How Valentine’s Became a Chocolate and Card Day

February 14, 2023

Why We Want To Win the Lottery

February 16, 2023In France, a later legal retirement age could mean government coffers receive an extra $19 billion by 2030.

But the protests have been massive and a national strike is a possibility.

Pension Reform

France

As a pay-as-you-go system, French workers’ payroll taxes go directly to beneficiaries. However, the ageing population has shrunk the worker beneficiary ratio from 2.1 in 2000 to 1.7 in 2020. As a result, with pensions gobbling up a whopping 14 percent of GDP, President Macron says they cannot be sustained.

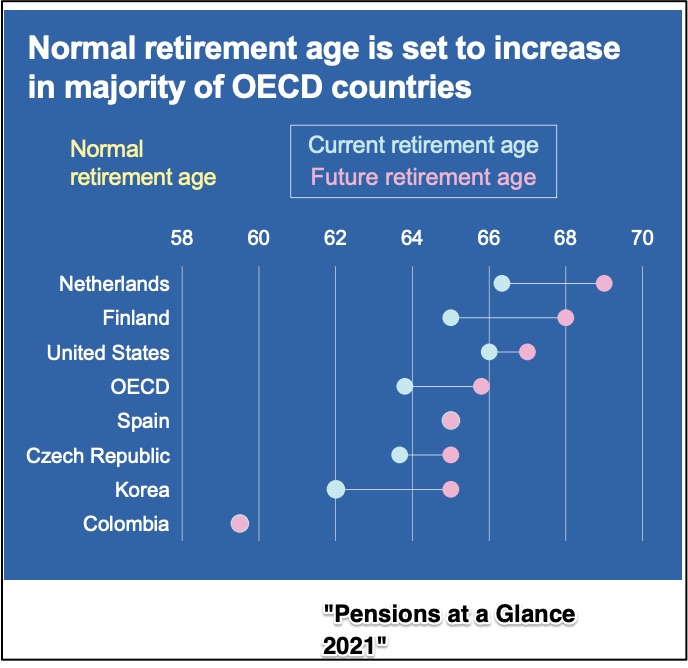

Compared to other OECD countries, France, at 62, has a young legal retirement age:

If the retirement age rises to 64, then government collects two more years of taxes (43 years instead of 41 for full retirement benefits) and have two fewer years paying benefits. More precisely, the reform would gradually raise the legal retirement age by 3 months annually until 2030 when it reaches 64.

Compounding the system’s distress are the more “strenuous occupations” where people can retire earlier. The NY Times tells us that it’s as early as age 42 for ballet dancers and 57 for utility workers. That means, with life expectancy at 82 in France, we culd be looking at 40 years of benefits.

Not entirely disagreeing with the system’s prognosis, alternative proposals say to tax the rich more.

Our Bottom Line: U.S. Social Security

With a looming debt ceiling crisis in the U.S., we hear echoes of the French turmoil. With Republicans saying that spending has to be cut, they need to focus on larger slices of the budget to make a difference. However, perhaps recognizing the similarity to France and President Biden’s affirmation during his State-of-the-Union, they have said Social Security is not their target.

If it were, a CBO documents suggests possibilities. Here too we have an ageing population and a shrinking worker beneficiary ratio that depends on pay-as-you-go funding. In a CBO report, other suggestions for diminishing the deficit through Social Scurity would involve less for higher earners, a flat payout amount, and/or increasing taxable earnings. Much more complex than this brief description suggests, the CBO details the complexities and decisions that each alternative involves.

So, whether we look at France or the U.S., pension reform is fraught with controvery, resistance, and protests. And yet, we, like the French, need to do it.

My sources and more: Moving from France to the U.S., we started with the pension protests in France and the description of their system from the NY Times and FT. From there, the CBO had the facts about the U.S. while the OECD looked at a slew of nations in its Pensions At A Grance 2021.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)