Where (International) Trade Grades Are Changing

April 13, 2021

Where Housing Prices Are Going Through the Roof

April 15, 2021Our story starts with two numbers. An estimated 45 million Americans owe approximately $1.6 trillion in student loans. They owe it mostly to the federal government.

But there is much more. We can start with the big picture and then see where student debt fits in.

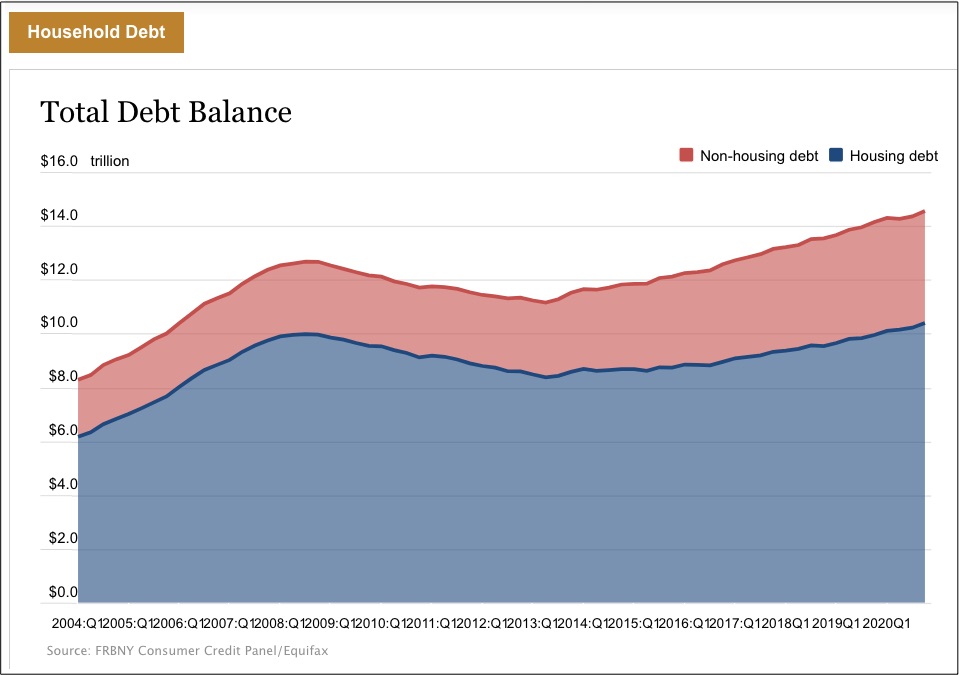

Household Debt

Most of household debt relates to housing. Student loans occupy part of the pink section of the Federal Reserve graph:

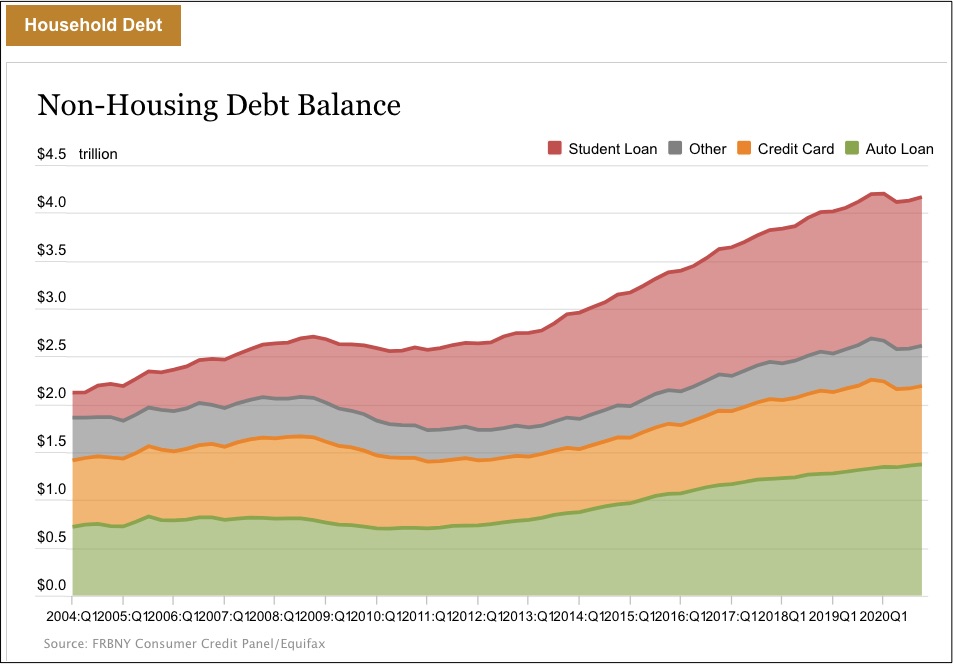

Then, looking more closely at the pink section of our first graph, we can see that, at $1.55 trillion, student loans occupy the largest slice. Auto debt is at $1.37 trillion:

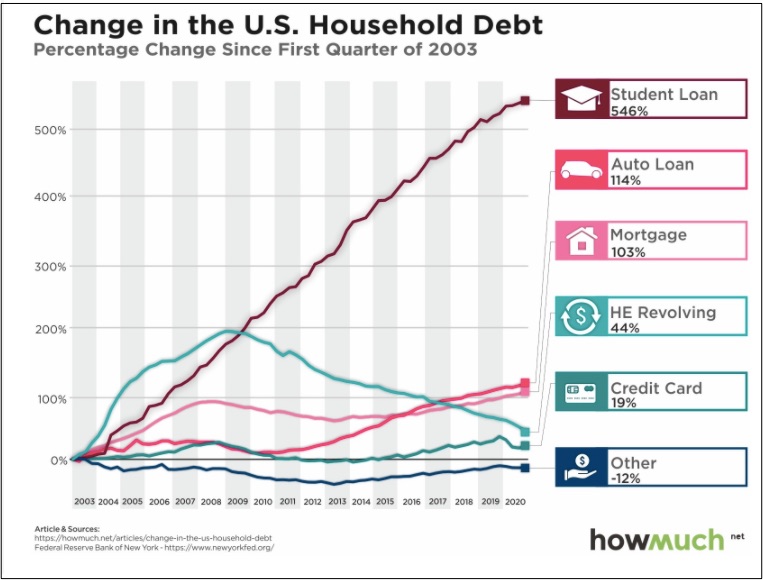

Furthermore, as a proportion of household debt, student loans have skyrocketed:

Those loans are for a younger group of people, aged 18-29. They get older at the graduate school level:

Our parents and grandparents have been helping out with student debt through different kinds of loans:

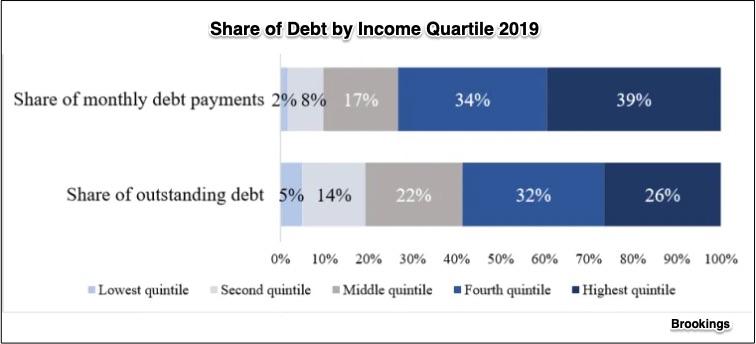

But still, it’s the most affluent who pay the most:

It might be most expensive to become a dentist:

Our Bottom Line: Student Loan Status

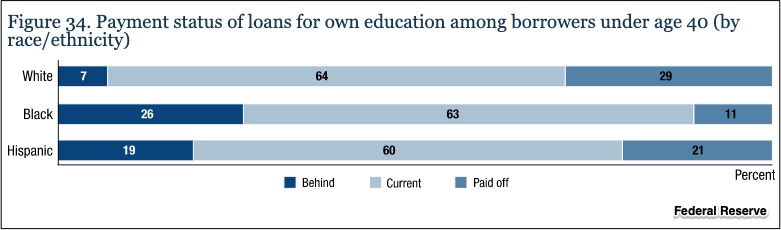

Keeping in mind that the Congress could forgive student loan debt up to the $10,000 that President Biden has supported or by as much as $50,000 through other proposals, we can ask about the payment status of loans. Below, you can see who is behind, current, and paid off:

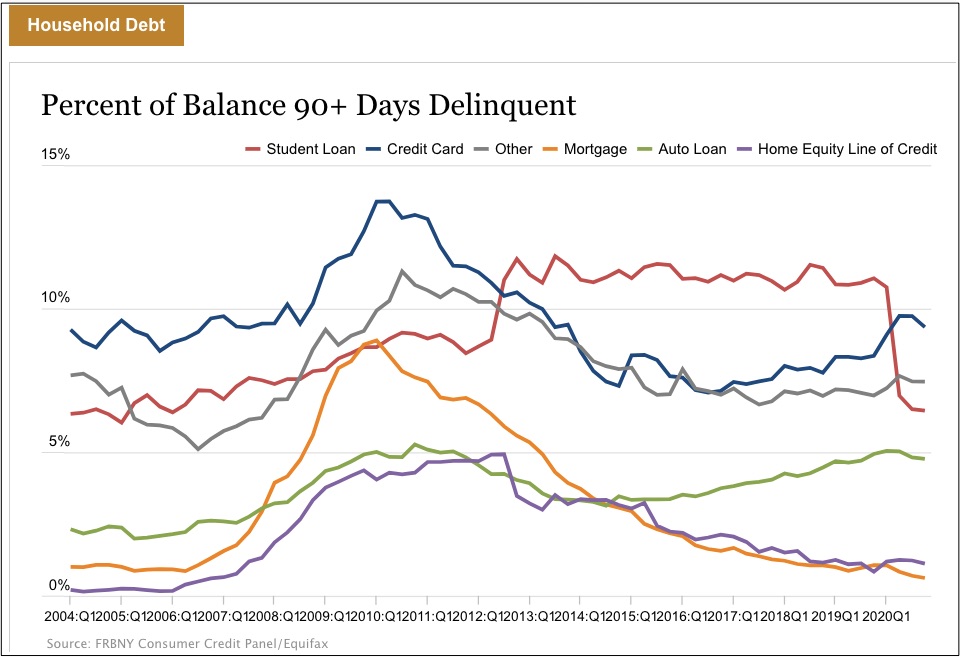

We also can look at delinquencies. The Federal Reserve tells us that delinquencies are down because of “forbearances” from the CARES Act and lenders during the Covid crisis. From over 10 percent, student loan delinquencies dipped to 6.5 percent during the fourth quarter of 2020:

So yes, we can say $1.6 trillion. But then, it gets more complicated when we look at households, different age groups, race/ethnicity, levels of education, and professions.

My sources and more: Brookings is always a good starting point for the topics they cover. From there, The Washington Post and the LA Times had a different set of details. But for a clear picture of the basic data, the NY Fed credit report and the Fed’s Economic Well-Being Report were excellent.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)