How Major League Baseball is Hanging On By a Thread

October 14, 2025

Just Ask Jenna: An Introduction

October 16, 2025When a designer at a fashion magazine saw a pricy snakeskin purse, she assumed she could not afford it. Then though her eye caught a small note on the checkout page. She could pay in 4 interest-free installments.

So, she got her purse. Meanwhile, the lender, receiving as much as 9% from the retailer, came out ahead and the seller got an extra purchase.

Everyone is happy. Yes?

Not necessarily.

Buy-Now-Pay-Later

The woman that bought the purse discovered she could spend far beyond her Visa limit by using Buy-Now-Pay-Later (BNPL). Then, whatever she owed was automatically withdrawn from her bank accounts in increasingly large amounts.

According to one study, consumers are 9% more likely to make a purchase and to spend 10% more when using BNPL.

As an industry, BNPL spending was close to $120 billion in 2023. For the woman in our story, her spending wound up as a $50,000 debt that took years and dipping into retirement savings to repay.

Behavioral Economics

Summing up BNPL with the two following graphs, a behavioral economist could have said the story was about temporal reframing.

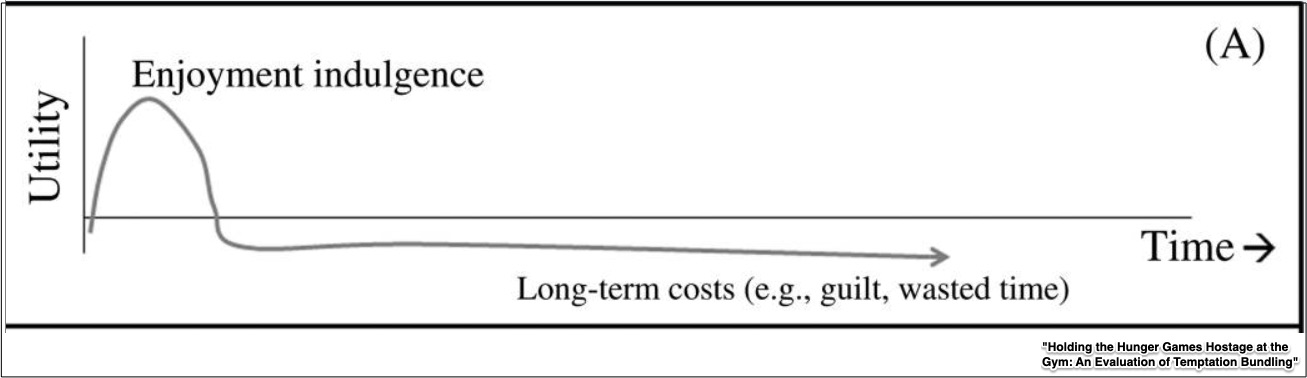

Below, you can see that an enjoyable activity initially has a bump in utility but then creates a long term cost:

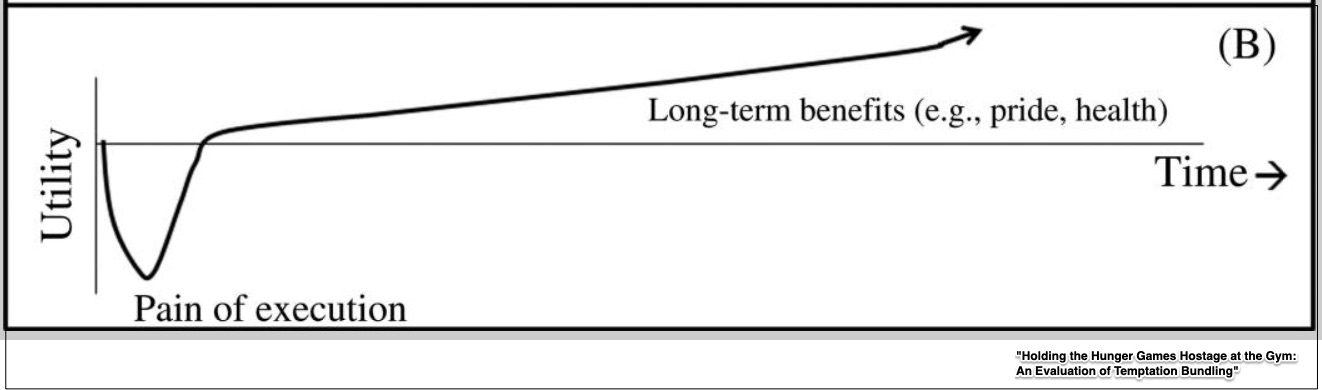

By contrast, for a beneficial activity (like paying upfront), quite the opposite happens. First, we have the pain, and then the benefits:

Our Bottom Line: Tradeoffs

For consumers, our story is also about a tradeoff. According to a Harvard Business Review article, installments make consumers feel their finances are more manageable. They also “perceive costs as more trivial.” More manageable and more trivial means the benefits of a BNPL decision are much more appealing than the benefits of the opportunity cost–paying fully upfront.

Consequently, a behavioral economist can easily explain how we pile up debt (and snakeskin purses) through BNPL.

My sources and more: Thanks to the NY Times for inspiring today’s post. From there, the Harvard Business Review had the ideal complement.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)