Do the Rich or Poor Sleep More?

May 22, 2025

May 2025 Friday’s e-links: A “Cautionary Tale”

May 23, 2025Before many of us were willing to buy an electric vehicle, we wanted more charging stations. And yet, for the incentive to build extra charging stations, we needed enough electric vehicle owners.

This chicken-and-egg problem remains a problem.

EV Charging Stations

Our EV story is really about the number of charging stations, their speed, and their price.

Numbers

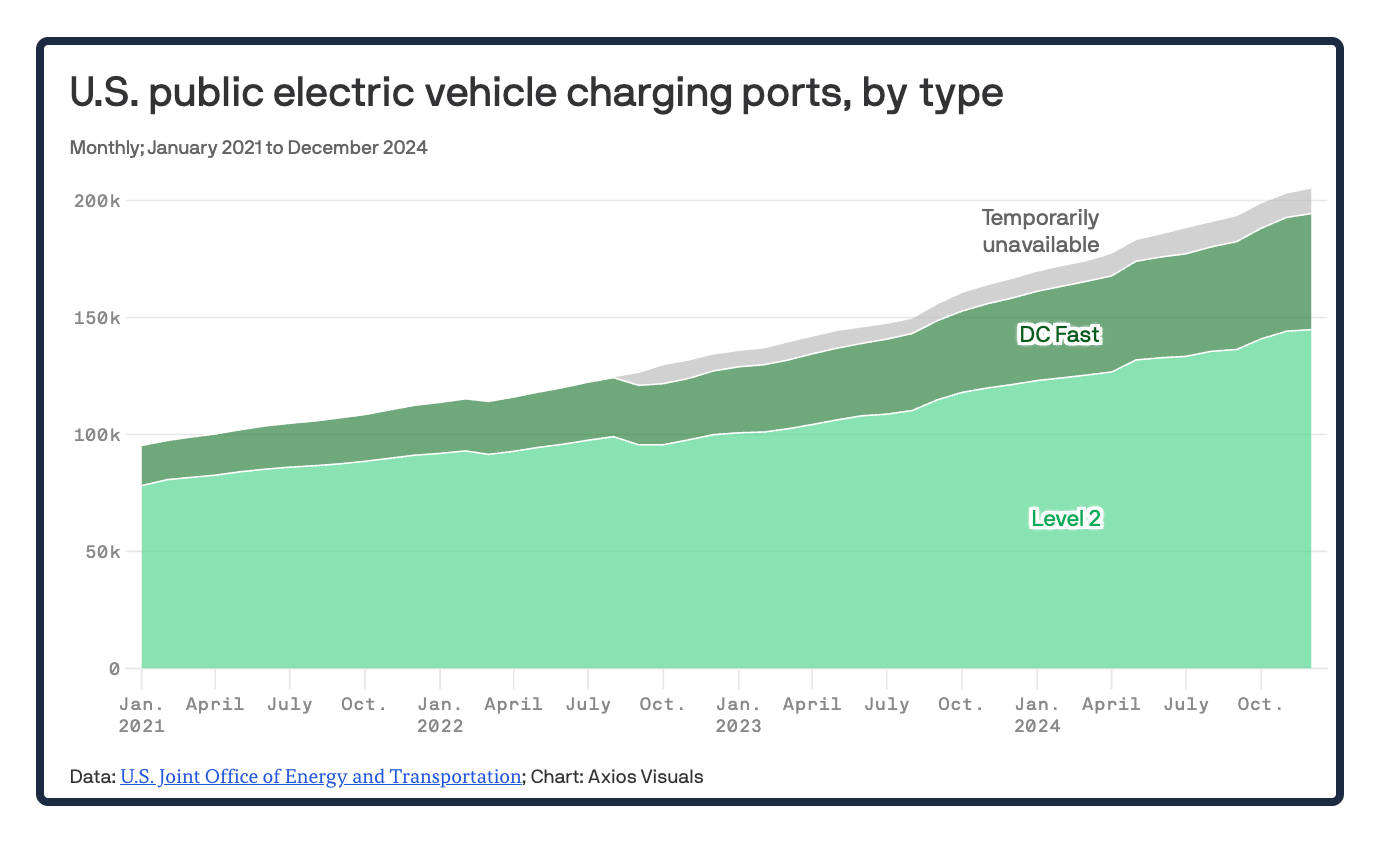

Still woefully inadequate, the number of public electric vehicle charging ports doubled since 2021:

So yes, we got 38,000 new chargers during the past four years. However, experts have estimated that, in just five years, we would need 1.2 million public chargers for the EV sales they expect. But GM Energy added just 2,500 fast chargers, IONNA projects it will have 30,000 by 2030, and Electrify America oversees 4,700.

Meanwhile, the Biden administration encouraged EV sales with tax credits, manufacturers’ perks, and tougher tailpipe emissions regulations. Furthermore, the Congress allocated charger funding through the Infrastructure Act and Tesla said other carmakers could use its Superchargers.

Responding, EV sales are a trickle. After an 11 percent sales pop during the first quarter of this year, during April, the uptick reversed to a 5 percent decline.

Speed

Used to a quick stop to refuel our gasoline powered vehicle, again we have some dismal facts. The good news is that super-fast charging exists. The bad news is that China owns the technology.

Recently in the news, China announced its five-minute charge. Two of their companies, BYD and CATL, each said they’ve developed the speedier alternative. In the amount of time it takes for a gasoline refill, CATL said it could provide a 320-mile range. Similarly, BYD said it had a 250-mile range. Although China’s superchargers will have a limited introduction in China’s EV market, we can assume that the trade war will entirely prevent them from entering the U.S.

Much longer, in the U.S., a level 2 charge takes a whopping four to ten hours (less for a hybrid) while the “speedy” DC Fast requires between 20 minutes and an hour.

Price

Continuing to evolve, charger prices will change. Just dipping a toe into the world of dynamic pricing, close to 40 percent of all public fast charger providers announced that what you pay could depend on the time, the day, electricity rates, weather, and whether it’s a holiday. As a result, one EV owner reported that she paid $35 for a middle of the night charge. Instead, between 1 pm and 9 pm, her cost would have been $48.

If it spreads, dynamic pricing will reduce spending for some consumers and also shrink wait times:

Our Bottom Line: Changes in Demand

Whether looking at the number of chargers, their speed or price, we are focusing on a determinant of EV demand. As one reason we will or won’t buy EVs, a charger is a complementary good. More of them with higher quality boosts EV sales. Now though, except for dynamic pricing, we seem to be moving in the opposite direction:

For all of us that are concerned with the slow pace of electric vehicle sales, we could blame charging stations.

My sources and more: Wonderfully, we had a plethora of EV charging news. We were able to start with the number of charging stations. Next, we could consider speed and price. Then, with EV sales data, here and charging times here, we could further understand the data. And finally, also do take a look at Our World In Data, Pew, and our own econlife.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)