How to Own the Word How

October 9, 2014

Our Weekly Roundup: From Cheap Gas to Expensive Soda

October 11, 2014A sugary drink tax is on the ballot in Berkeley, CA. Called Measure D, the proposal mandates a one-cent per ounce tax. The goal is to diminish obesity and encourage healthy eating.

Sadly, it is not quite that simple.

Municipalities debating a tax on sugary drinks have to decide whether they want to raise revenue or diminish obesity. If the tax is not very high, people will continue buying sugary drinks and generate revenue. On the other hand, if the tax is high enough and people buy fewer sugary drinks, then obesity diminishes.

Perhaps.

But, we also have to think about substitution. If the tax discourages sugary beverages, drinkers might switch to some equally caloric alternative. However, when all junk food is covered, researchers have observed that consumers absorb the higher prices.

And still it gets more complicated.

One study indicated that only households in middle income quintiles will respond to a sugary drink tax. For the most affluent, the tax is relatively small and easy to ignore. For the lowest earners, consumption continues while other spending decreases.

And finally, we might not even know we are being taxed. When a two-liter bottle of Coca-Cola is marked an untaxed $2.50 in the supermarket aisle, most of us do not even recognize the taxes we pay at the register. (Interestingly, the Berkeley tax would be paid by distributors, not consumers.)

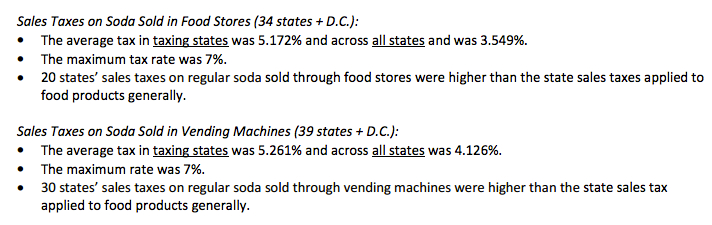

State Sugary Drink Taxes

According to a 2014 paper looking at a 5.5 percent tax in Maine during the 1990s and a 5 percent tax in Ohio in 2003, the impact was insignificant. Most researchers suspect that municipalities need a much heftier tax to get us to respond.

Soda tax facts:

To see your own state, here is a sugary tax list.

Our Bottom Line: Inelastic Demand

Price increases can always take us to demand elasticity. As with medication, if price changes a lot and the quantity we buy remains pretty constant, then our demand is inelastic. By contrast, if price swings have a big impact, then our response is elastic. For soda, within a certain price range our demand is inelastic. Maybe a 35% tax (or more) would nudge us into elastic territory.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)

2 Comments

[…] leads us to the price elasticity of demand. If the price changes a lot but the quantity we buy just changed a little or it remained the same, […]

[…] for the demand to change drastically. It has been shown that the price tax has to be more than 35% for soda in order for the demand to be elastic. That is because juice has an elasticity of 1.01 […]