Finding the Mobile Talent That Became Nobel Laureates

November 11, 2025

Just Ask Jenna Looks at the Unequal Side of Group Work

November 13, 2025We know that there is no such thing as a free lunch. The same is true for free rewards:

Rewards Spending

Some History

At first, as the only available credit card reward, Diners Club started offering airline miles in 1984. However, to see the real beginning, we can look way back to 1793 (reputedly), when some merchants began giving customers copper tokens with their purchases. Then, fast forwarding to the 1890s, we have the earliest S&H Green Stamps.

Countless families accumulated the stamps in their S&H Stamp books that they then redeemed through a Green Stamps catalog or store:

So yes, the rewards and loyalty programs that boost consumer spending have been around for a long time. But now instead of copper tokens and stamps, rewards include points, miles, and cash back.

Current Rewards Programs

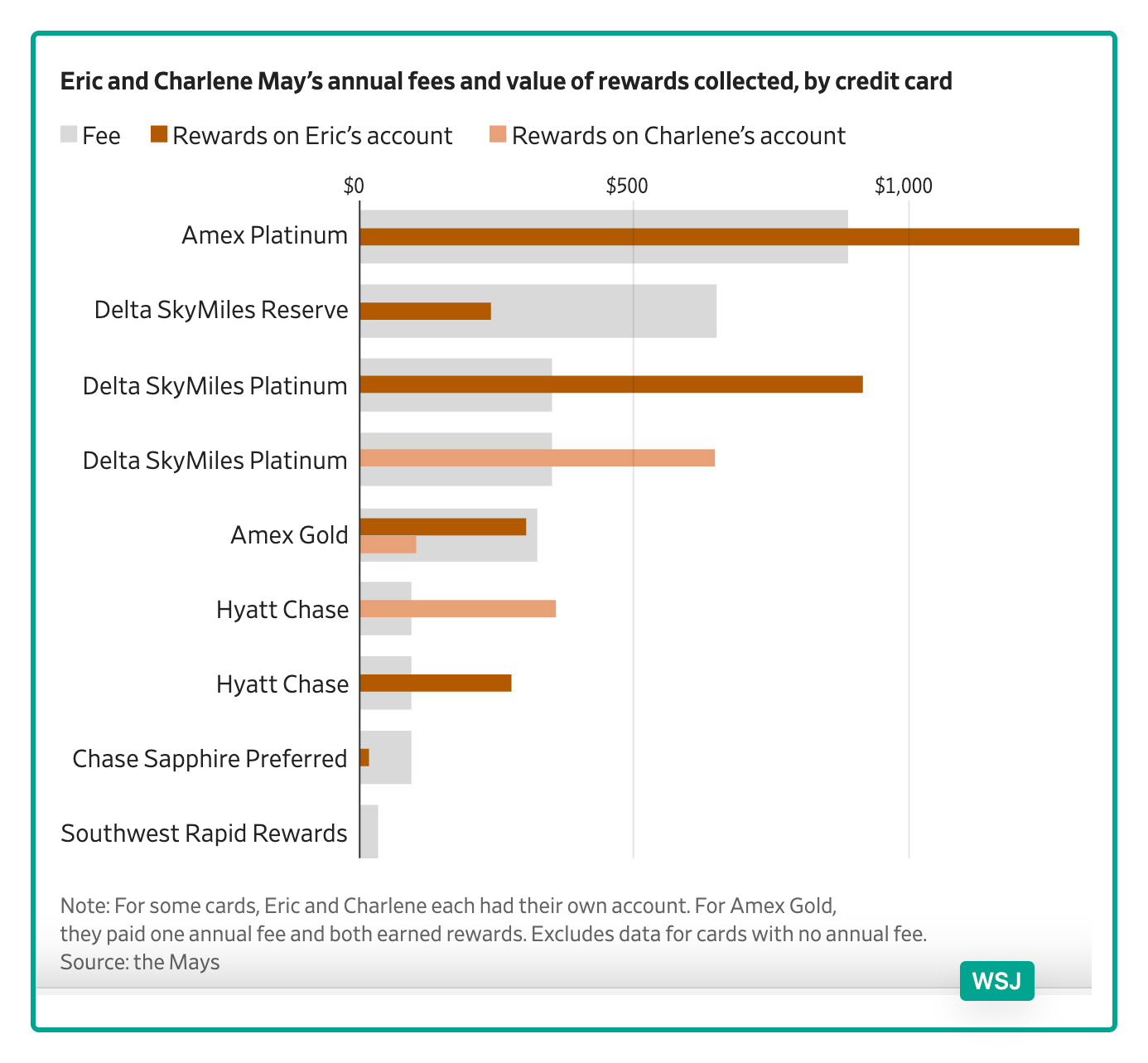

Spotlighting one couple, the Wall Street Journal detailed the complexities of rewards programs. They report that they get $900 more in credits than they spend on their cards’ fees:

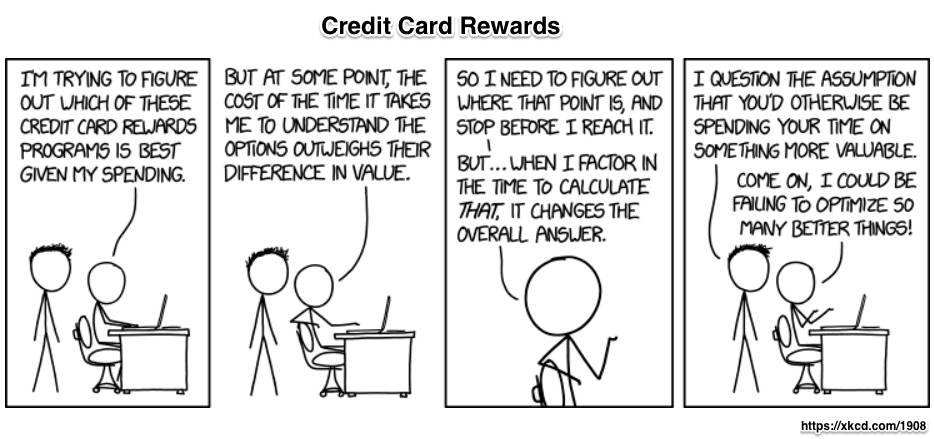

To optimize their purchases, they need a spreadsheet to keep track of everything. For Uber alone, they have to select the right card that provides the perk for an airport trip, Uber Eats, or Uber rides.

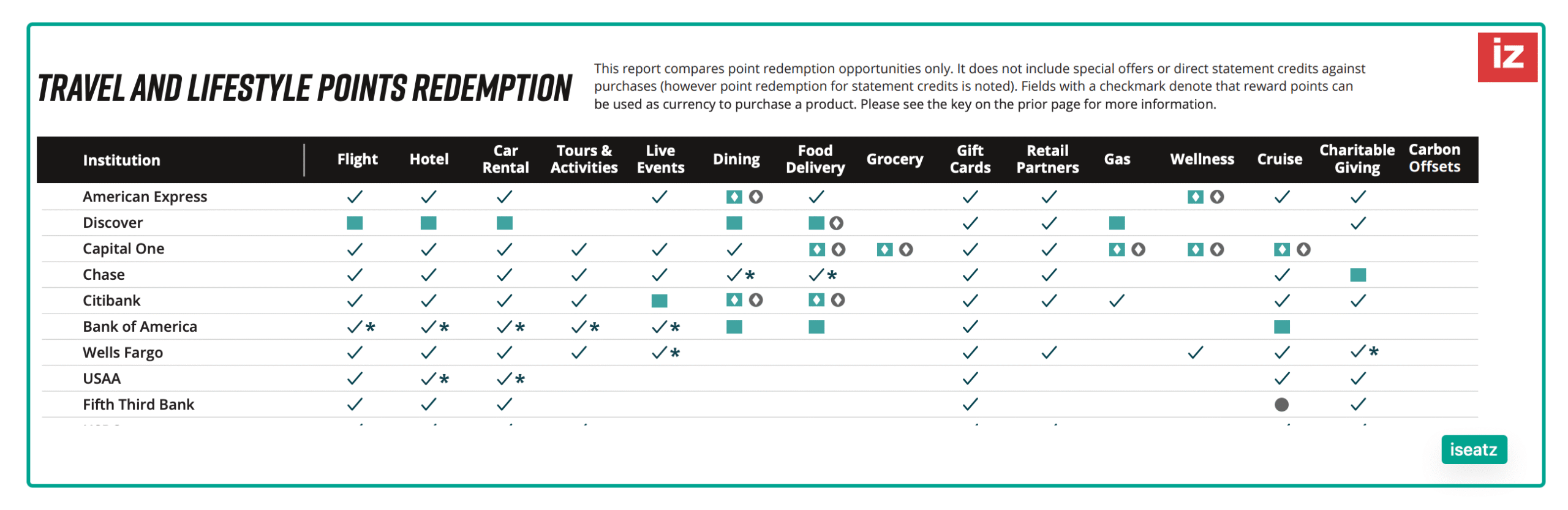

Meanwhile iseatz provided an overview of what we buy with our rewards. From a much longer list, I copied the first 10:

Total Spending

During 2022 (the most recent year with dependable numbers that I could find), rewards spending surged:

Our Bottom Line: Who Pays?

When we redeem our rewards benefits, it can feel like they are free. Looking closely though, we find an opportunity cost. Someone, somewhere will always sacrifice something.

In terms of behavior, like the Mays, we sacrifice time when we choose and then use a rewards program. Furthermore, what we purchase could even be distorted by a rewards program.

In a Federal Reserve paper, researchers suggest the cost is higher for two groups:

- Cash buyers disproportionately absorb the cost of rewards programs.

- Those with less income bear the cost because the more affluent enjoy more of the benefit.

Or, as they express in the abstract that precedes their study: “We estimate an aggregate annual redistribution of $15 billion from less to more educated, poorer to richer, and high to low minority areas, widening existing disparities.”

You can see that the most rewards flow to individuals with the highest credit scores:

So, who pays for free rewards? In very different ways, all of us pay.

My sources and more: With considerable insight, the Federal Reserve looked at reward programs here as did the Consumer Financial Protection Bureau. Then, while iseatz had the most up-to-date analysis, I have no idea if their data is academically rigorous (but it gives us an idea of the trends). As a result, perhaps WSJ gave us the most insight through their focus on one household.

Please note that several of today’s sentences were in a past econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)