Try to imagine goods and services marching around a circular flow model of the U.S. economy. Through markets that respond to supply and demand, we produce and distribute goods and services that move between households and businesses.

Below, the outer arrows illustrate the money that moves around the economy. Meanwhile the inner circular takes us to the goods and services that those dollars pay for:

When the economy is healthy, the march of goods and services around the circular flow is vigorous. Then, during typical business cycles, we see it temporarily decelerate.

Circular Flow Slowdowns

After natural disasters, the circular flow comes close to a halt. Because of hurricanes, earthquakes, fires, and floods economic activity contracts. Then after, when we try to restore what was destroyed, rebuilding activity boosts the GDP. Although it just takes us back to where we began, still, it’s a springboard.

While we could call COVID-19 a natural disaster, the slowdown appears very different.

A rare macroeconomic disaster has been defined as an event that creates a cumulative decline in real per capita GDP or real per capita consumption of 10 percent or more during one year or several adjacent years. The three events that fit that definition since 1870 were the Great Depression and World Wars I and II. Because of the six percent GDP decline in a typical country from the 1918 pandemic, economists have suggested that it belongs in that macro disaster classification and so too might the legacy of COVID-19.

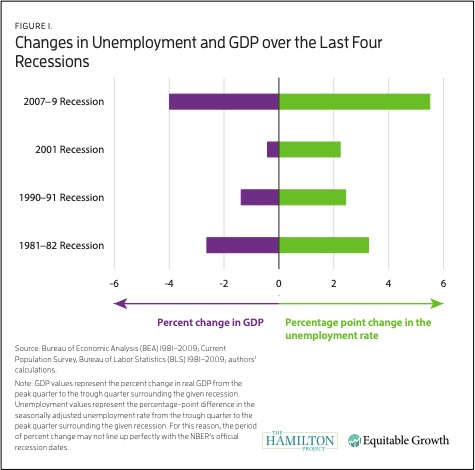

Looking at recent contractions, you can see that only the Dec. 2007-June 2009 recession comes close:

Our Bottom Line: Business Cycles

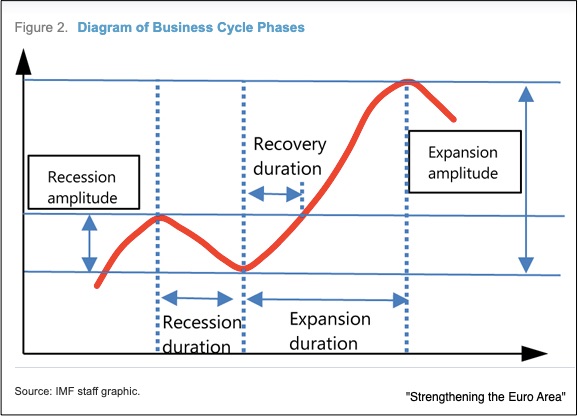

During a business cycle, the economy expands, hits a peak, contracts, touches a trough, and then starts all over again. When the new peak is higher than the one before it, we’ve got economic growth.

A business cycle:

Returning to where we began, a circular flow slowdown reflects a recession that is the result of overheated and excessively risky economic activity. At the time though, people say, “This time it’s different.” It’s not.

But with COVID-19, it is indeed possible that it is different. For awhile, we can expect the circular flow will march much more slowly.

My sources and more: Thanks to the Conversable Economist for alerting me to Joshua Gans’s manuscript on the economic impact of COVID-19. From there, this March, 2020 paper on the 2018 flu pandemic provided insight.