Sometimes called rockets and feathers, rising gas prices ascend quickly like rockets but then they float gently downward for a slow descent.

Scholars have looked at why.

Gasoline Prices

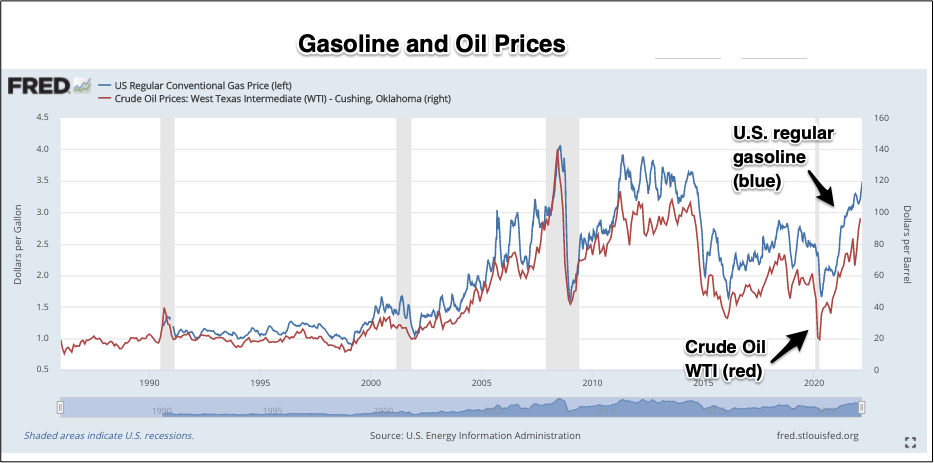

As the benchmark price of U.S. crude oil, WTI (West Texas Intermediate) changed, so too did the regular price of gasoline.

But not exactly.

The following graph takes us to February 2022. It lets us compare the trajectory of crude and gas but is a bit misleading because gas, much less expensive, is the top curve:

Tough to tell by looking at the graph, gas prices rise quickly and go down slowly according to a Boston University energy economist. He says the reasons for the speedy increase include consumers’ inability to signal their displeasure because their daily driving is pretty consistent. Another economist cites the lack of competition. Like me you’ve probably seen similar prices at two adjacent gasoline stations. In addition, brand loyalty, encourages a speedy price rise.

The common denominator could be information. Because oil companies and gas stations know each other’s prices, they adjust quickly. However, since consumers are less aware of the big price picture, they have less influence. Most of us won’t drive elsewhere for a lower price–especially if it could have too high a cost:

Our Bottom Line: Elasticity

A final consideration could be the price elasticity of demand. We define elasticity as the relationship between a change in price and the change in quantity demanded. If the proportional change in quantity exceeds the proportional change in price, then we say the demand is elastic. Much more simply stated, elasticity implies that we really liked the price change. It could have been a sale price that inspired us to buy lots more. Meanwhile, the situations in which our response to a price change is relatively constant indicates our demand is inelastic. Then, we could be talking about medication or milk.

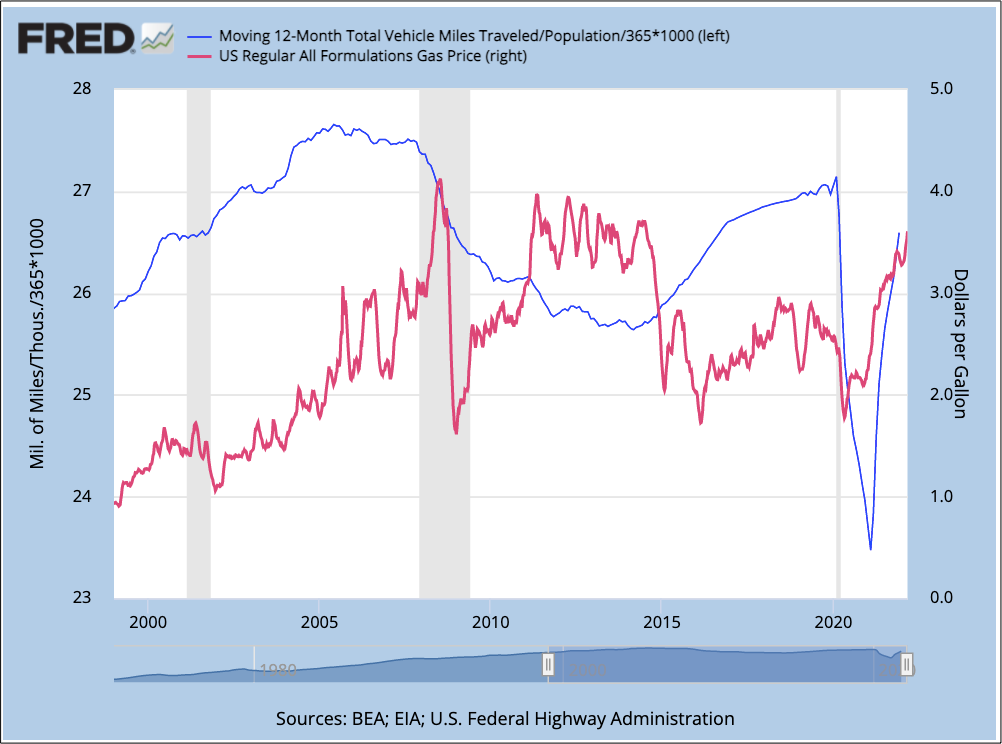

With gasoline, I would like to suggest (with implicit confirmation from past studies) that the demand curve has an inelastic and an elastic range where $5.50 might be a dividing line. In the inelastic range, price changes have little impact. Then though, as they climb, we drive much less. Mostly though, the recent academic literature says our gasoline demand is more elastic than previously assumed because we can aggregate more exact data now.

On this graph you can see the mirror images of price and mileage:

So why do gas prices rise faster than they fall? Because they can…even with our newly identified elasticity and increasing access to information.

My sources and more: In a readable article the LA Times gives us the facts and analysis of rising gas prices. From there, the Dallas Fed had a good discussion of gas price elasticity while the academic perspective is here. But if you just go to one source, I suggest gasbuddy for up-to-date gasoline prices. (Please note that our featured image is from Yahoo Sports.for February 22, 2022.)