The Turkeys That Presidents Pardoned

November 25, 2025

A 2025 Top Ten List For Thanksgiving

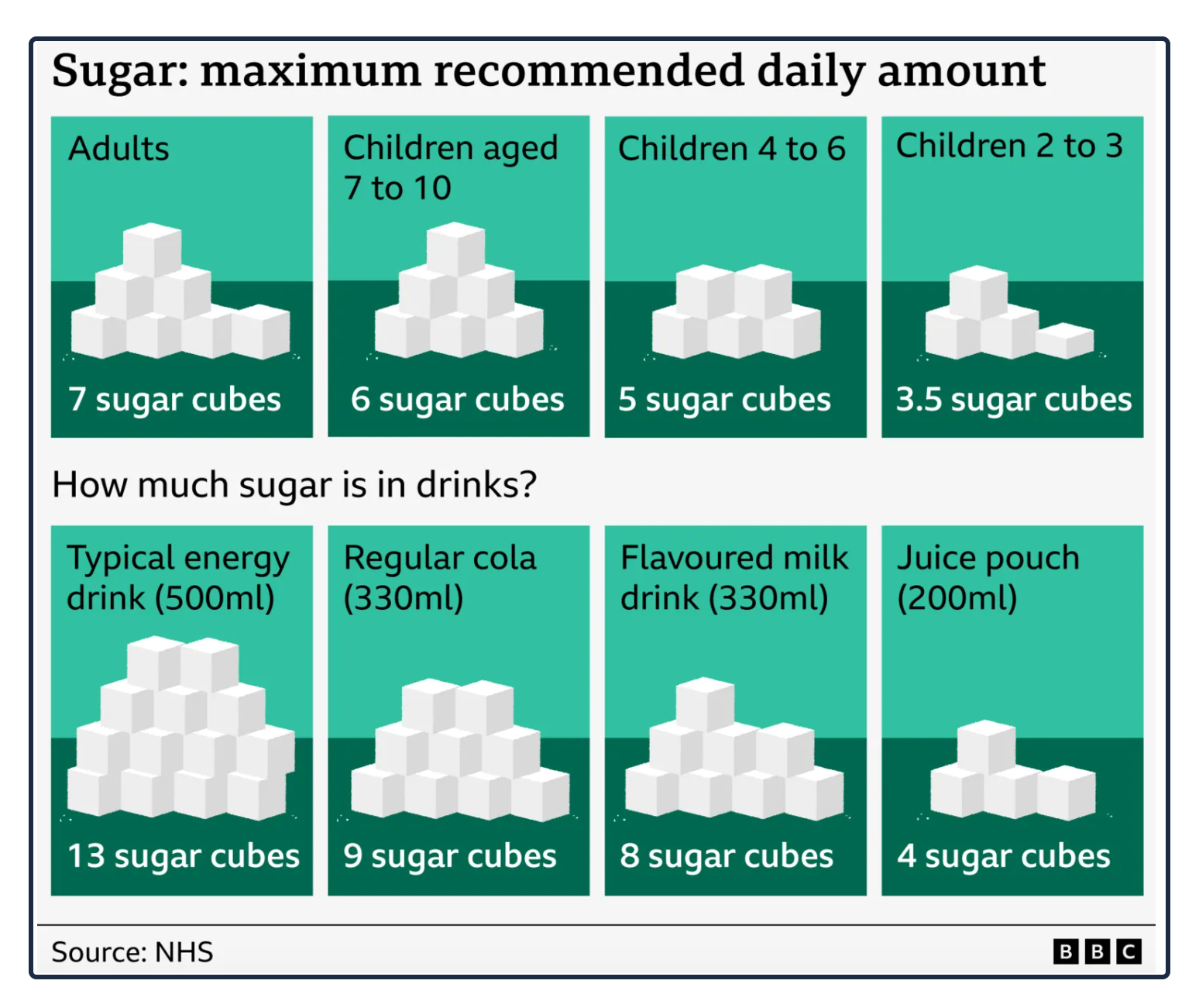

November 27, 2025The UK is going to have a “Milkshake” Tax that targets pre-packaged sugary milk-based drinks.

They want to stop us from drinking a whopping 13 sugar cubes:

Like all Pigovian taxes, the new regulations could also raise much needed revenue. Unless they lower sugar content and tweak taste, producers have to pay the tax.

The Sugary Drinks Tax

Concerned with childhood obesity, since 2018, the UK has had a sugary drinks tax that applies to many of the pre-packaged sodas and juices sold in supermarkets. For drinks with at least 5g of total sugar per 100ml, consumers pay an extra 19.4p per litre and more for drinks with higher amounts. As a result, Coke and Pepsi were among the hardest hit.

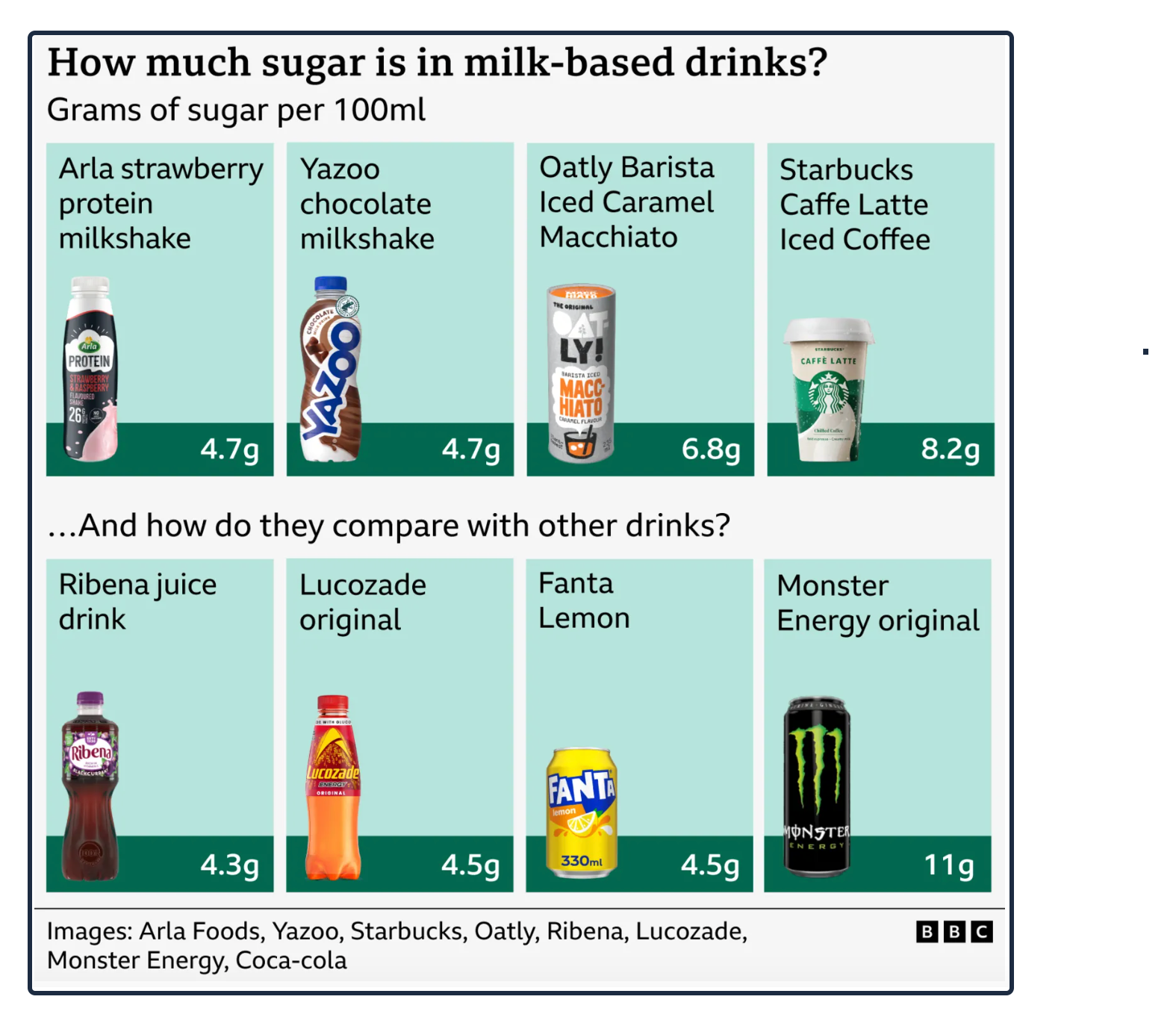

However, hoping to encourage calcium consumption, the 2018 act excluded milk-based drinks and plant-based alternatives. Now though, the government tells us that, at 3.5 percent, the calcium children get from milk-based drinks insufficiently offsets their sugar content. As a result, on January 1, 2028, the milk and milk alternate category will come under the sugar tax umbrella. In addition, the government will reduce its 2018 sugar allowance.

Even with milk, drinks can move beyond seven grams of sugar:

Demand

As always, demand helps it all make sense.

The law of demand tells us that we are supposed to spend less when price goes up and more when it declines. But we need to ask whether the size of the tax creates an elastic response. If yes, then price will considerably affect the quantity we demand. Otherwise, we could find ourselves in an inelastic demand range which means a change in price will have little impact on purchases. But it’s also possible that consumers would display a change in demand by switching to untaxed items.

Most of all, though, sugary drink taxes would make Arthur Pigou smile.

Our Bottom Line: Pigovian Taxes

Long ago, economist Arthur Pigou explained that using taxes to reduce undesirable conduct increases municipal revenue and decreases the harmful behavior.

Arthur Pigou (1877-1959):

Focusing on the ripple of positive externalities, he looked at the impact of a policy or agreement on an uninvolved third party. While it begins with the original activity, the effect continues. With sugary drink taxes, supporters would remind us that sugar content in targeted drinks is down 46 percent. Starting there, we could see a slew of health benefits and the revenue from noncompliance. However, including the time and money cost of compliance (and avoidance), the negative externalities can be considerable.

My sources and more: Thanks to Bloomberg radio for alerting me to the “milkshake” tax. From there, for the details, the BBC and Beverage Daily came in handy.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)