GDP Surprises in Ireland and Macau

August 24, 2022

What We Can Learn From a Big Mac

August 26, 2022After pausing most student debt repayments during the pandemic, President Biden took the next step. Yesterday, he canceled $10,000 student loans for all individuals earning less than $125,000 a year.

Conveying a picture of the entire student loan landscape, the following facts help us assess loan forgiveness.

Student Loan Facts

Degrees

While owing more than $1 million is rare, the expense of a graduate degree is much more typical.

Explained by a 37 year old orthodontist in 2018, his $1,060945.42 debt grows $130 a day. The reason? The interest he owes balloons faster than his monthly payments. In 20 years, the total could touch $2 million.

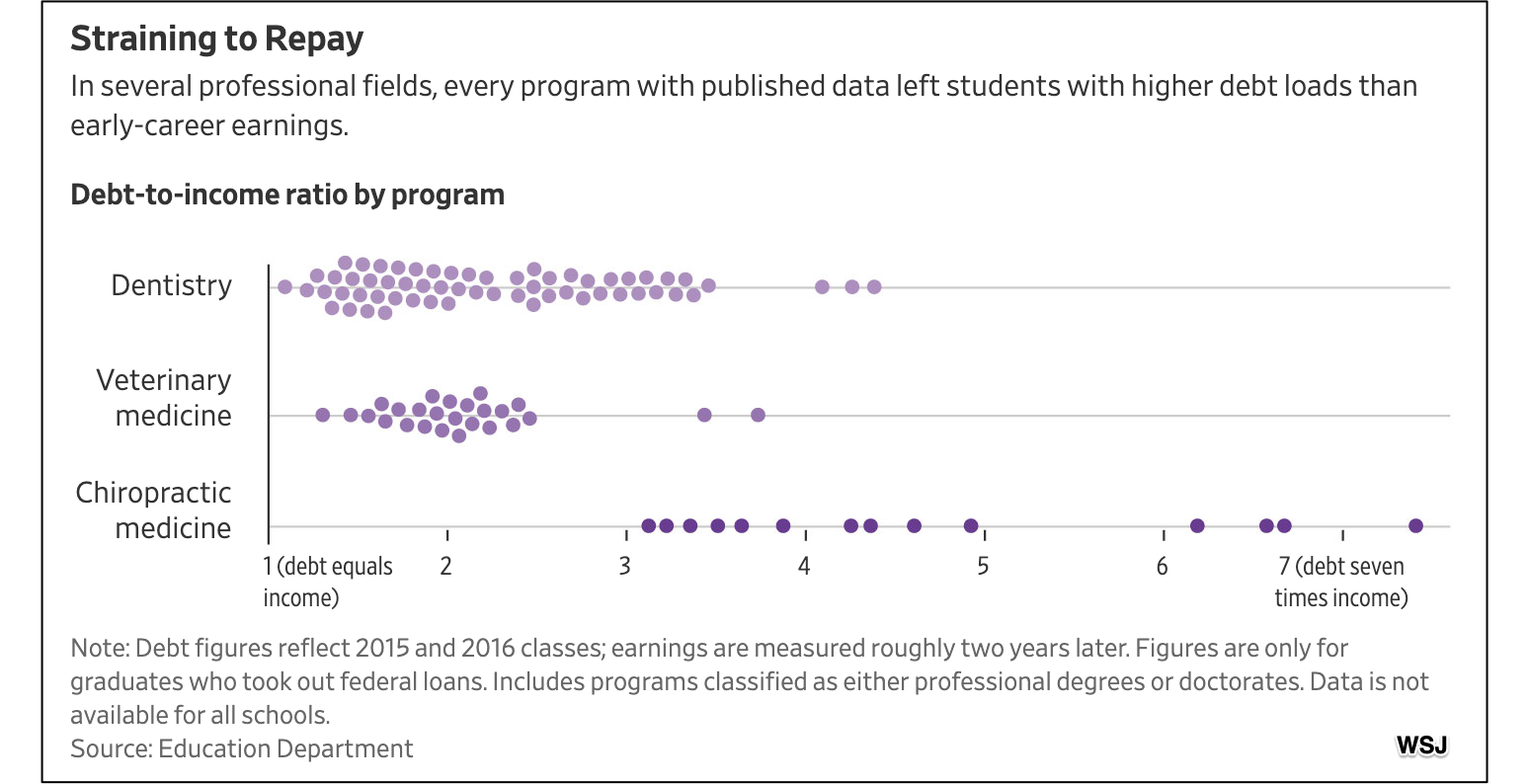

Below, the Wall Street Journal shared debt to income ratios to give us a better idea of the debt burden for three professions:

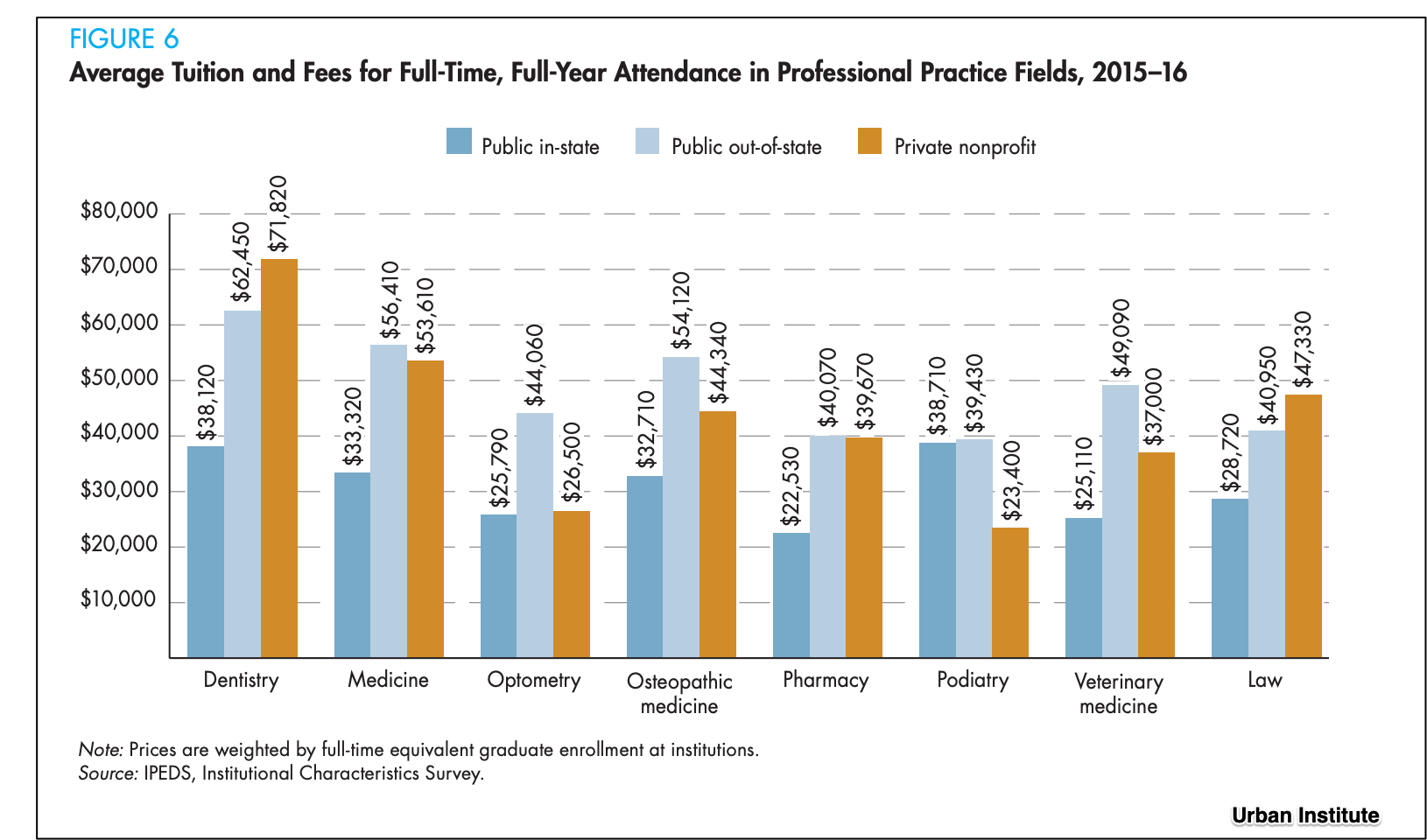

Other professions, though are equally pricey:

Age

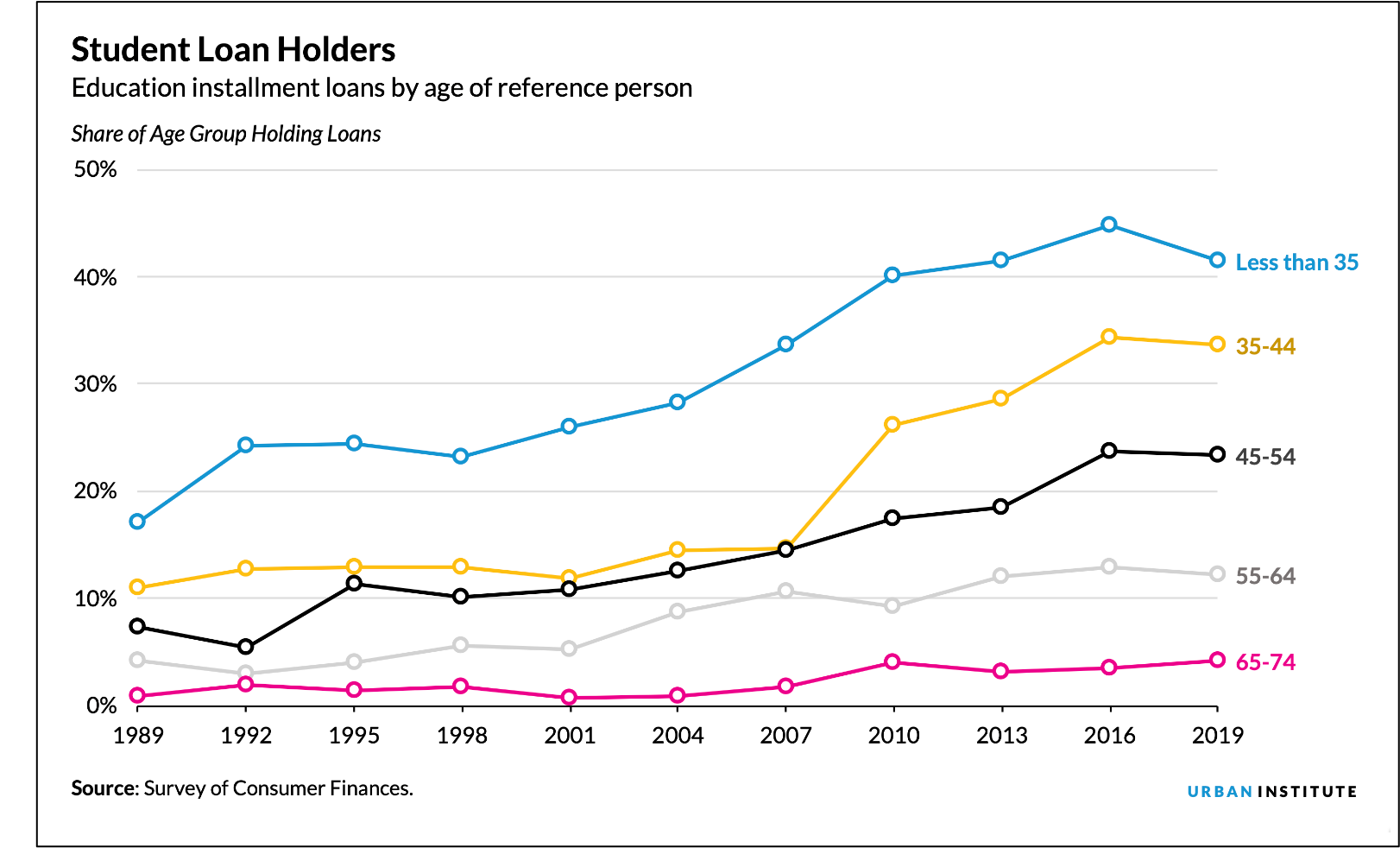

Increasing from 15 percent to 34 percent, the share of student loan holders aged 35 to 44 has climbed the most. Researchers at the Urban Institute hypothesize that the reasons could be the increasing number of graduate students and also borrowers holding debt for a longer time period:

Race

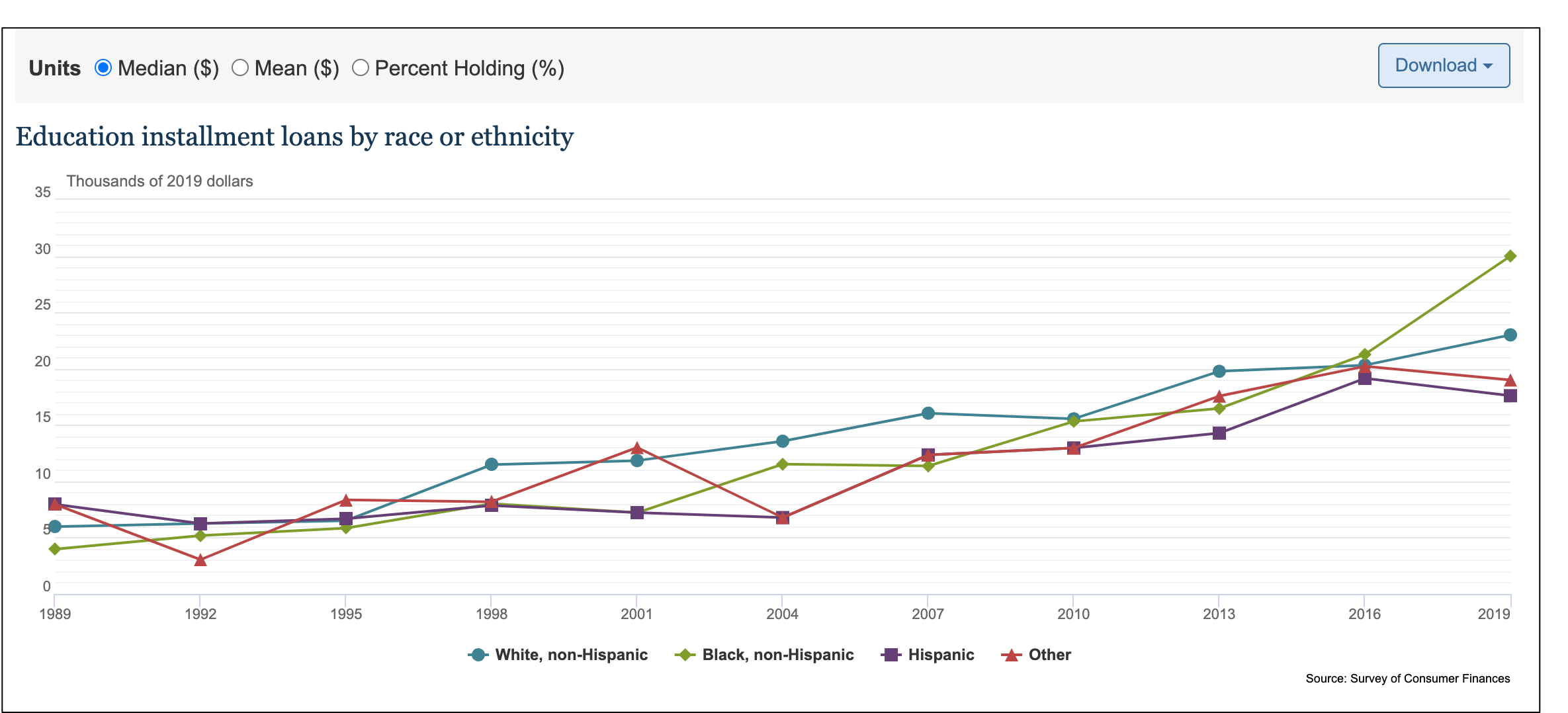

In addition, Black borrowers moved from below the median amount borrowed to above it:

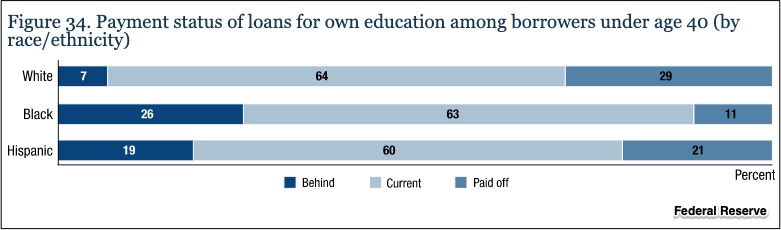

Consequently, we’ve wound up with the following groups that have been behind on payments:

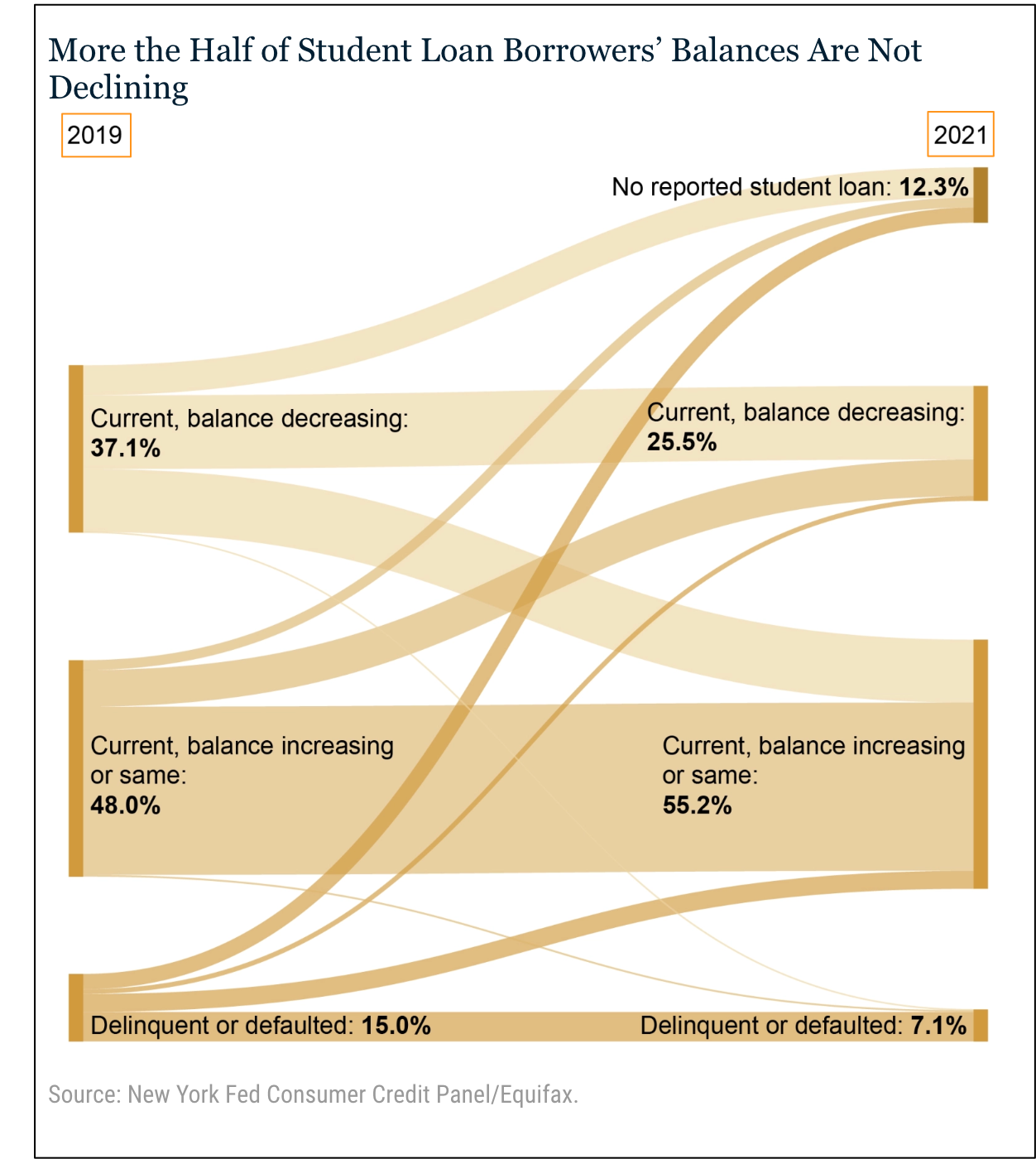

And finally, the majority of student loan balances have been rising:

Our Bottom Line: Human Capital

Looking at student loan facts, an economist could tell us that education builds human capital. Rather like we increase productivity by adding the tools and equipment that compose physical capital to a factory, we boost our human capital with more education.

My sources and more: For student loan facts, WSJ, here and here and the NY Fed’s Liberty Street Economics were ideal complements. From there, the Urban Institute came in handy. And finally, last May we debated the cancellation tradeoffs.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)