All We Need to Know About a Universal Basic Income

October 26, 2025

When Men’s Earnings Rose and Women’s Did Not

October 28, 2025To see the impact of current tariffs, 2019 might have some answers.

We just need to trace a wine bottle’s travels from the importer, to the distributor, and the retailer.

Wine Tariffs

During 2018, the World Trade Organization said U.S. aerospace companies were harmed by the subsidies given to Airbus by France, Germany, Spain, and the UK. It authorized the U.S. to respond with “countermeasures” that included up to a 25 percent tariff on its agricultural imports. One result was a 25 percent tariff on wine with alcohol by volume (ABV) that was equal to or less than 14 percent.

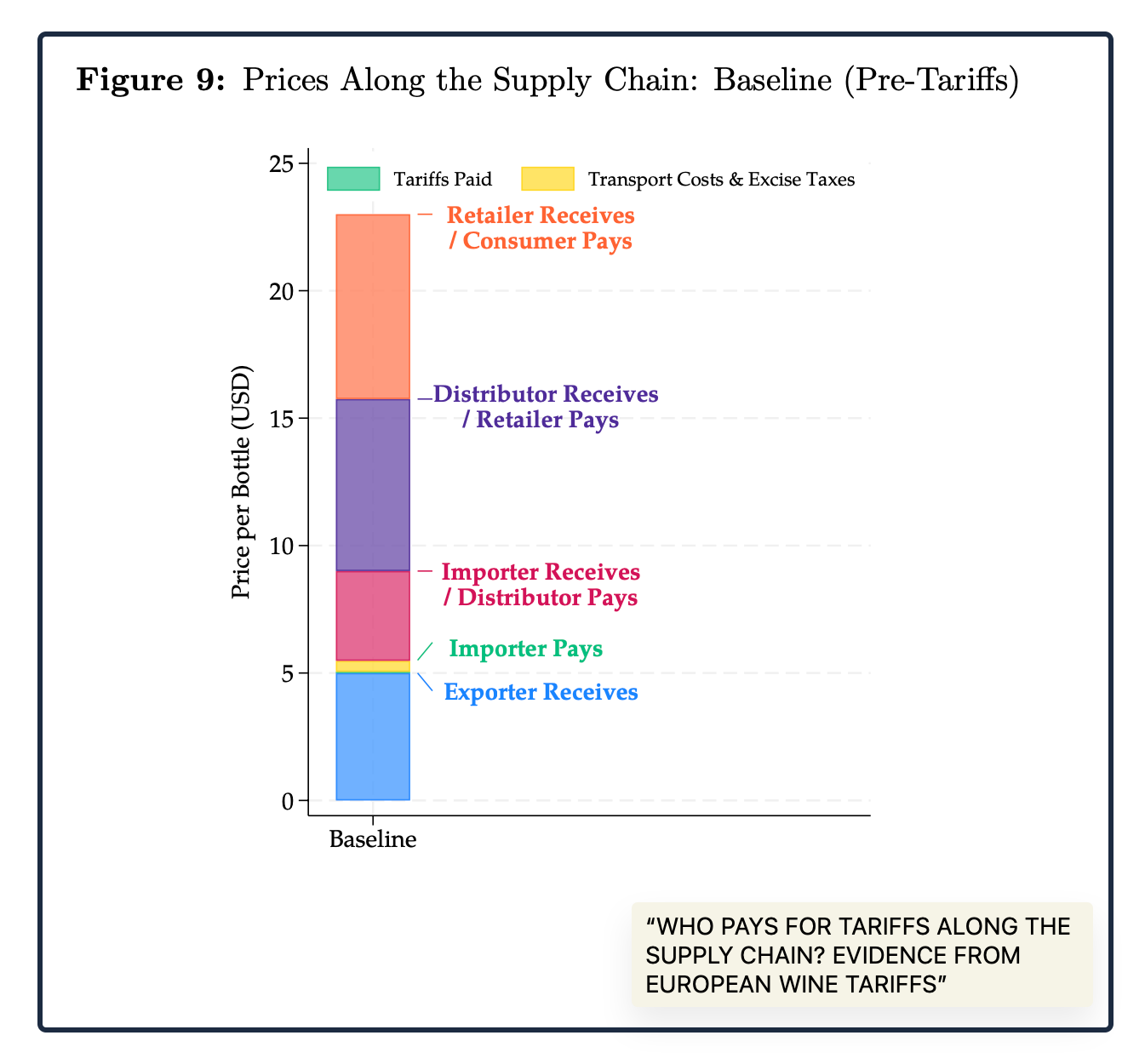

Pre-tariff

Pre-tariff, of course, step by step, price rose until the wine met the consumer:

Post-tariffs

Next, we can look at price and composition to see the tariff response.

According to a 2025 NBER paper, for a wine bottle that entered the country at $5, there initially could have been a $1.19 add-on for a 25% tariff. Then though, following the bottle from the distributor to the retailer, we would see consumers paying an extra $1.59. Researchers note that while consumers did not experience a 25% price hike, their dollar amount exceeded what the tariff cost. They also told us that 25% of the tariff revenue comes from the foreign producer while the US supply chain paid the rest. In addition, explaining the inflationary lag, it took nearly a year for consumers fully to experience the tariff’s impact.

Composition

This is where it gets interesting.

To avoid the tariff, more wine buyers selected bottles with alcohol content that exceeded 14 percent. Their bottle of a 2019 Cabernet-Merlot blend would not have gone up because the alcohol content was 14.02 percent.

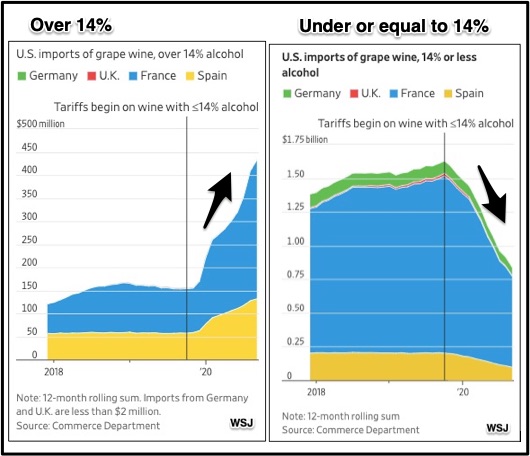

Below, the graphs display (my arrows) a whopping 48 percent decrease in U.S imports of less potent wine after the tariff kicked in:

:

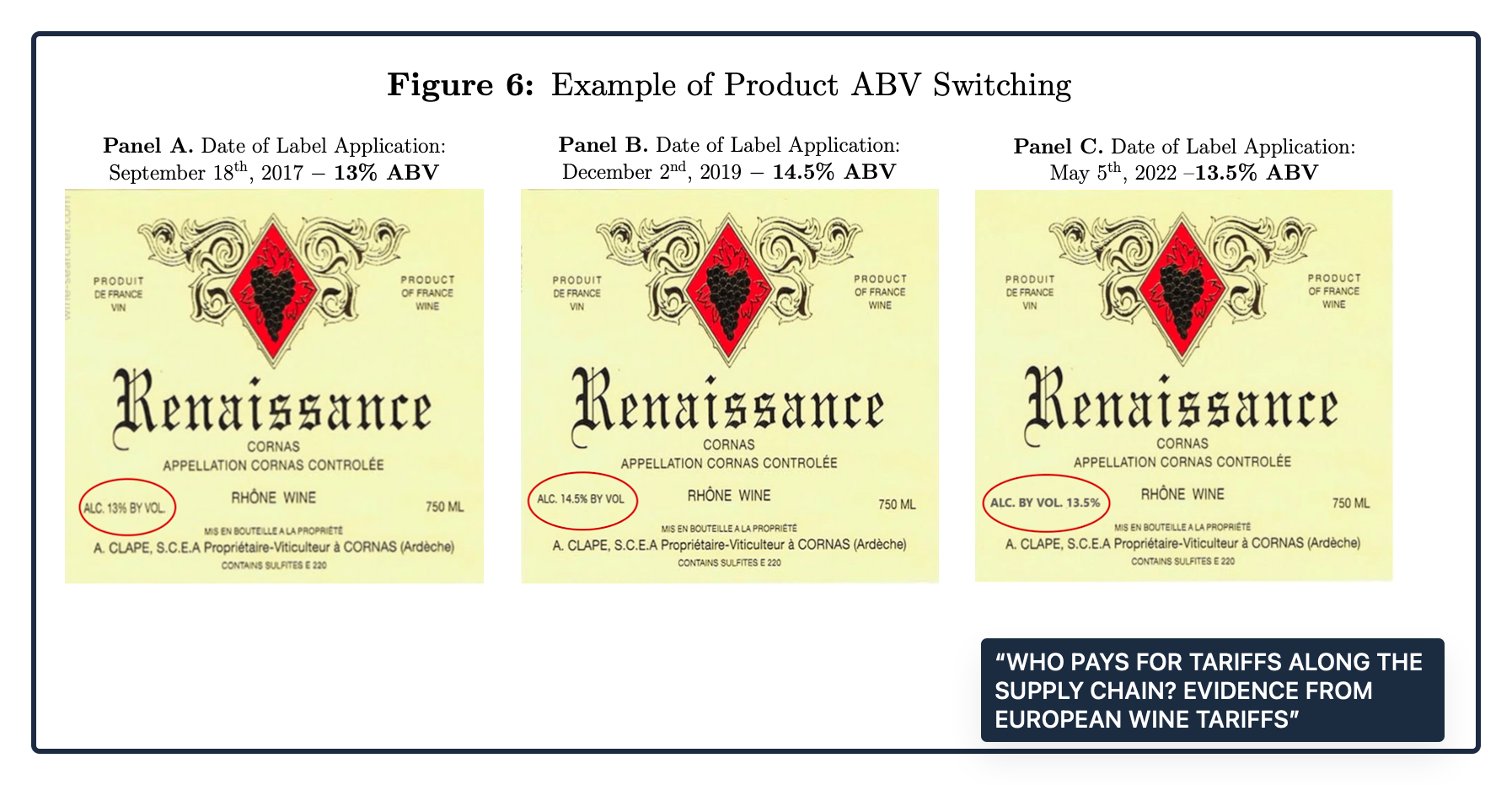

But also, the product changed to non-tariffed alcohol content. Below, the three panels show the alcohol content before the tariff, during the tariffs, and after it was suspended:

Our Bottom Line: Perverse Incentives

You can see why most economists dislike tariffs. Whether it’s wine or airplanes or a slew of other goods and services, tariffs distort the decisions made by markets. They change what businesses are willing and able to produce and what consumers want to buy. By elevating prices, tariffs change production decisions and diminish efficiency. They encourage fewer purchases of the Bordeaux and Burgundy wines that we enjoy drinking.

My sources and more: Thanks to my Hutchins Roundup email from David Wessel for alerting me to the NBER paper on wine tariffs. Then this 2020 WSJ article on the 2019 tariff was the perfect complement.

Please note that several of today’s sentences were in a past econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)