How Does Democratic Socialism Compare to Other Economic Systems?

November 4, 2025Among the hurricanes that have hit Jamaica, Melissa was the strongest. Exceeding Category 5 maximums (157 mph), her winds topped 185 mph. Wiping out all power, the storm left communities under water. Ranging from hospitals to homes to roads, the damage from Melissa’s direct hit was massive.

This is where a financial product can make a difference.

Financial Products

Catastrophe Bonds

Most bonds are IOUs. In exchange for the bond, the issuer–maybe the U.S. government or a corporation– gets the money. Then, after a specified time period, having collected interest, the bondholder gets paid back the principal. As for the interest, the risk determines how much. With no chance of a default, U.S. bonds pay the least. (However, the size of the deficit did nudge rates upward.)

Then, at the other end of the risk scale, we have catastrophe bonds.

Jamaica’s Catastrophe Bonds

Catastrophe bonds raise the money that a natural disaster clean-up like Hurricane Melissa might require.

Investors in catastrophe bonds could receive as much as a 20% return on their investment. The reason? If a disaster hits, instead of the bondholder, the money heads to the recovery. As a result, the investor could get zero.

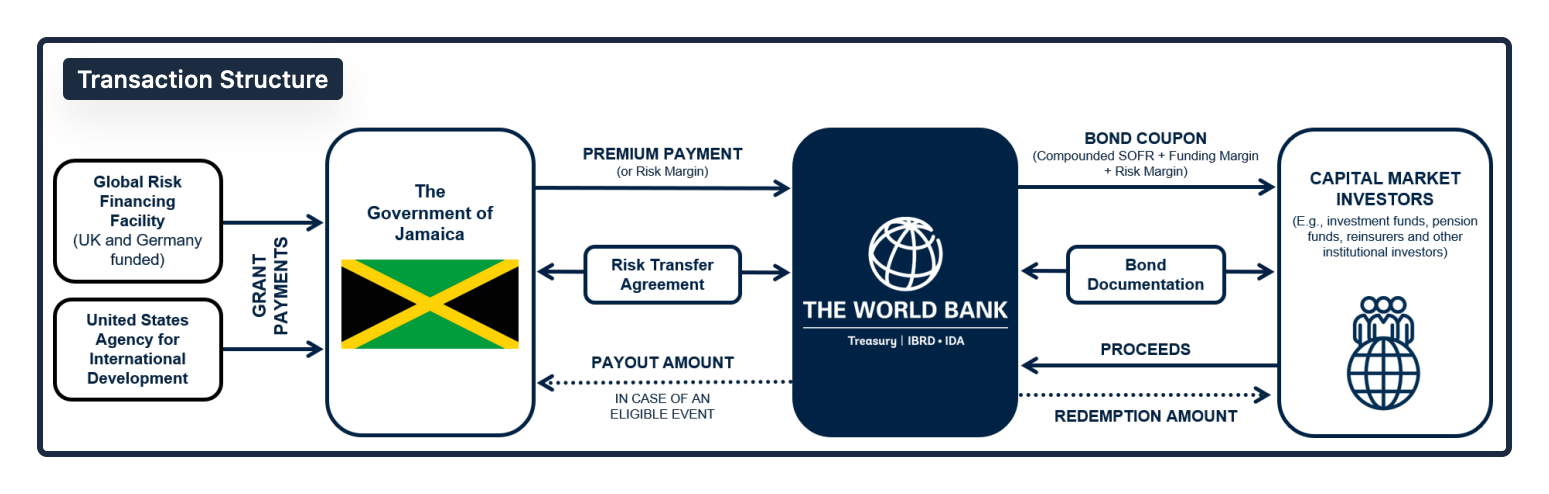

This was the structure for a Jamaican catastrophe bond that covered three hurricane seasons spanning 2021-2023:

A payout could depend on the intensity and trajectory of the storm.

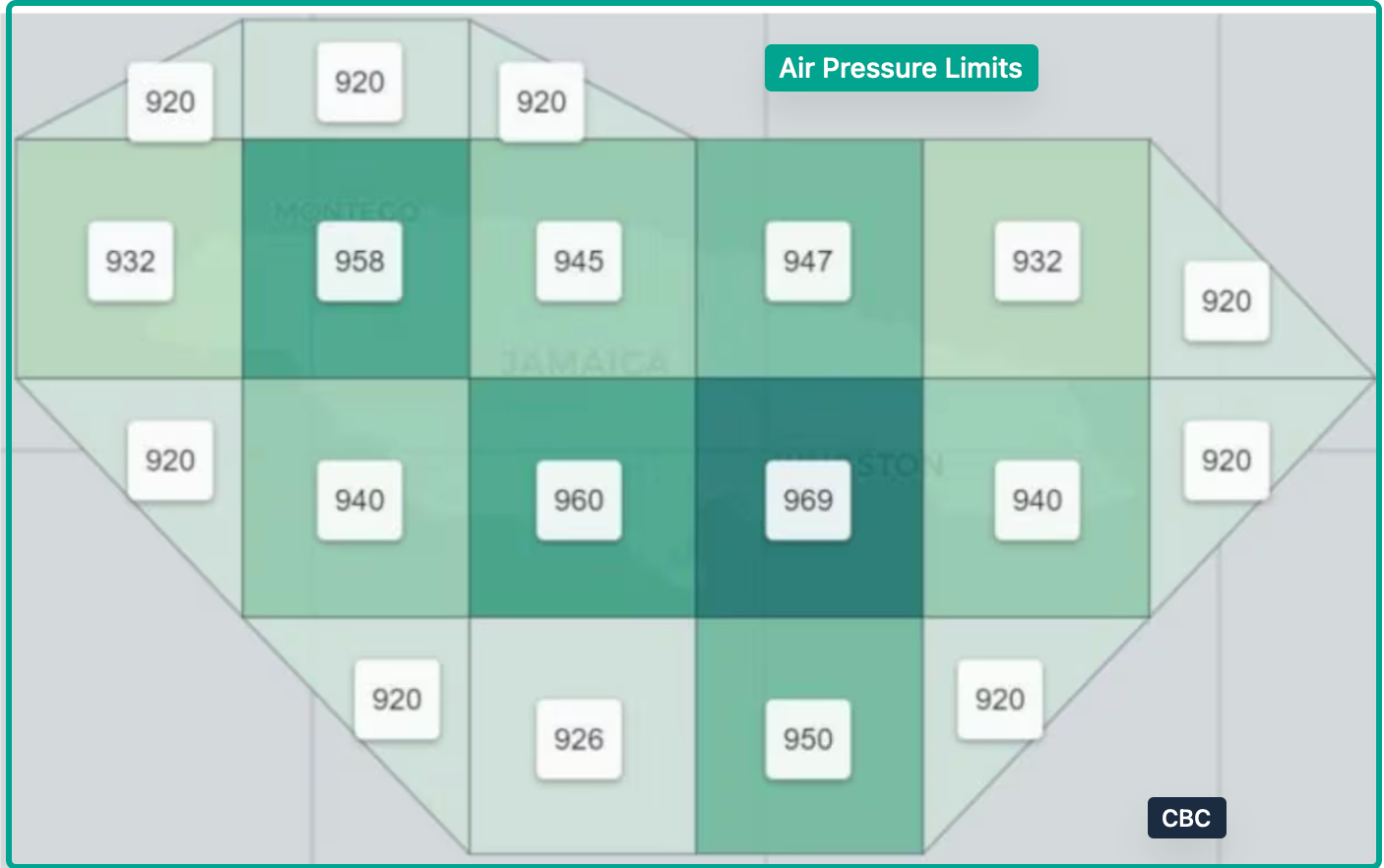

For its recent Jamaican cat bond, the World Bank specified the air pressure trigger. With lower numbers signaling a more severe storm, Melissa’s landfall air pressure, at 892 millibars, activated the bond:

At $150 million, covering four hurricane seasons, Jamaica’s recent cat bond will mature in 2027 and offer a 7% interest payout. According to CBC Radio Canada, the payout ascends from 30% to the full amount of the bond. Rather than the cost of the clean-up, the funding depends on the severity of the storm.

Our Bottom Line: U.S. Bonds

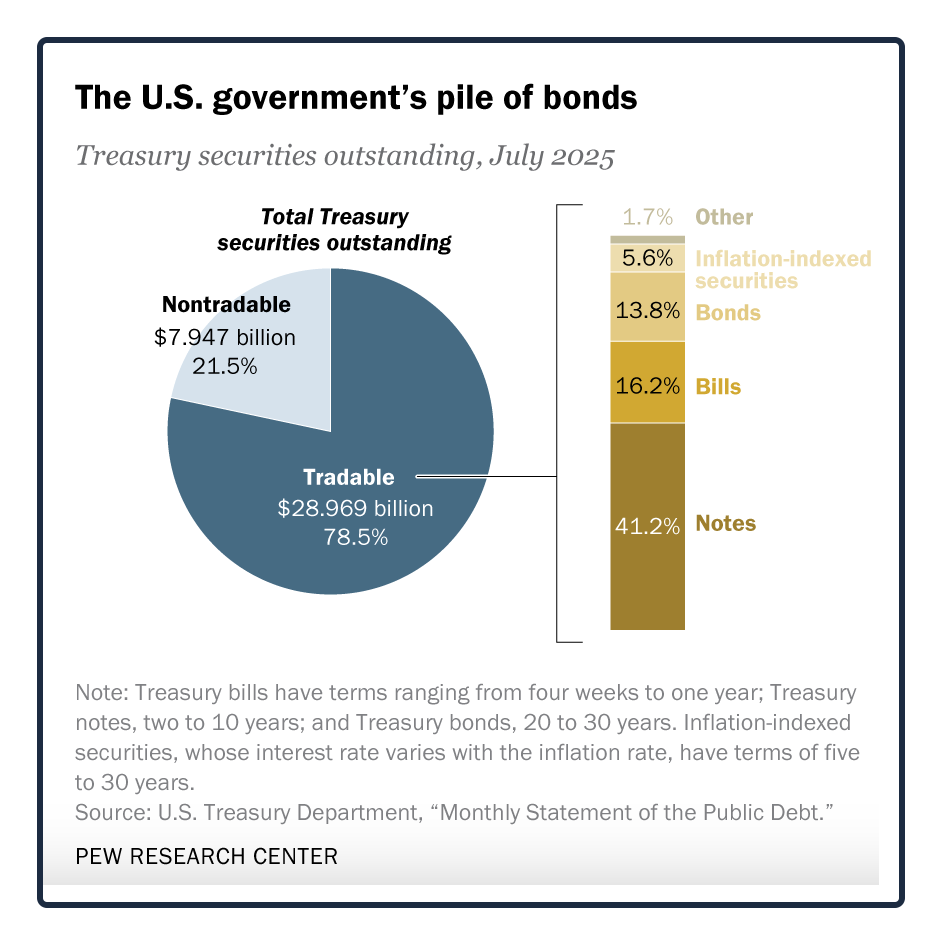

As economists, we say that a bond is a fixed income investment because of its predictable payments. More precisely, the U.S. government sells bonds, bills, and notes. The last two have shorter maturities than U.S. Treasury bonds.

U.S. Bonds

Making a long explanation very short, we can summarize the U.S. fixed income market by showing the different kinds of securities:

When you buy a tradable Treasury, you can sell it in bond markets. The non-tradable version includes the bonds held by the Social Security and Medicare trust funds.

So indeed, whether referring to cat bonds or U.S. bonds, we are looking at financial products that that let us temporarily use other people’s money.

And to conclude, answering the question asked by our title…

How to Plan For a Catastrophe?

Sell a Catastrophe bond.

My sources and more: Thanks to the BBC’s World Business Report (that sadly is cutting back) for inspiring today’s post. From there, for the big picture, Pew has a perfect overview. Then, for catastrophe bond explanations, the possibilities include the World Bank, the CBC, and the Chicago Fed. Also, Reuters described Melissa. And finally, do look at how the rhino bond is a similar concept.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)