Just Ask Jenna Looks At Dining Out

December 18, 2025

December 2025 Friday’s e-links: Adjusting to Aging

December 19, 2025The first to try, the governor of Indiana just said his state could charge tolls on existing interstate highways.

- The problem? Indiana’s road maintenance fund has a $2 billion shortfall.

- The solution? Through tolls, everyone pays, even drivers passing through the state.

Starting with the 1956 Federal-Aid Highway Act, we already pay for our 160,000 miles of highways through a gasoline tax. Initially at 3 cents per gallon of gasoline and now 18.4 cents, the money funds our roads. In addition, states collect their own gasoline taxes.

But it’s not enough.

Highway funding

Toll Roads

While toll roads are one funding possibility, the federal government has resisted. During 1916, in an amended version of the first law providing aid to the states for the construction and upkeep of roads, the Congress decided that an appropriation couldn’t go to a toll road. Then, in 1927, an amended Federal Highway Act of 1921 partially perpetuated the prohibition by saying toll bridges were okay, but only until the bridge (or tunnel) was paid for. (This let a Chicago mayor during the 1950s use federal funding for a road that he called a bridge so he could charge tolls. There was a tiny stretch of water under part of the road.)

Now though, Congress seems to have changed its mind. Creating exceptions to non-tolling rules, they’ve said new roads that manage congestion or reduce emissions could be toll financed.

The Highway Trust Fund

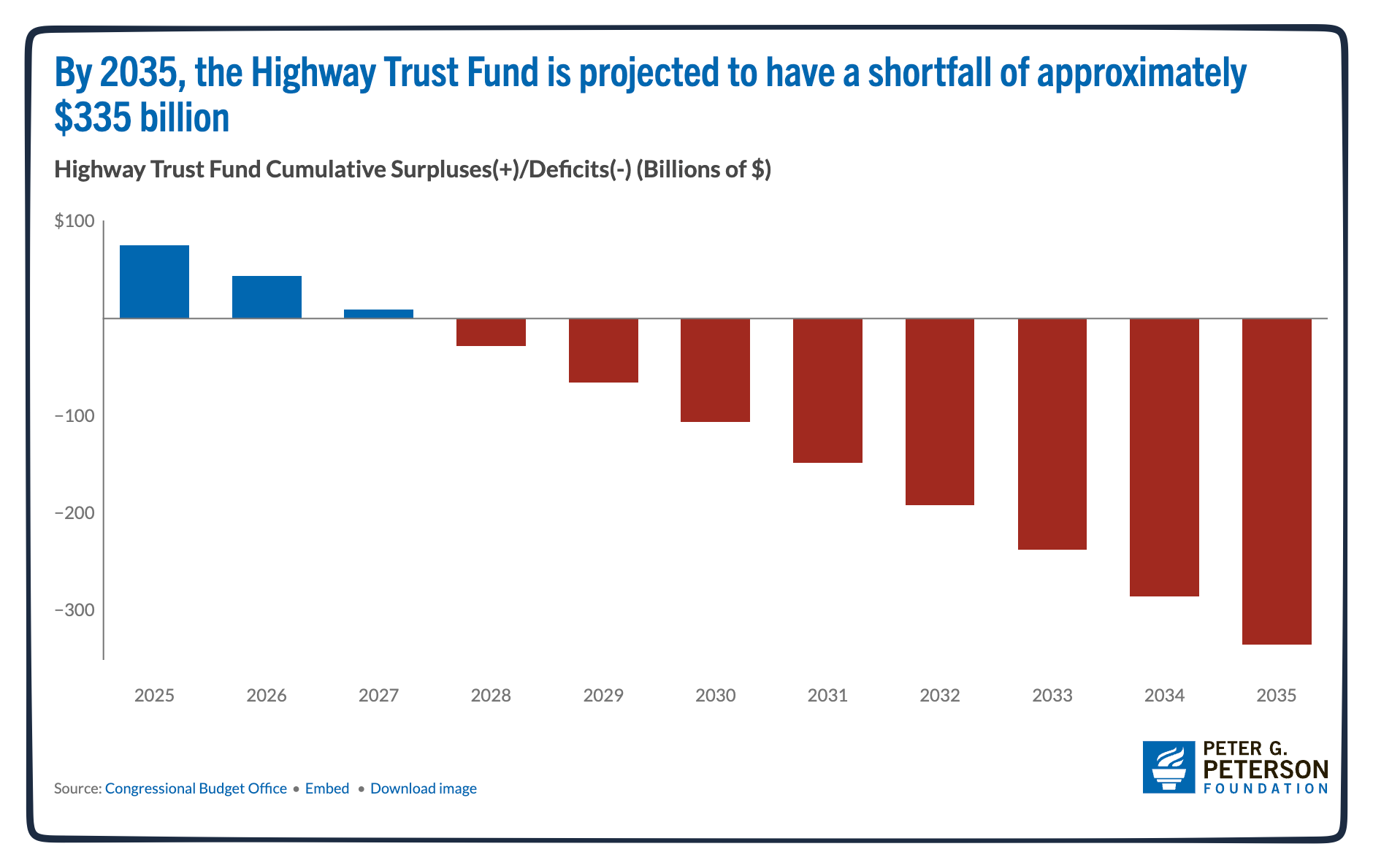

One reason for the toll reverse could be the Highway Trust Fund. As the recipient of federal gas tax dollars, the Highway Trust Fund is responsible for building and maintaining our interstate highways and bridges. In addition, its Mass Transit Account is supposed to allocate funds to buses, railways, and other public mass transit.

You can see below that the Highway Trust Fund will soon run out of money:

Gas Taxes

Because of fuel efficient and EVs, we are using less gas:

For all of these reasons, the Economist suggest that we will soon have more toll roads.

Our Bottom Line: the VMT

But also, we could have a VMT.

I suspect, though, that the real solution is a VMT (Vehicle Miles Traveled) fee.

…with the Southern US states paying the most:

VMT issues include selecting a tracking method, a tax rate, and deciding if privacy is a big problem:

And that returns us to Indiana. Toll roads or a VMT?

My sources and more: Thanks to the Economist for inspiring today’s post. From there, I checked the history of federal funding prohibitions. Then, for the most up-to-date gas tax facts, do take a look at the Tax Foundation. And finally, for the Highway Trust Fund financials, Peter Peterson came in handy.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)