How We’ve Responded To Rising Restaurant Prices

January 11, 2023

The 6 Facts We Need To Know About Gender Gaps

January 13, 2023We have good news and bad news.

U.S. baby boomers and future generations might smile when they hear that the size of their Social Security retirement checks will exceed what they paid in taxes. However, the Penn Wharton Budget Model also tells us that a Social Security shortfall will contribute to massive fiscal imbalances. As a result, the federal debt is projected to soar to 236 percent of GDP by 2050.

The U.S. is not alone.

Comparing the World’s Retirement Systems

Annually, during the past 14 years the Melbourne Mercer Global Pension Index ranks global retirement systems. Summarizing current trends, they cite a shift from defined benefit (DB) plans to defined contribution (DC). With DB plans, retired individuals typically get income payments until they die. By contrast, upon retirement, we can expect a DC plan to indicate a lump sum. As a result, with DC, we know what we put into a program but we cannot be sure of what we will receive. DB is sort of the reverse.

With adequacy, sustainability, and reliability its three criteria, the Melbourne Mercer Index Scorecard covers 44 retirement systems and 65 percent of the world’s population. At 40 percent of a country’s score, the adequacy component is mostly based on the system’s revenue, savings, benefits, and growth potential. Meanwhile, with sustainability counting for 35 percent, it includes a score for demography, debt, and total assets. Then, through its focus on governance, costs, communication, and protection, integrity is 25 percent.

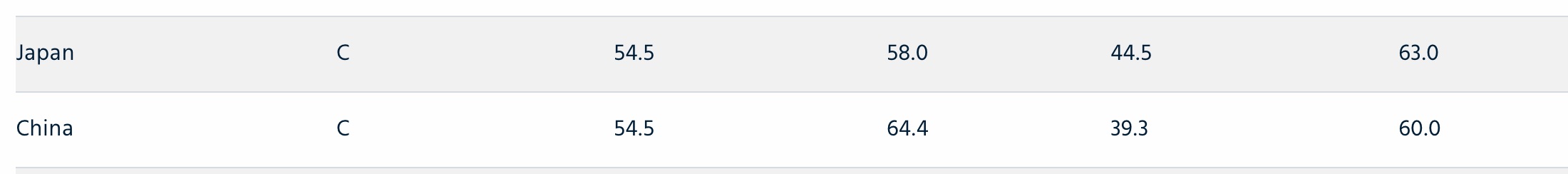

Looking at the list, we see Iceland, the Netherlands, and Denmark got the only A grades for their pension systems. We also can see that Iceland was at the top for its system’s adequacy and sustainability while Finland had the highest integrity score. Then, at the bottom, we have India’s system especially lacking adequacy, Austria’s, sustainability, and the Philippines, integrity:

Moving down the Melbourne Mercer Scorecard, I’ve copied some other countries’ ranks and scores. At 8, 9, and 10, we have Sweden, Singapore and the U.K.:

Moving down the Melbourne Mercer Scorecard, I’ve copied some other countries’ ranks and scores. At 8, 9, and 10, we have Sweden, Singapore and the U.K.:

Continuing with the U.S. Colombia and France, at 20, 21, and 22, each has a C+:

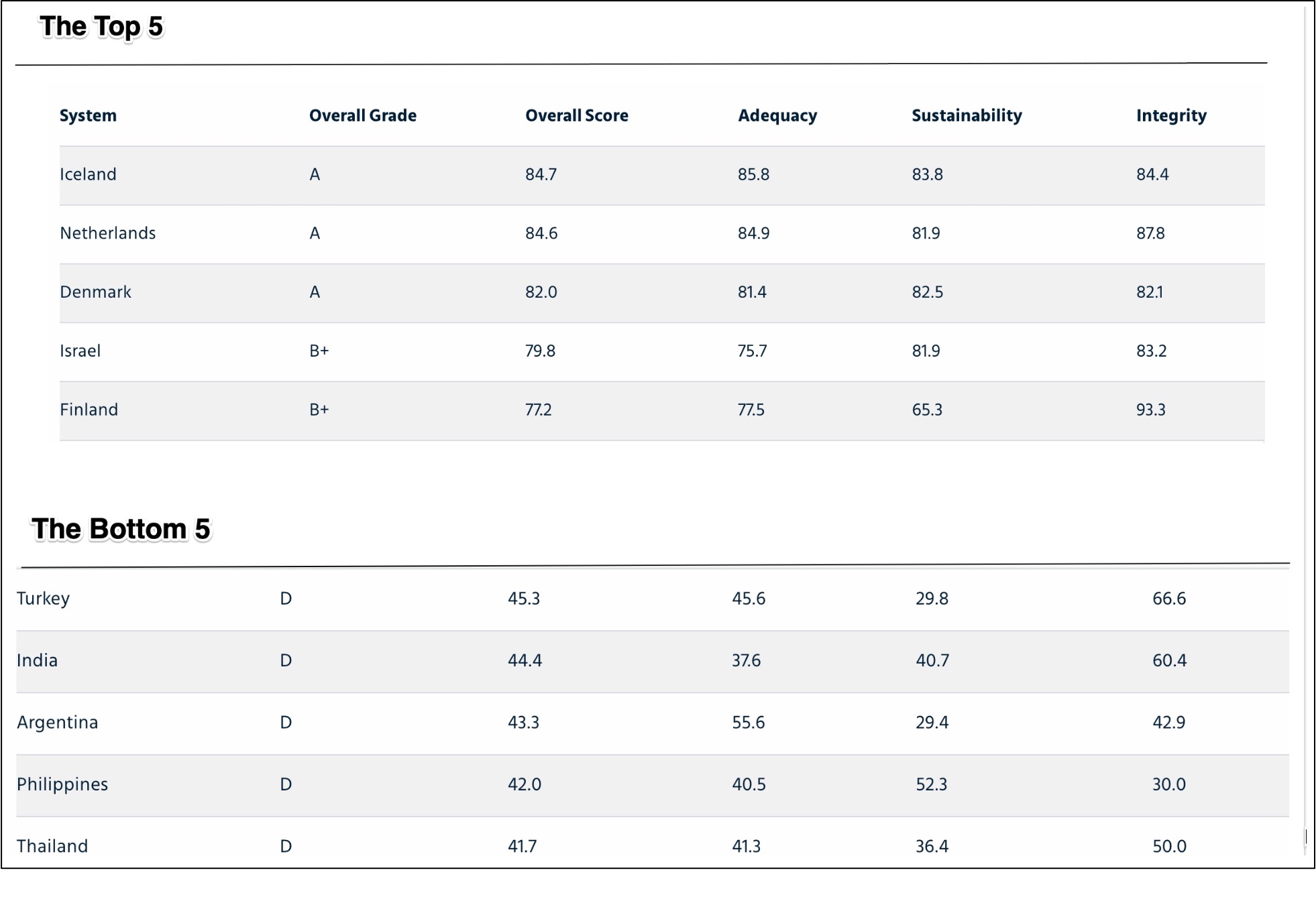

Next to each other, Japan and China are at 35 and 36:

Our Bottom Line: Entitlements

When a pension type of payment like Social Security comes from government it is called a transfer payment. Not given to people for creating any good or service, it is money that their country has decided they deserve because they have certain characteristics. They could have reached a certain age or stopped working. They might have a disability. The common thread is the inability to earn an income. As a result, we have created entitlements that include Social Security transfer payments.

However, the resilience of our entitlement systems varies. While few of us want a C or D, as we have seen in the U.S., it can be tough to raise our grades.

My sources and more: The Penn Wharton Budget Model is always a handy first stop for federal budget analysis. Then, we are able to take the next step with a global lens through the Melbourne Mercer Global Pension Index. And finally, the U.S. Department of Labor described different retirement plans.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)