Where Soda Pop Means More Than a Carbonated Drink

May 13, 2021

Learn With Elaine: Impulse Buying

May 14, 2021In Brazil during the 1990s, shoppers raced to supermarkets when they opened their doors. The problem was a hyperinflation that government fed by printing too much money. When the inflation rate hit 80 percent a month, a dozen eggs could cost one dollar on day 1, two dollars on day 30, and $1,000 after a year. Every morning at supermarkets, customers tried to front run the employees who were placing new price stickers on most items.

As of January 2021, Brazil returned to a list of high inflation countries:

The last time the U.S. had double-digit inflation was during the 1970s. Certainly not in the “hyper” category, it touched a 12-month high of 13.3 percent from 1978-1979. The culprits included climbing oil and food prices from the supply side and monetary policies that propelled more demand.

Now, some of us are again feeling some inflation worries.

Inflation Worries

Prices jumped more than we expected in the May CPI report. At 4.2 percent, on a 12-month unadjusted basis as of April 2021, they were substantially beyond the 2 percent goal and the highest 12-month increase since 2008. Still though, for an inflationary outlook, we need to ask which prices are rising.

My May 13 Axios newsletter had some answers. Noting that “inflation is messy,” it traced the ups and downs of airfares that rose by more than 10 percent during April but are still lower than before the pandemic. As for car and truck rentals, prices are up a whopping 44 percent after falling 23 percent but then rising 87 percent between May 2020 and April 2021:

Our Bottom Line: Flexible and Sticky Prices

When we divide the CPI (Consumer Price Index) into flexible and sticky prices, we get some worrisome clues. Flexible prices reflect current changing market conditions whereas sticky prices are more forward looking. Because they are set with an eye on the future, the direction of sticky prices can foreshadow inflation.

I’ve copied a partial list of flexible and sticky prices from a Cleveland Fed paper:

In the Atlanta Fed’s May 12th update, sticky prices are moving upward:

We know what that can mean.

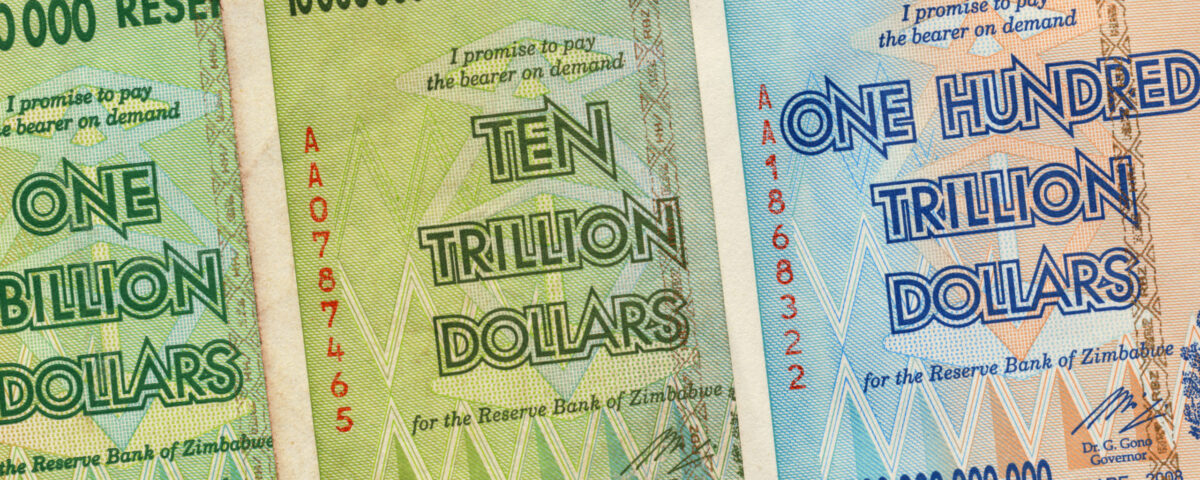

My sources and more: With inflation in the news, the articles are endless. First though my go-to person is Steve Hanke to check on hyperinflation. Then, I always enjoy the Felix Salmon (Axios) newsletter. After that, the Atlanta Fed Inflation Dashboard and a Cleveland Fed essay on the CPI came in handy for today’s post. And finally, I needed data from the May CPI report for April and this NBER paper. (Our featured image is Zimbabwe currency.)

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)