Why We Buy Pricey Movie Theater Popcorn

February 19, 2026During November, 2025, we considered the California billionaire tax proposal. Since it’s again in the headlines, we should take another look.

The California Billionaire Tax Proposal

The proposal (Initiative 25-0024) will need to collect more than 874,641 signatures by June 24, 2026 to get on the ballot for the November election. Recently, its sponsors decided to double what they were paying per signature to $10. But, according to the NY Times, $10 might not be enough since other related initiatives have offered $12.

Proposed by a California healthcare union, the tax targets individuals with a net worth exceeding $1 billion. At first it sounds rather simple. Implemented for just one time, the rate is 5%. All the tax collector has to do is add up the value of stocks, real estate, intellectual property, paintings–all that is owned by a very affluent person. Also though, WSJ says that they will have to distinguish between a billionaire’s “voting interest and economic interest.” Here, they are referring to people like Mark Zuckerberg that has 61% voting control (through super-voting nontransferable shares) but owns 13.6% of Meta.

Unintended Consequences

- The Tax Foundation tells us that stock prices could plunge if owners, needing liquidity, have to sell massive blocks of shares. The externalities could include the impact on all investors.

- Billionaires might just move. Consequently, not only would the tax not apply to them but also their previous tax revenue would be l;ost. (The proposal includes a retroactive residency date of January 1, 2026.)

- For people like Tony Xu, the founder of DoorDash, the act creates multiple liabilities (like a capital gains tax) that add up to more than his net worth:

- Since a married couple is subject to the tax but not two individuals living together, divorces could become more popular.

I’ve listed just a few considerations cited by the Tax Foundation. There are many more.

Our Bottom Line: Wealth Concentration

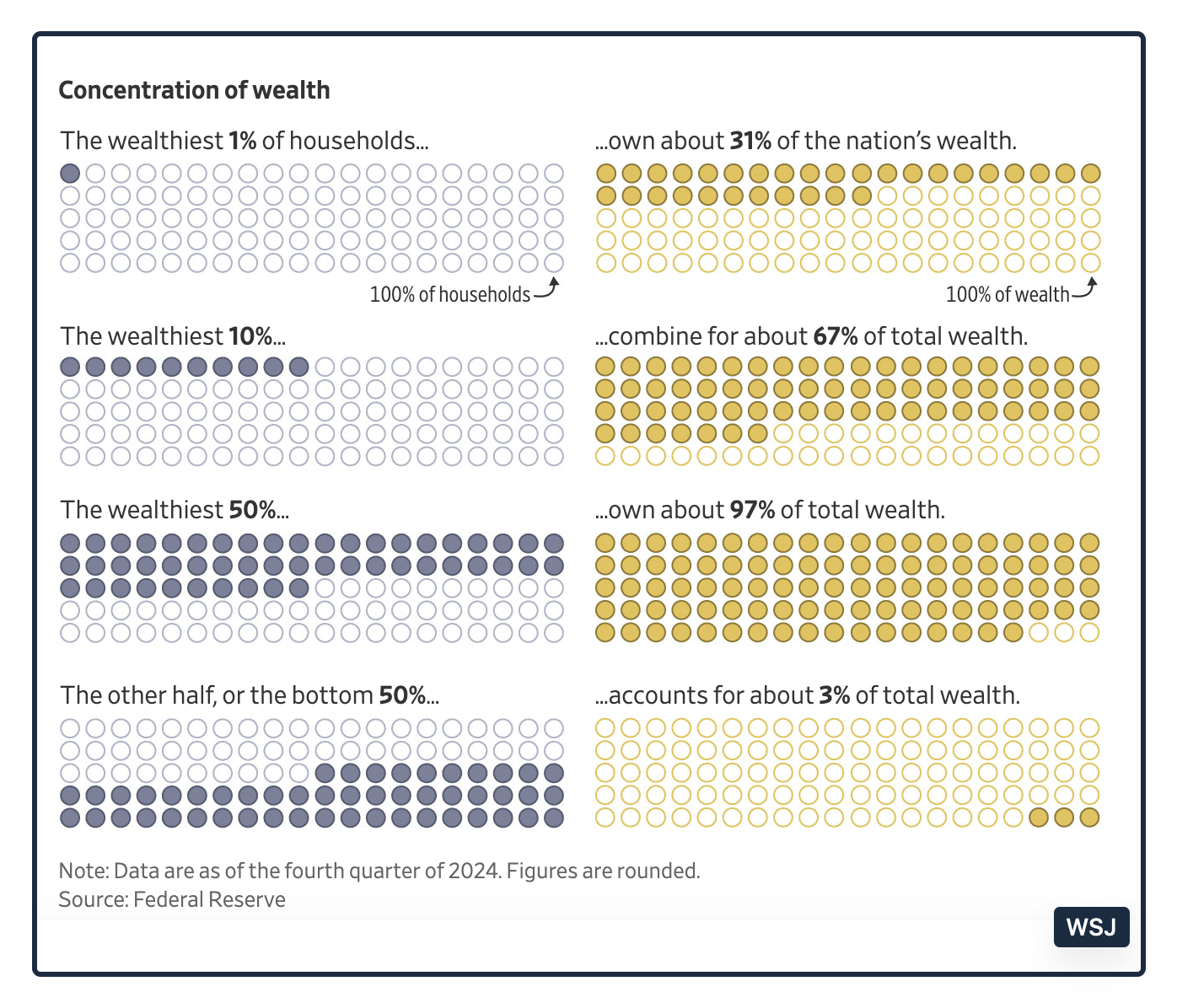

Perhaps though, we are really talking about the problem of wealth concentration:

The solution?

It is complicated.

My sources and more: Good for background and up-to-date, this NY Times article was a good place to start. Then, the Tax Foundation’s analysis was the perfect complement.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)