The Price We Pay For a Costly Comma and an Absent Apostrophe

October 13, 2021

When a Big Bin Makes a Difference

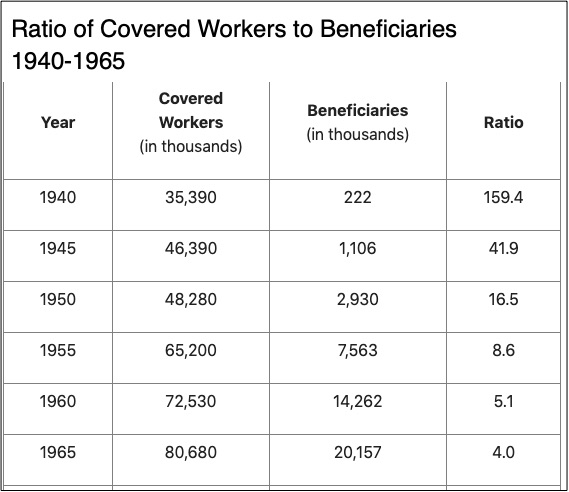

October 15, 2021At 65, in 1940, Ida Mae Fuller was the first U.S. retiree to get a Social Security check for $22.54. In 1941, she got $22.54 each month. In 1942, 1943, and 1944 she still got her $22.54. Until 1950, she received $22.54 a month.

Although every check said $22.54, she wasn’t really getting the same amount. So the Congress gave us Social Security COLAs.

Social Security COLAs

In 1949, Ida Mae needed a monthly check for $38.32 to retain her purchasing power.

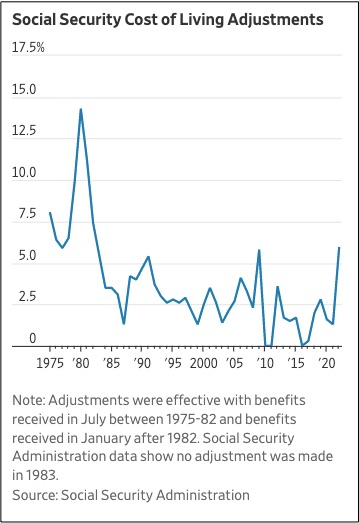

Realizing that inflation had cut what beneficiaries could buy, in 1950 Congress gave Social Security its first Cost-Of-Living-Adjustment. Since then, at first through special legislation and then automatically based on the CPI, Social Security check amounts usually rise annually.

For just three years–2010, 2011, 2016–since 1975, the increase was zero. Otherwise checks have gone up by as much as 14.3 percent (1980):

https://www.wsj.com/articles/social-security-cola-increase-2022-11634067648

Now again, the COLA is ascending. Highest since 1982, the 2022 5.9 percent increase echos a surge in inflation. For the average Social Security recipient receiving $1,657 a month, the increase is $92 (or $1,104 annually).

Although the COLA’s surge sets a recent record, it still might not be enough. The size of the COLA is based on the CPI ‘s urban wage earners. However, senior citizens point out that their spending is different. Based more so on healthcare and housing, seniors have higher expenses that could be rising faster than the CPI that determines their COLAs.

Our Bottom Line: A Social Security Mismatch

Called pay-as-you-go, current payroll taxes from the labor force provide the dollars that go to Social Security recipients. As a result, it was perfect that we had 41.9 workers for every retiree in 1945. Now though, a 2.7 ratio is a mismatch:

https://econlife.com/wp-content/uploads/2021/10/Social_Security_History.jpg

The good news (and bad news) is the trust fund.

Although payroll taxes have not been enough to cover what Social Security owes, we do have a trust fund. When there was extra, the Social Security trust fund grew. Now it is shrinking and could be down to zero in 2034.

A 5.9 percent 2022 COLA could accelerate the disappearance of the Social Security Trust Fund. At that time, benefits might have to go down.

My sources and more: WSJ has had some good inflation and Social Security articles. Then, the Social Security Administration, here and here, has the ideal complement. And finally, while these CPI-E facts are dated, they still have credibility.

Please note that several of today’s sentences were in a previous econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)