Where Have All of the Bank Robbers Gone?

June 22, 2022

The (Chicken/Egg) Problem With Your EV

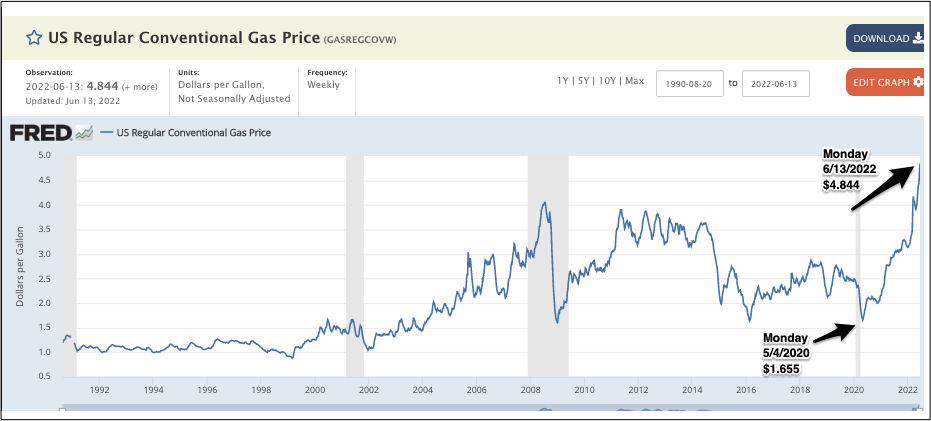

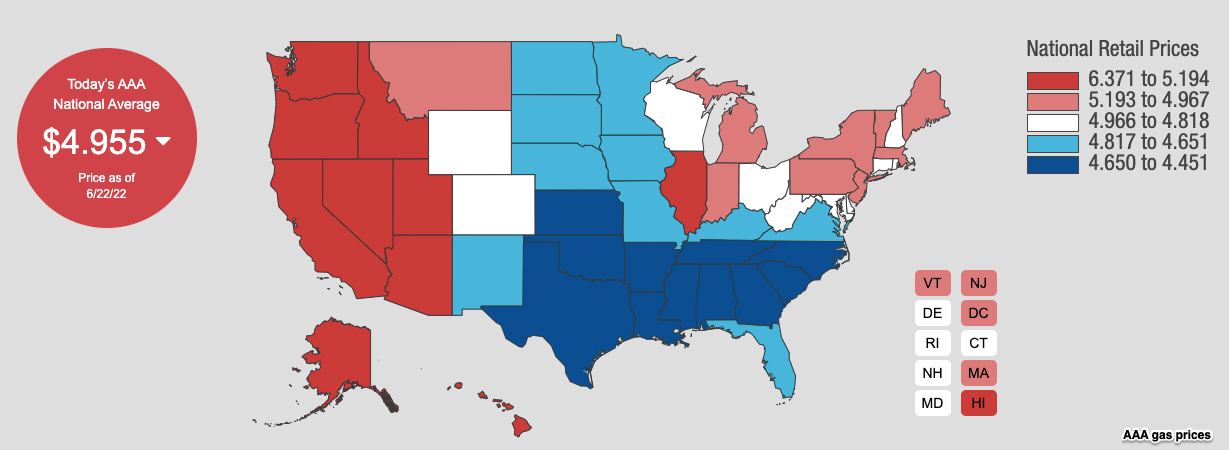

June 24, 2022Approximately two years ago, on April 27th, gasoline prices averaged a low of $1.655 per gallon. Now, the national average for a gallon of regular is close to $5.00:

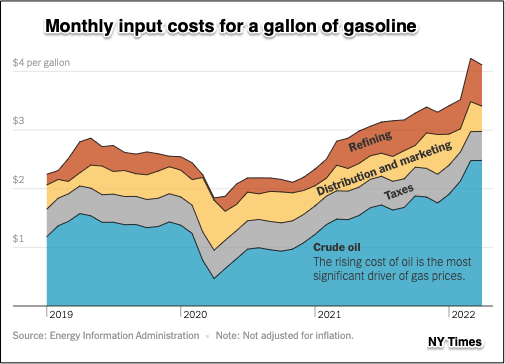

What we pay for gasoline depends on four components. President Biden wants to reduce one of them.

Let’s take a look.

Gasoline Prices

Federal Taxes

Suggesting an 18.4 cent federal tax suspension, the Biden proposal targets a small proportion of the total price:

However, the President also asked states to suspend their gas taxes.

State Taxes

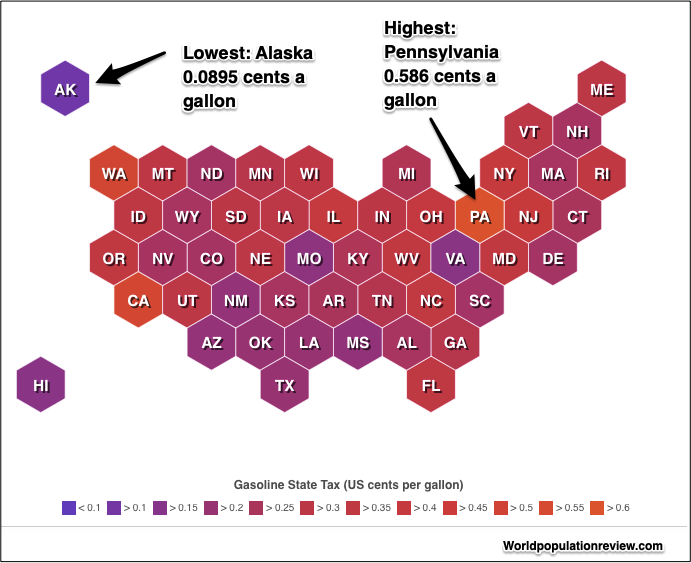

State gas taxes range from a per gallon high of 58.6 cents in Pennsylvania to a low of 8.95 cents a gallon in Alaska:

Yet still, for a slew of reasons ranging from pipeline positions and refinery locations to environmental regulations, the highest tax states don’t necessarily have the most expensive gasoline (although California does). And Alaska is not the cheapest:

Our Bottom Line: Demand and Supply

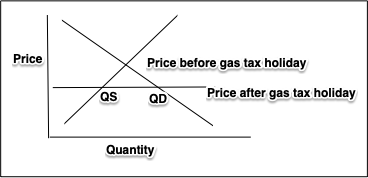

As economists, we can ask how demand and supply would respond if state and federal tax suspensions reduce the price of gas. Starting with law of demand, we typically have the quantity we demand climb when price drops. But then, as you can see below, the quantity demanded exceeds the quantity supplied.

Consequently, I wondered if we wind up with insufficient supply?

Or, perhaps, if the price will soon go up again, the supply side will respond..

My sources and more: As always, it is tough to make us feel good and do good at the same time. With gas taxes, there is so much to consider. We can only begin to get some answers by looking at the U.S. Energy Information Administration (EIA). the AAA, and this website for up-to-date gas taxes. Then, The Washington Post and the NY Times had some analysis. And finally, we could have added this econlife discussion of elasticity.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)