Where We Sleep the Most

September 11, 2025

September 2025 Friday’s e-links: The Real Meaning of “Made in America”

September 12, 2025When President Lyndon Johnson wanted a quickie take on the U.S. economy during the 1960s, his chair of the Council of Economic Advisers, economist Arthur Okun (1928-1980), came up with the Economic Discomfort Index. Simply the sum of the unemployment and inflation rates, it measured economic distress.

Then, during 1980, with an election to win, Ronald Reagan (reputedly) gave the Economic Discomfort Index a new name. Seeing it soar, he called it the Misery Index. He won the election against Jimmy Carter and the Misery Index was born.

Fast forwarding to now, based on the Misery Index, we should be sadder.

The Misery Index

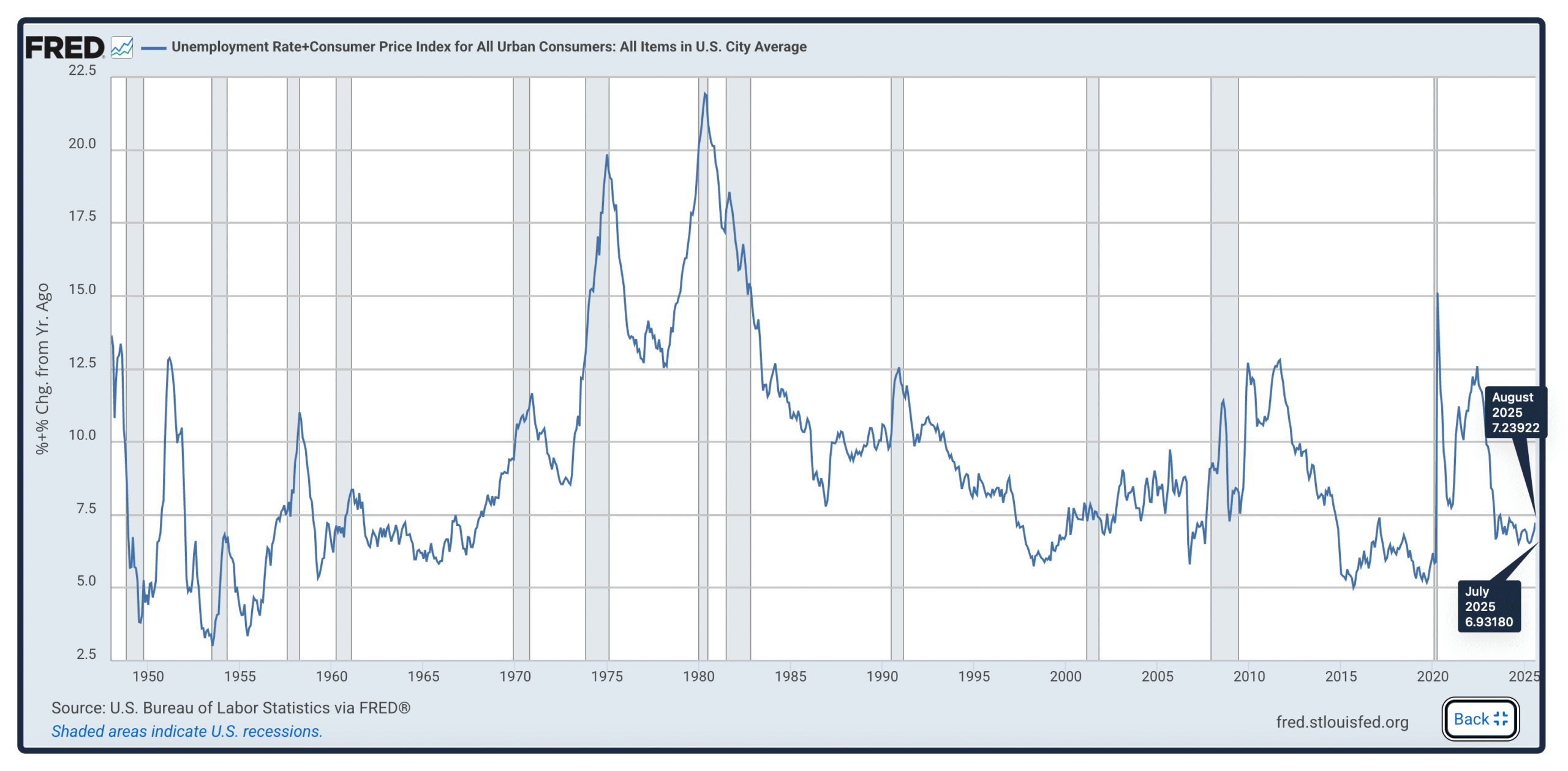

Just adding together the annual inflation rate and the unemployment rate, the following FRED graph uses the simplest version of the Misery Index. While the numbers are far from their peaks during the mid-1970s to the early 1980s, they are rising.

Shown by the recent increase, the Misery Index went up from July to August:

If this summer’s trend continues (as this week’s numbers indicate), job markets and inflation are worsening. As of today, 12-month inflation is 2.9% and the August unemployment rate was 4.3%.

The Hanke Misery Index

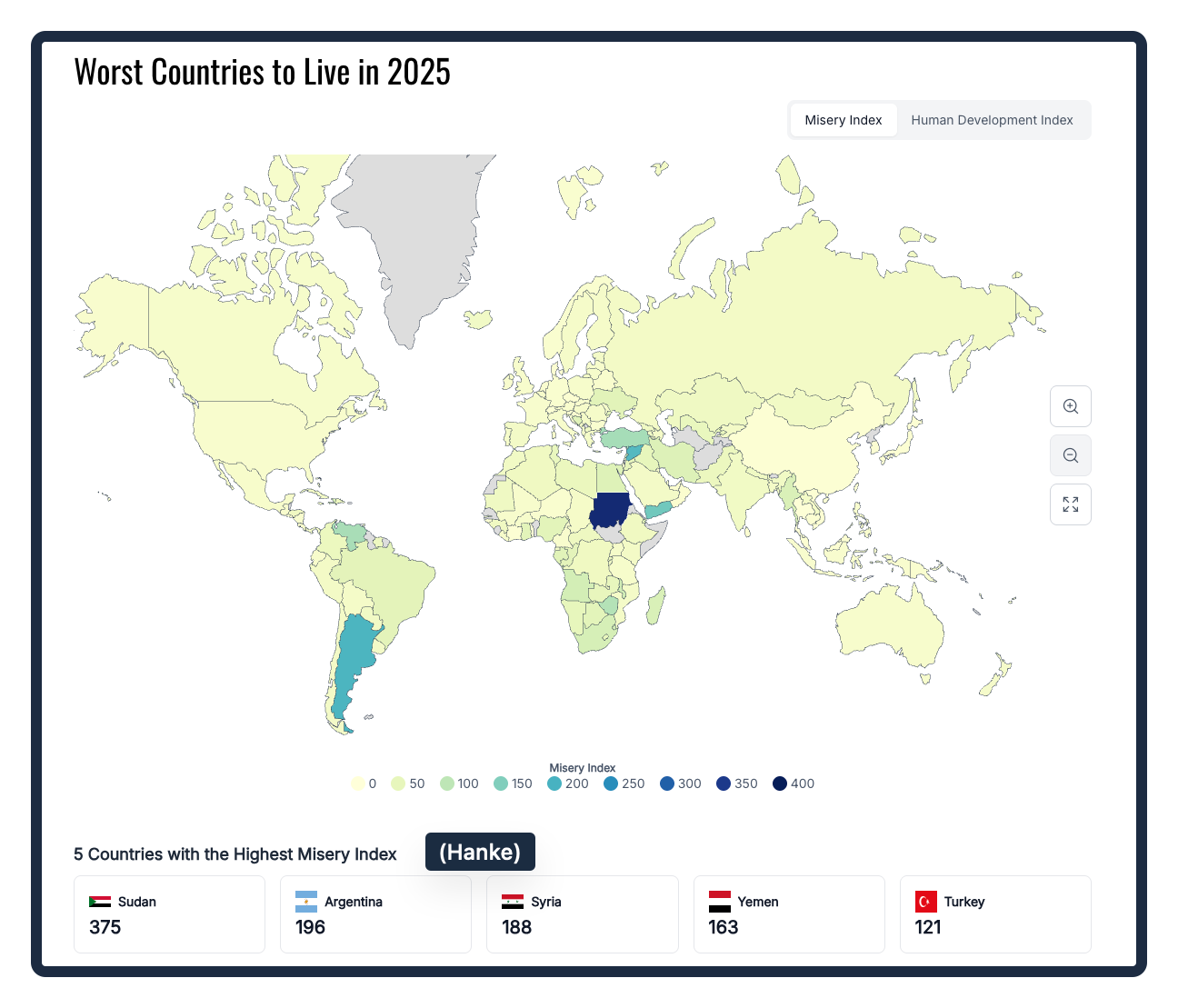

Taking the idea a step further (from where a Harvard economist, Robert Barro, tweaked it), Johns Hopkins Professor Steve Hanke decided to add interest rates and growth. More precisely, he totaled the unemployment, inflation, and bank lending rates. Then, from that number, he subtracted the percent change in per capita GDP growth. When the first three rise, they are the “bads.” But if the last one goes up, it is a “good.” Recently though, his index changed a bit when he decided to double the unemployment rate component. In the Hanke Index, called HAMI, high numbers are alarming.

Not a list in which you want to be #1, the 2024 Hanke index places Sudan and Argentina at the top:

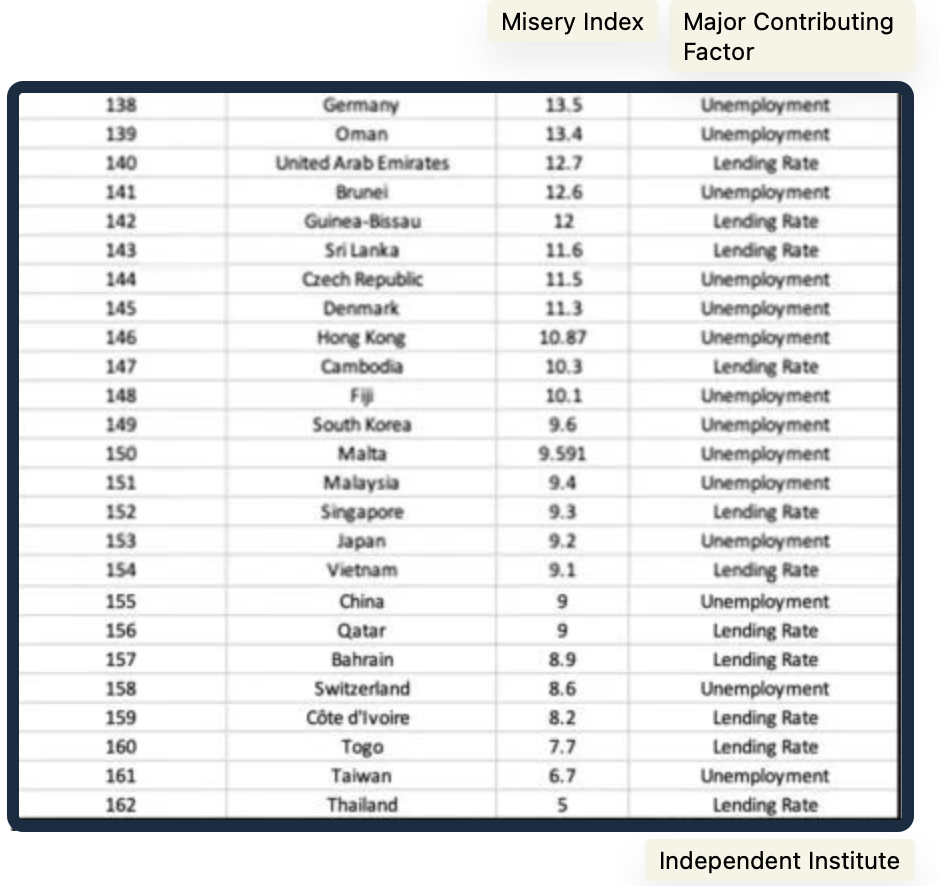

Below, we have countries with a low (desirable) Hanke misery score (Sorry for the blurry print). The U.S. was #119:

Because of Switzerland’s “low” rank at #158, one analysis suggested all of us just need more chocolate and cheese.

Our Bottom Line: Inflation or Unemployment?

According to a study from three New Zealand economists, the pain from unemployment far exceeds the suffering created by inflation. Based on Gallup poll answers from 2005 to 2019, they concluded that a “1% point rise in the unemployment rate has 4.6 times as large an effect on sadness as a 1% point rise in inflation.” Furthermore, the ripple from unemployment, with jobs lost, business activity contracting, and state revenue declining affects us more than inflation. And yet, everyone is complaining more about rising prices.

My sources and more: Looking up the Misery Index and HAMI, I also discovered the Baseball Misery Index. But perhaps most crucially, this study said unemployment was worse.

Please note that today, we updated and revised a previous post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)