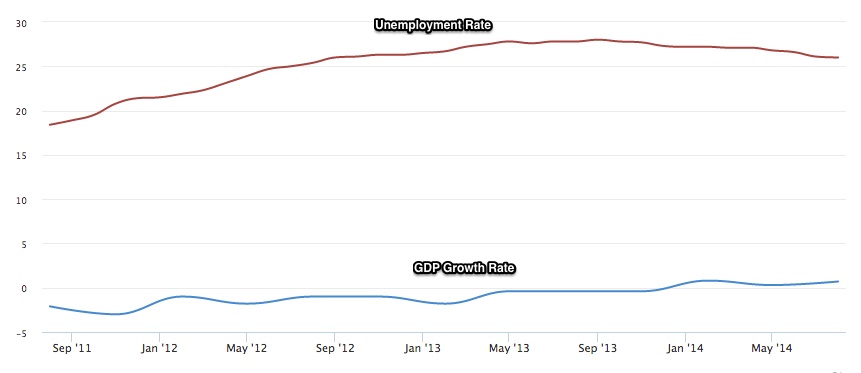

You can see the results (below). Greek unemployment remains huge and GDP growth, tiny.

From: ieconomics

A Rationale for Ending Austerity

Proposing free electricity and food coupons for the poor, state pensions returning to pre-crisis levels, a higher minimum wage, and higher taxes for affluent, the far left party Syriza has the lead in Sunday’s election. Abandoning austerity is their theme.

And that takes us to a question. Should those who disagree with Syriza say Greece has invested so much in austerity that it cannot stop now? Or, citing the troika’s bailouts, should eurozone officials say too much has been committed to stop now even if Greece resists further austerity?

Our Bottom Line: Sunk Costs

Whether looking at a phone call on hold, a Greek eurozone exit, a disintegrating marriage or an overpaid underperforming quarterback, the attraction of sunk costs is a key consideration. A sunk cost represents our unrecoverable past time, money, energy, investment. It is called a sunk cost because it is gone. But still it tends to influence a future decision.

Economists say the value of sunk costs is a fallacy. Instead, we should focus on future cost and benefit.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)