The Surprising Reasons For Food Inequality

February 8, 2018

Weekly Economic News Roundup: From NAFTA Burgers to Cupcake Bubbles

February 10, 2018Whether looking at 1637 or 2000, markets and bubbles always seem to find each other.

A Tulip Bulb Calamity

The wealthy merchant had only wanted to say, “Thank you.” He appreciated the information that the seaman had shared and, in return, gave him a juicy red herring to enjoy for breakfast. Thinking that the “onion” bulb resting on the counter would complement the herring perfectly, the seaman popped it into his pocket and left.

Horror is the only word that comes close to describing the merchant’s response to his missing bulb. Rather than an onion, the seaman had consumed a tulip bulb for which the merchant had paid 3,000 florins–a huge sum of money in seventeenth century Holland. At that time, a suit would have cost 80 florins and one thousand pounds of cheese, 120 florins.

The tulip had first been introduced to Europe in 1559 or so—approximately when Elizabeth ascended to the British throne. Gathering popularity, especially in Holland, tulips had been displayed for their beauty. Eventually though, the quantity that was demanded exceeded the amount available. Unwilling to wait for a blossom, the rich and the poor started to trade the bulbs in markets that sprouted where buyers and sellers met. With buyers far outnumbering sellers, bulb prices skyrocketed.

In February 1637, tulip bulb prices plunged. All who had dabbled in the tulip market suffered. Even if the sailor had never appeared, the merchant would have seen his investment evaporate.

Recent Bubbles

Like 17th century tulip bulbs, dot.com stock, housing prices, and cupcakes hit the stratosphere and then crashed.

Dot.com

The 2000 dot.com bubble (Shaded areas indicates recessions):

Housing

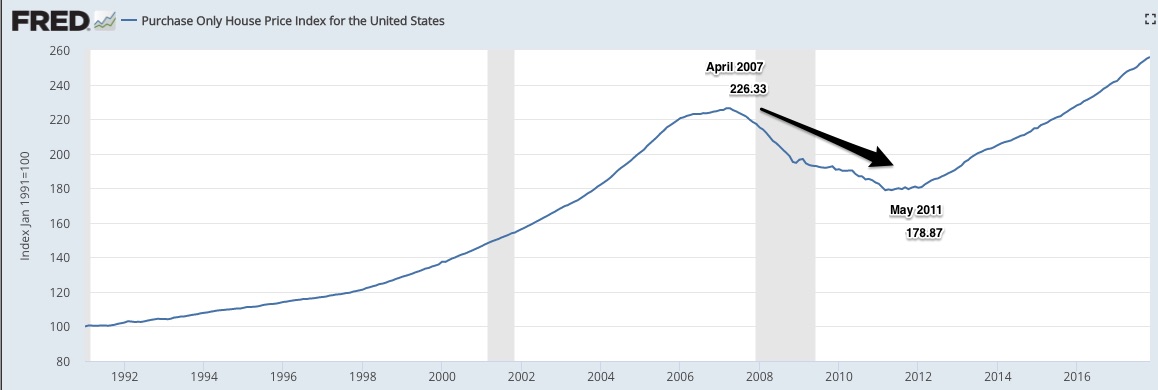

The 2007 housing bubble (Shaded areas indicates recessions):

Cupcakes

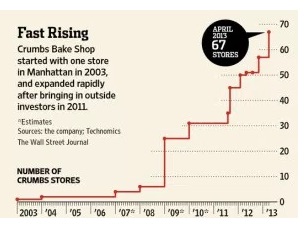

In 1996 we had first pricey cupcake. At a small NYC shop called Magnolia, the $3 gourmet cupcake was born. But it took an entrepreneur to start a chain called Crumbs for the bubble to inflate. Believing cupcake consumption was unstoppable, Crumbs’s production and prices shot skyward. They even charged $42 for a giant cupcake that fed eight people…and it sold!

The Huffington Post said we had reached “Peak Cupcake” when a Crumbs IPO let all of us join the frenzy. At first the stock was $13.10 a share during June of 2011. By June 30 2014, it had plunged to 4 cents a share and Crumbs was closing all of its shops.

Our Bottom Line: Bubbles

Are we in a bubble with cryptocurrencies? The stock market? The auto industry? Bubbles start with something new that captivates the market. As euphoria builds, so too do demand driven price increases. Then, with speculative purchases escalating, prices move even higher. But always, the euphoria switches to panic, sellers multiply and the market crashes. On the way up, participants like to say “This time it’s different.”

But for tulip bulbs and tech, housing and cupcakes, it wasn’t.

My sources and more: Most of this post was previously published at econlife. Then we’ve brought it up-to-date with FRED graphs and The Huffington Post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)