Why Google Just Got a Parent Called Alphabet

August 16, 2015The Unintended Consequences of Parental Leave

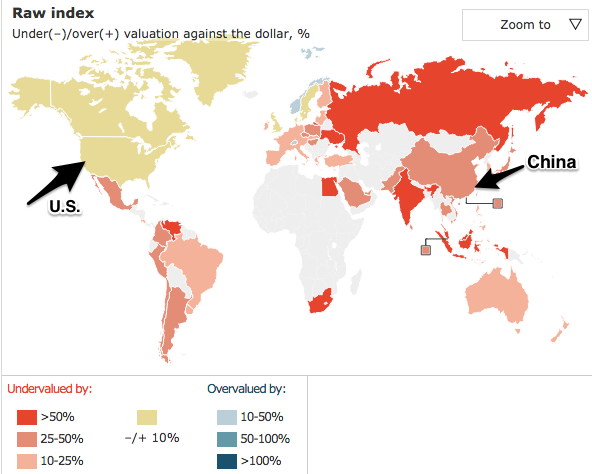

August 18, 2015With the devaluation of the yuan in the headlines, the most recent Big Mac Index could be helpful.

Where are we going? To how China and the U.S. look at devaluation differently.

The Big Mac Index

As a survey of Big Mac prices in different countries, the Big Mac Index tells us about the purchasing power of a currency. We can start by assuming that If the Big Mac is pretty similar everywhere, then its price should be pretty similar everywhere. But it is not. And from those differences, we can get an idea of whether a currency’s purchasing power is over- or undervalued.

The July 2015 Big Mac Index indicates that the yuan was substantially undervalued.

From: The Economist

There is one problem though. It makes sense that a Big Mac will be cheaper in countries like China that have less expensive labor and therefore a lower GDP per person. As a result The Economist also created an adjusted Big Mac Index that recognizes GDP per person.

Through the lens of the adjusted index, we see that the yuan’s purchasing power for a Big Mac is much closer to the dollar.

From: The Economist

What It Means to be Undervalued

To explain valuation, we can look at purchasing power. Using The Economist’s 2013 data, a Big Mac cost $4.20 in the U.S. and 15.4 yuan in China. If, though, you were to convert $4.20, you get 26.54 yuan. But a Big Mac costs 15.4 yuan. With 26.54 you have purchasing power that will get you 1.72 Big Macs. Too cheap, the Chinese Big Mac shows that the yuan was undervalued.

Our Bottom Line: Devaluation

While the unadjusted index indicates the yuan was undervalued during the beginning of July, the adjusted version does not. That could provide a clue about why the Chinese just devalued their currency. By cheapening their currency, the Chinese made their exports more attractive. As a result, domestic production could get a boost from more worldwide demand.

On the other hand, U.S. opinion could be divided. We could say that the devaluation makes Chinese imports cheaper, Spending less on imports, we have more resources to allocate elsewhere. However, U.S. producers who compete with the Chinese will protest that their goods and services have become less attractive.

We should conclude by reminding ourselves that like a hamburger index of purchasing power, a short list of China’s currency behavior is a vast simplification of what we know and do not know.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)