Comparing Santa and UPS

December 22, 2021

Wondering What Happened to the Bread

December 24, 2021What to do when your own currency is worthless? Use a tattered and worn limited supply of U.S. dollars that you occasionally need to launder and hang on the line to dry:

From: WSJ/Associated Press /Tsvangirayi Mukwazhi

During 2008, Zimbabweans were laundering an inadequate supply of U.S. dollars. Used over and over again, the bills needed washing.

We last looked at Zimbabwe’s money problems in 2017.

Now some clouds remain.

The Return of Zimbabwe Inflation

As more than just a snapshot, laundered currency tells you the story of a troubled economy. Lacking a functional money supply, the country winds up producing less. And then lower production means layoffs and diminishing demand.

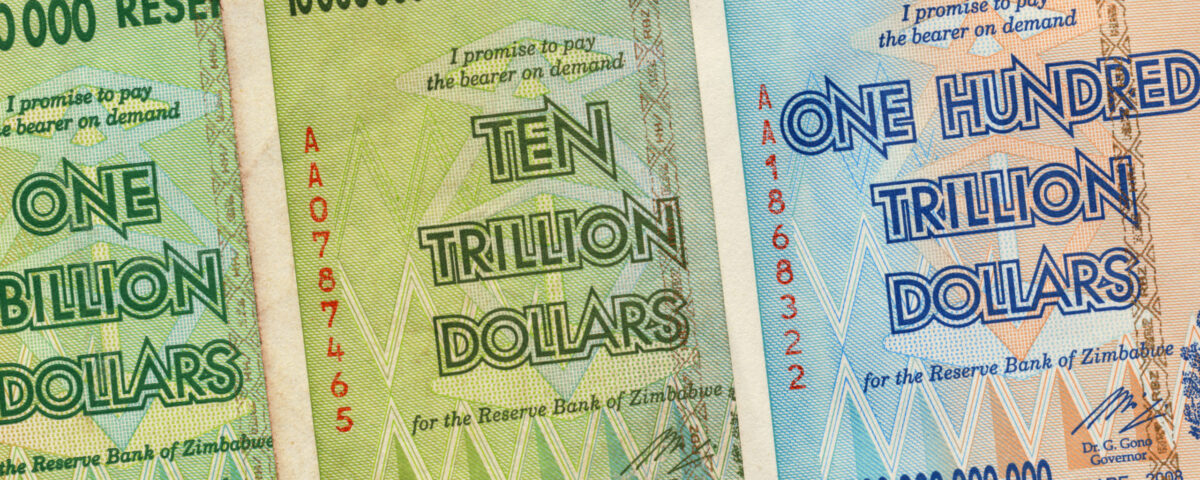

With prices doubling every 24.7 hours because of too much money in circulation, Zimbabwe’s inflation rate was 79.6 billion percent in late 2008. To reverse the plunge, in 2009 Zimbabwe replaced their own dollar with money from other countries. Since then, they’ve relied on the U.S. dollar, the South African Rand, and assorted foreign currencies.

No more.

In 2019, they banned foreign currencies, issued a new Zimbabwean dollar, and created an electronic currency. It did not work. Instead, by July 2020, inflation returned as prices climbed, purchasing power plunged, and salaries were worthless.

Professor Steve Hanke estimates a Zimbabwean inflation rate of 97.27 percent as of December 9, 2021. On his map of inflation hotspots, the countries with the highest rates are shaded red:

Our Bottom Line: What is Money?

Money can be rectangular squares of paper, tobacco leaves or cows. It can be backed by gold or silver or a bank or nothing. What matters is what people think. If we believe that a commodity is a yardstick of value, a medium of exchange, and can store value, then it functions as money.

Because few people believe that Zimbabwe’s currency is money, the country has to launder U.S. dollars.

Our sources: For more detail on Zimbabwe inflation, do take a look at this BBC article, Al Jazeera, and Reuters. However, my top recommendation for inflation info is always Professor Steve Hanke. Please note that today we’ve repeated several sentences from past Econlife posts.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)