Why Your Birthday Cake Might Have Too Many Candles

November 20, 2019

The Airline Seat Size Squeeze

November 22, 2019The U.S. Social Security System is called pay-as-you-go because today’s payroll tax revenue becomes today’s benefits. Going to rich and poor, the benefits pretty much equal what people paid in.

In their 2019 report, the Social Security Trustees told us that insufficient tax revenue will lead to diminished benefits after 2035. Like many other countries, we are living longer and having fewer babies. For Social Security, that means more beneficiaries and proportionally few workers. Add low interest rates and sluggish economic growth and you get pension problems almost everywhere.

So today, let’s see where retirees should be most and least concerned..

Scoring Global Pensions

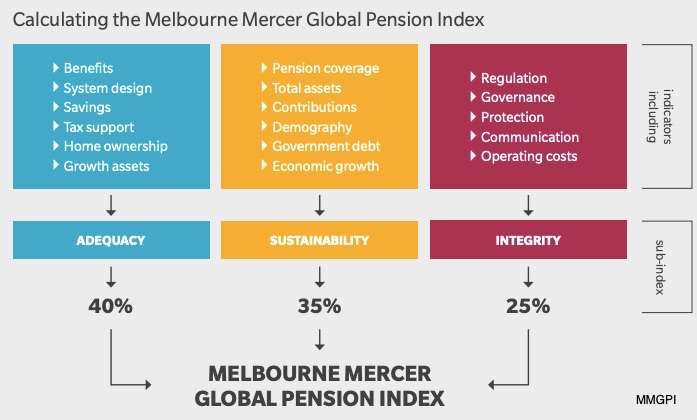

The Melbourne Mercer Global Pension Index (MMGP) gives a retirement income score to 37 countries. Their main criteria are sustainability, adequacy, and integrity:

- Adequacy focuses on the variables that can guarantee a sufficient stream of savings.

- Sustainability takes us to the resilience of the public program’s funding.

- Integrity is about regulation and governance.

These are the categories:

You can see that the Netherlands and Denmark are at the top while Thailand is last:

Selected Country Scores

On a 0-100 scale, scores for pension income systems ranged from a high of 81.0 (Netherlands) to a 39.4 low (Thailand). The average was 59.3.

Australia

- Score: B+ (75.3)

- Above average, Australia’s pension income system got a B for adequacy, a B for sustainability, and an A for integrity.

Canada

- Score: B (69.2)

- Above average, Canada’s pension income system got a B for adequacy, a C+ for sustainability, and a B+ for integrity.

France

- Score: C+ (60.2)

- Close to average, France’s pension income system got a B+ for adequacy, a D for sustainability, and a C for integrity.

India

- Score: D (44.6)

- Below average, India’s pension income system got a D for adequacy, a D for sustainability, and a C for integrity.

Japan

- Score: D (48.3)

- Below average, Japan’s pension income system got a C for adequacy, an E for sustainability, and a C+ for integrity.

Mexico

- Score: D (48.3)

- Below average, Mexico’s pension income system got a D for adequacy, an C for sustainability, and a D for integrity.

Peru

- Score: C (58.5)

- Close to average, Peru’s pension income system got a C+ for adequacy, a C for sustainability, and a C+ for integrity.

Sweden

- Score: B (72.3)

- Above average, Sweden’s pension income system got a B for adequacy, a B for sustainability, and a A for integrity.

United Kingdom

- Score: C+ (64.4)

- Above average, the U.K.’s pension income system got a B for adequacy, a B for sustainability, and a A for integrity.

United States

- Score: 60.6 (C+)

- Above average, the U.S. Social Security System got a “C” for sustainability, a C+ for adequacy and a C+ for integrity.

Our Bottom Line: Tradeoffs

Out of 37 countries, 19 have a close to average or below average MMGPI. To improve their adequacy, sustainability, and integrity, they will need to consider the sacrificed alternatives–the opportunity cost– that each solution requires.

So, do retirees need to worry? When solutions require more national spending, elevating the retirement age, and raising taxes, the tradeoffs could be daunting.

My sources and more: A good starting point is the summary of the Social Security Trustees 2019 report. Then, for the global view of pension income systems, the Melbourne Mercer analysis is the perfect complement.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)