Our story starts with Sami who worked three jobs to support his family.

However, because of the pandemic, he was furloughed from his NIH cook’s job, lost his union organizing position, and stopped driving for Uber. Having come here from Saudi Arabia, he lives with his wife and two children in a one bedroom apartment in Alexandria, Virginia. Currently jobless, he is struggling to pay his $1500 monthly rent, $520 car payments, his insurance, his everyday expenses. A one-time $1200 federal stimulus check and his expanded unemployment benefits barely cover it all.

This is Sami Bourma in front of the apartment complex where he lives:

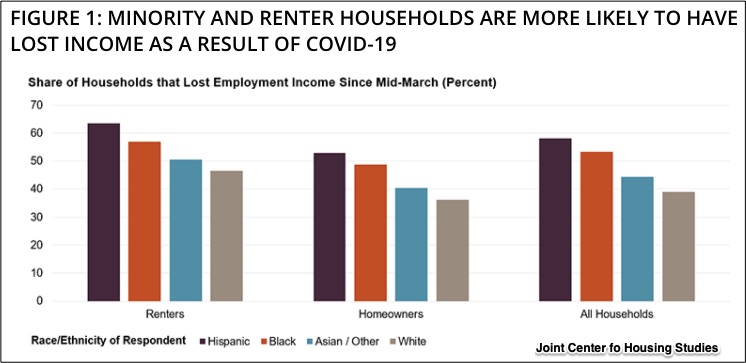

Sami’s rent plight is typical. According to Harvard’s Joint Center for Housing Studies, more than 50 percent of Hispanic, Black, and Asian/Other renters lost income because of the pandemic:

Sami’s rent plight is typical. According to Harvard’s Joint Center for Housing Studies, more than 50 percent of Hispanic, Black, and Asian/Other renters lost income because of the pandemic:

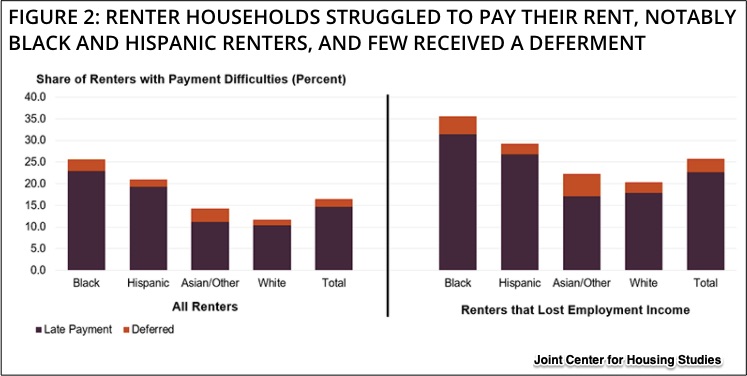

As a result, many minority households have been struggling to pay their rent:

Eviction and Rent Strikes

Some landlords have responded with eviction notices. Meanwhile tenants like Sami organized rent strikes, asked for rent cancellation, and appealed to the courts. Sami and his neighbors just got a court decision that extended their eviction moratorium to September 16.

Like Sami, close to 20 million people could lose their homes because of the pandemic. Sami went to court after Virginia’s eviction moratorium ended. Similarly, Texas has scheduled more than 2,000 eviction hearings and New York, Florida, and California expect a surge in eviction notices when their moratoriums end.

Throughout the United States, there is a patchwork of protections for low income renters. The CARES Act allocated $12 billion to housing assistance and the federal government has suspended evictions in federally subsidized housing. Chicago had 83,000 applicants for a one-time $1,000 check to 2,000 people and New York’s Governor Cuomo announced a new Covid rental assistance program that started on July 16.

Our Bottom Line: The Rent Cancellation Ladder

Deciding what to do takes us to a ladder of dilemmas.

Starting with Sami and other low income households, we have many millions of tenants who need our support. We have property managers and landlords who expect the rent that pays for their mortgages and building expenses. Then, we the have big and small banks, the mortgage servicers, and mortgage providers whose loans are typically held by investors. And to all of this we can add the mortgages that have government guarantees and the mortgage backed securities that were purchased by the Federal Reserve to preserve their value.

So where are we? Knowing we have to support Sami, still, we have to decide who on that ladder should pay the rent.

My sources and more: Yesterday, I began my walk with a podcast that started me thinking again about rent. From there, the possibilities multiplied. My go-to website for housing information is the Joint Center for Housing Studies at Harvard. From there, The New Yorker had more. So too did WAMU. Vox, and the New York State governor’s office.