Our Weekly Economic News Roundup: From Justin Bieber to Ford Pickups

January 28, 2023

What Movie Makers Say About Gender

January 30, 2023To really understand our economy’s turbulence, we should look at its tailwinds and headwinds.

They might even tell us if we will have a soft landing.

Economic Tailwinds and Headwinds

Tailwinds

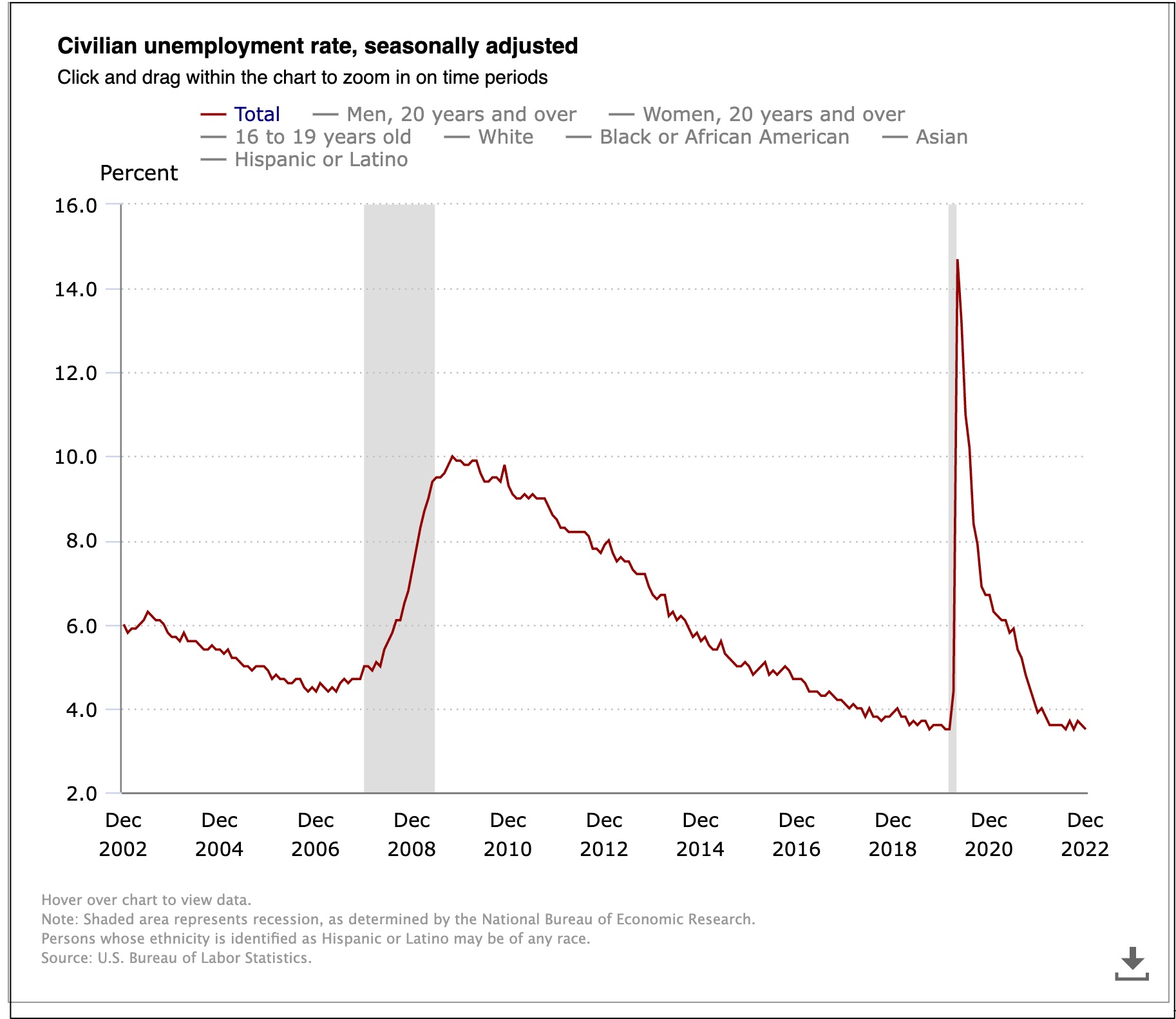

Propelling economic activity, we have a resilient labor market and decelerating inflation.

After a Covid high, unemployment quickly returned to its previous trend with December 2022 equaling a January 2020 low of 3.5 percent:

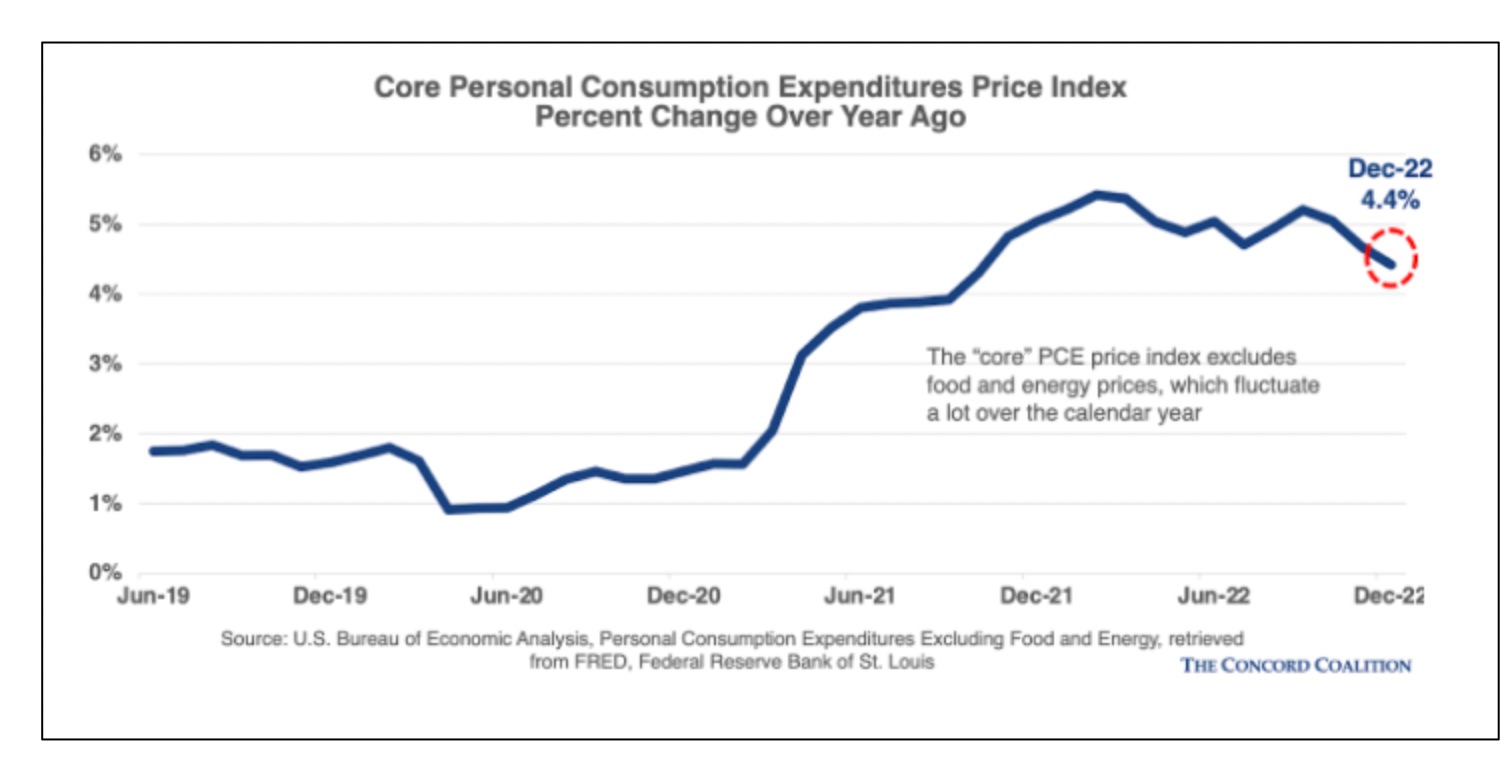

Broader than the CPI (Consumer Price Index), the PCE (Personal Consumption Expenditure) Index showed more decelaration:

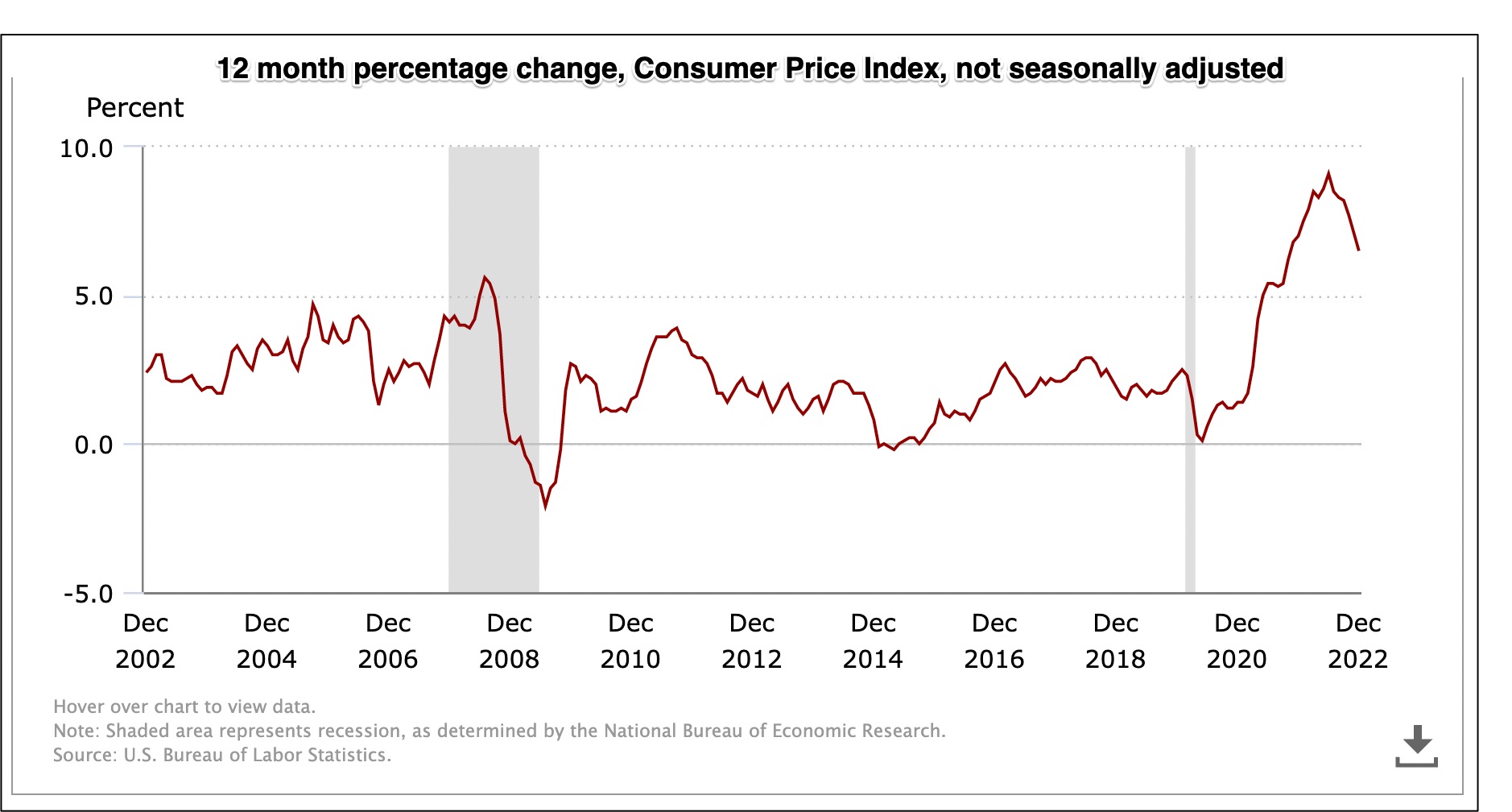

CPI

You might find it interesting (as did I) to compare the two inflation indices. While the Fed prefers the PCE, Social Security uses the CPI for its beneficiaries’ COLAs (cost of living adjustments):

Headwinds

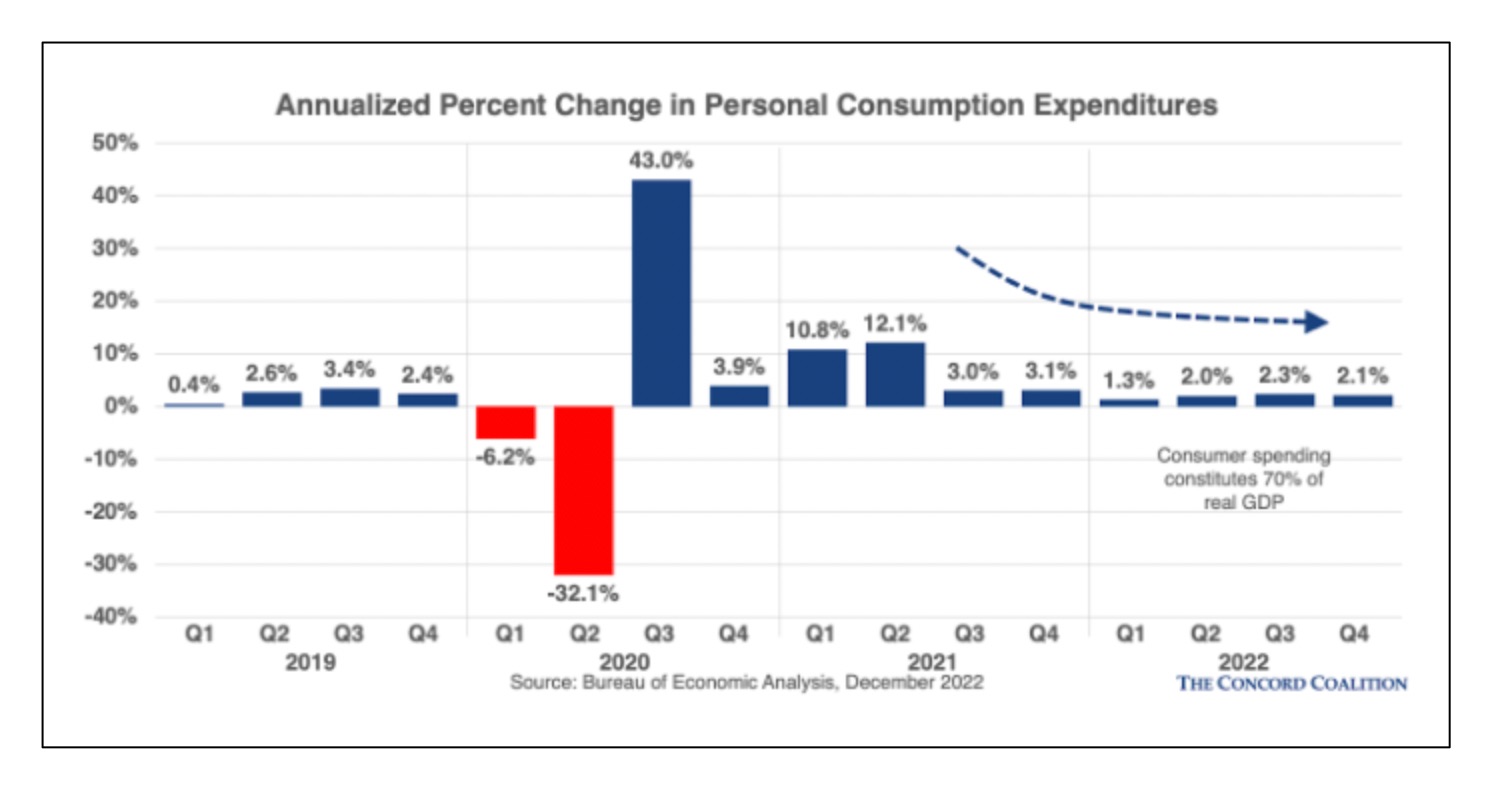

Meanwhile, consumers could soon create a slowdown.

Consumer spending

Less of an increase in the consumer spending component of the GDP hints at a headwind:

Our Bottom Line: A Soft Landing

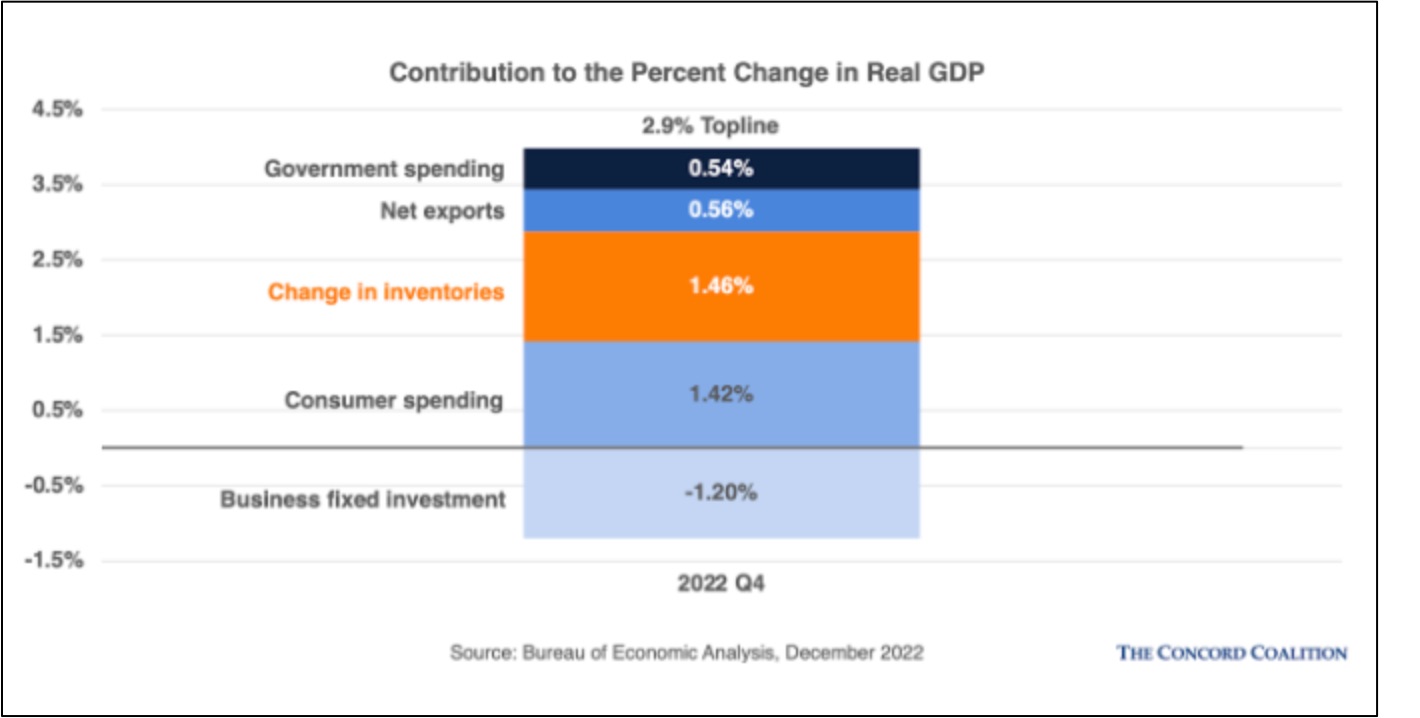

If the Fed brings us down from high inflation with a soft landing, that means we will have sidestepped a recession. While we know that consumer spending could be a problem still, at an annualized 2.9 percent, the headline GDP number is hopeful:

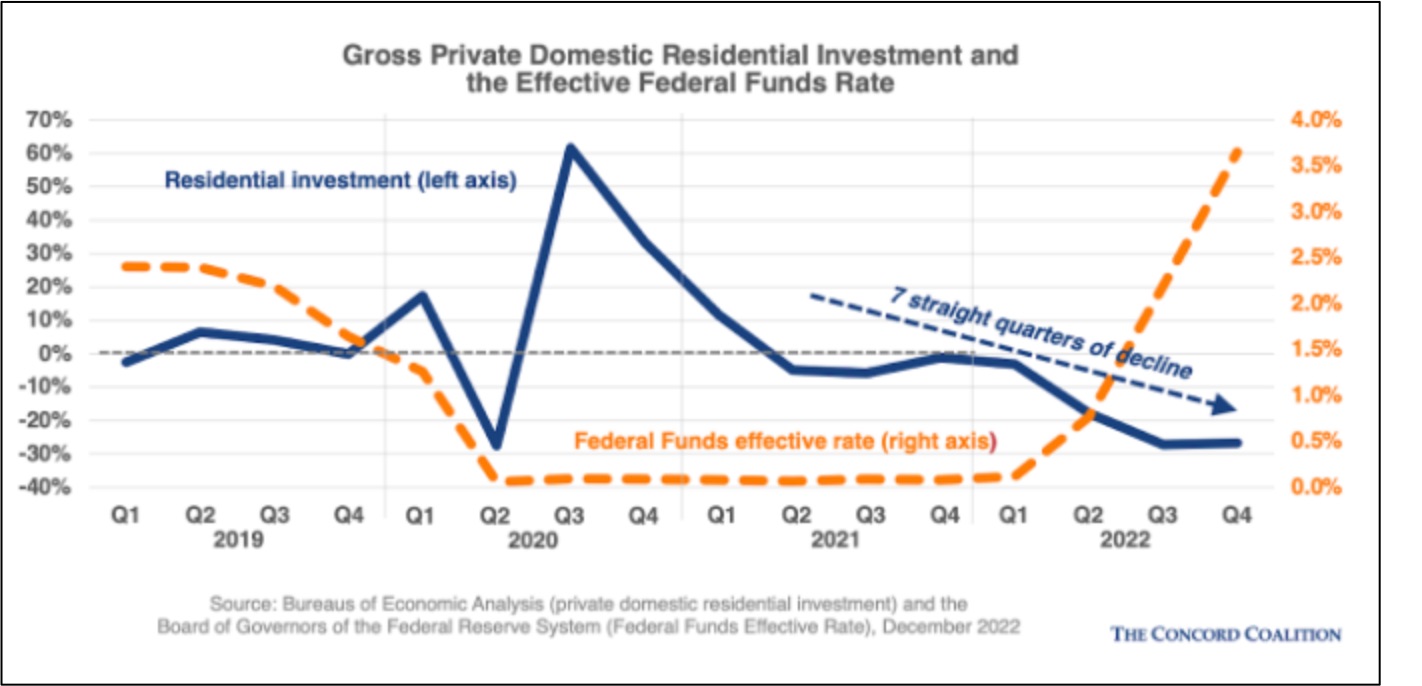

In addition, the housing dip, viewed negatively by some, could moderate the Fed’s aggressive interest rate approach and help us avoid a recession:

Perhaps though the GDP’s change in inventories sums up what we see in our crystal ball. Because businesses were restocking their inventories, they helped to nudge the GDP upward. However, traditionally volatile, the inventories trajectory is not a dependable growth signal:

So, reflecting the mixed message from our economic tailwinds and headwinds, our crystal ball looks rather cloudy.

My sources and more: My inspiration for today came from the Concord Coalition’s Janjuary 27th blog post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)