Where Statistics Could Be More Accurate

February 10, 2026Called “the uncool index” by an “unimpressed younger crowd,” the Dow Industrial Average has been hitting new highs. Instead, for many, the S&P 500 is a benchmark.

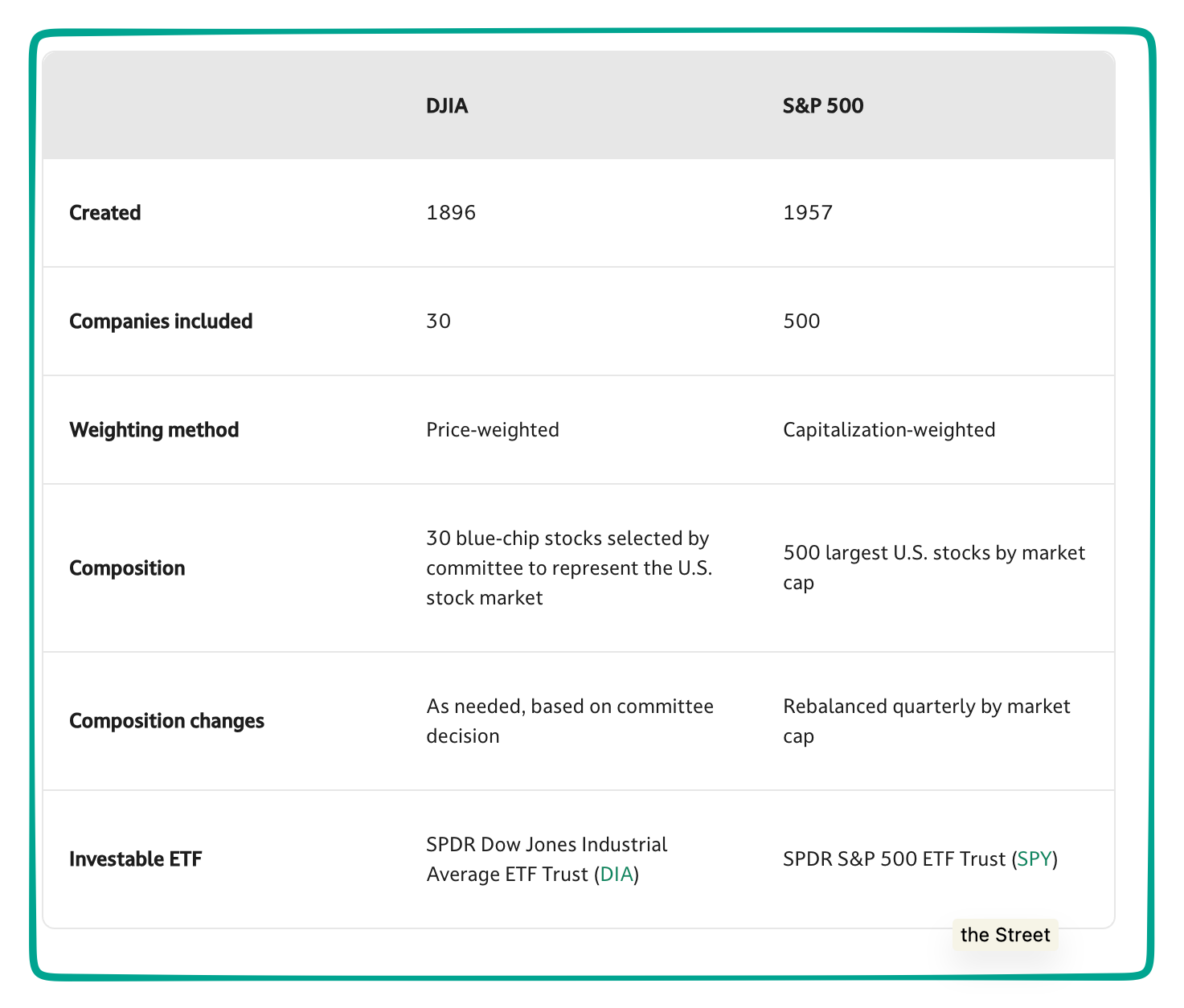

Let’s see how they compare.

The Dow and the S&P

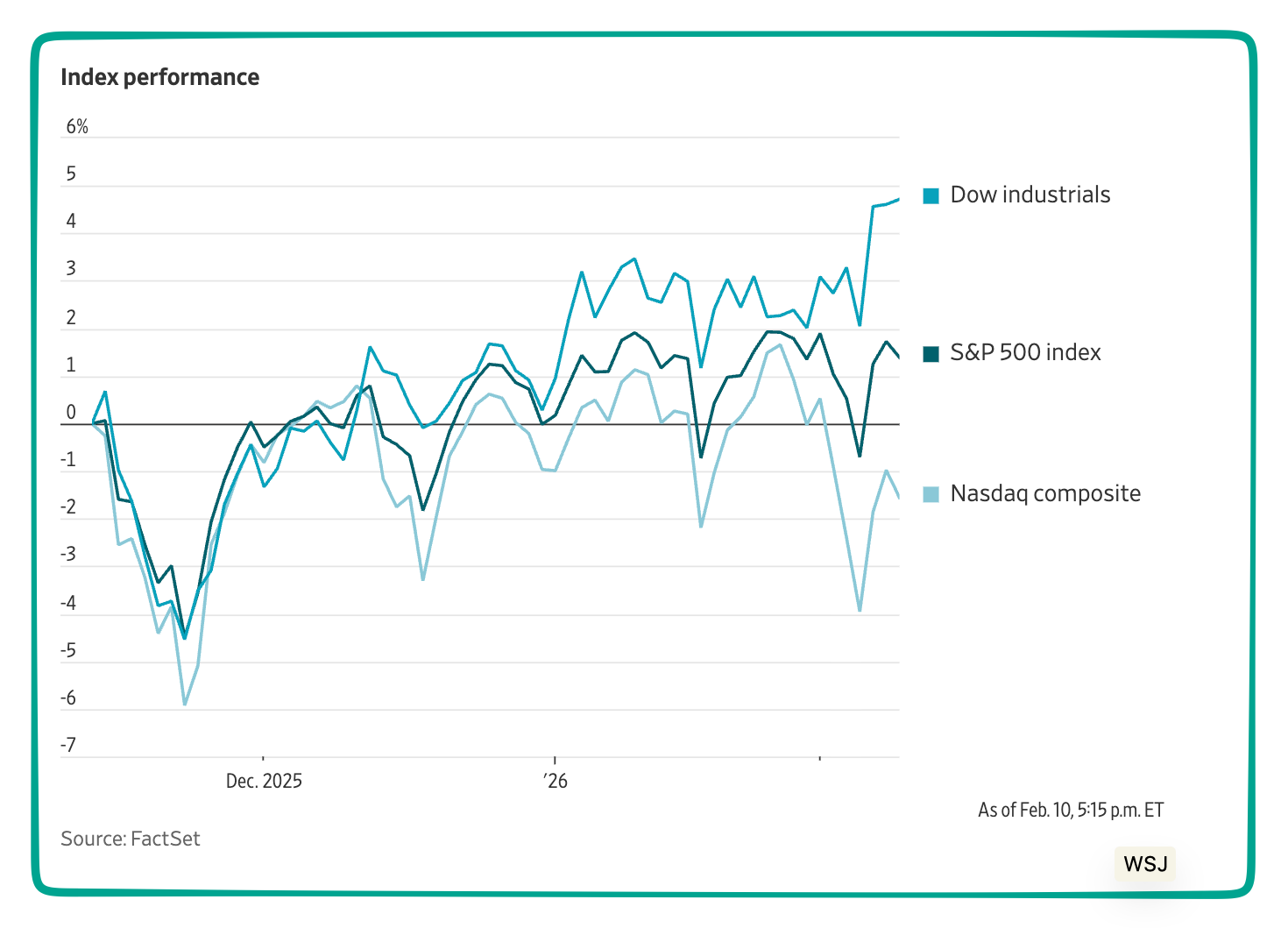

Performance

Their trajectories are similar:

Origins

the Dow

In 1882, three friends started Dow Jones & Company. During every business day, six or seven 14- to 16-year-olds continuously delivered market facts and gossip gathered by Charlie Dow, Eddie Jones, and Charlie Bergstresser. Fast forwarding, we’ve moved from their first Dow–an 1884 railroad-dominated list of 11 companies (like the New York Central and Union Pacific)–to today.

Composed now of 30 companies, on November 11, 2024, the Dow welcomed “AI superstar” Nvidia and paint maker Sherwin-Williams. To make room, Intel and Dow departed:

the S&P

At a Lawyers Club luncheon, on February 27, 1957, between the entree and dessert, a Standard & Poor’s executive described the launch of a new stock index. Known as the “Father of the S&P 500,” Lew Scheilback told 35 financial journalists that the S&P was moving onward from its 90 stock market yardstick to 500. Composed of 425 industrials, 25 rails, and 50 utilities, it was supposed to represent the entire market.

Inclusion Criteria

the Dow

The 30 Dow stocks are selected by a committee from S&P Global and the Wall Street Journal on an “as-needed basis.”

Their considerations (that I copied from the Street) include the following:

- Non-transportation, non-utility company included in the S&P 500

- Incorporated and headquartered in the U.S.

- Good reputation

- Many investors/high trading volume

- History of sustained growth

- Generally considered a good representative of its market sector

the S&P

Quantifiably composed, the S&P selects the 500 largest publicly traded U.S. companies by calculating float-adjusted market cap totals. Recomputed every quarter, the index adds and deletes firms that meet its metric.

A Summary

Our Bottom Line: Financial Intermediaries

Acting as a financial intermediary that connects those that have money and the institutions that need it, stock markets are a process rather than a place. By determining the prices of securities and the quantities that are traded, stock markets help businesses raise money when they sell shares to the public. They also create liquidity for investors who want to trade stocks and bonds, they help governments fund their debt, and they raise money for corporations. Always though, as financial intermediaries, they link savers and borrowers.

My sources and more: Thanks to WSJ for inspiring today’s post. From there, we returned to a past econlife. But, most crucially, we depended on four articles, here, here, here, and here.

Please note that several of today’s sentences are from past econlife posts.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)