Econlife: 2025 Holiday Quiz

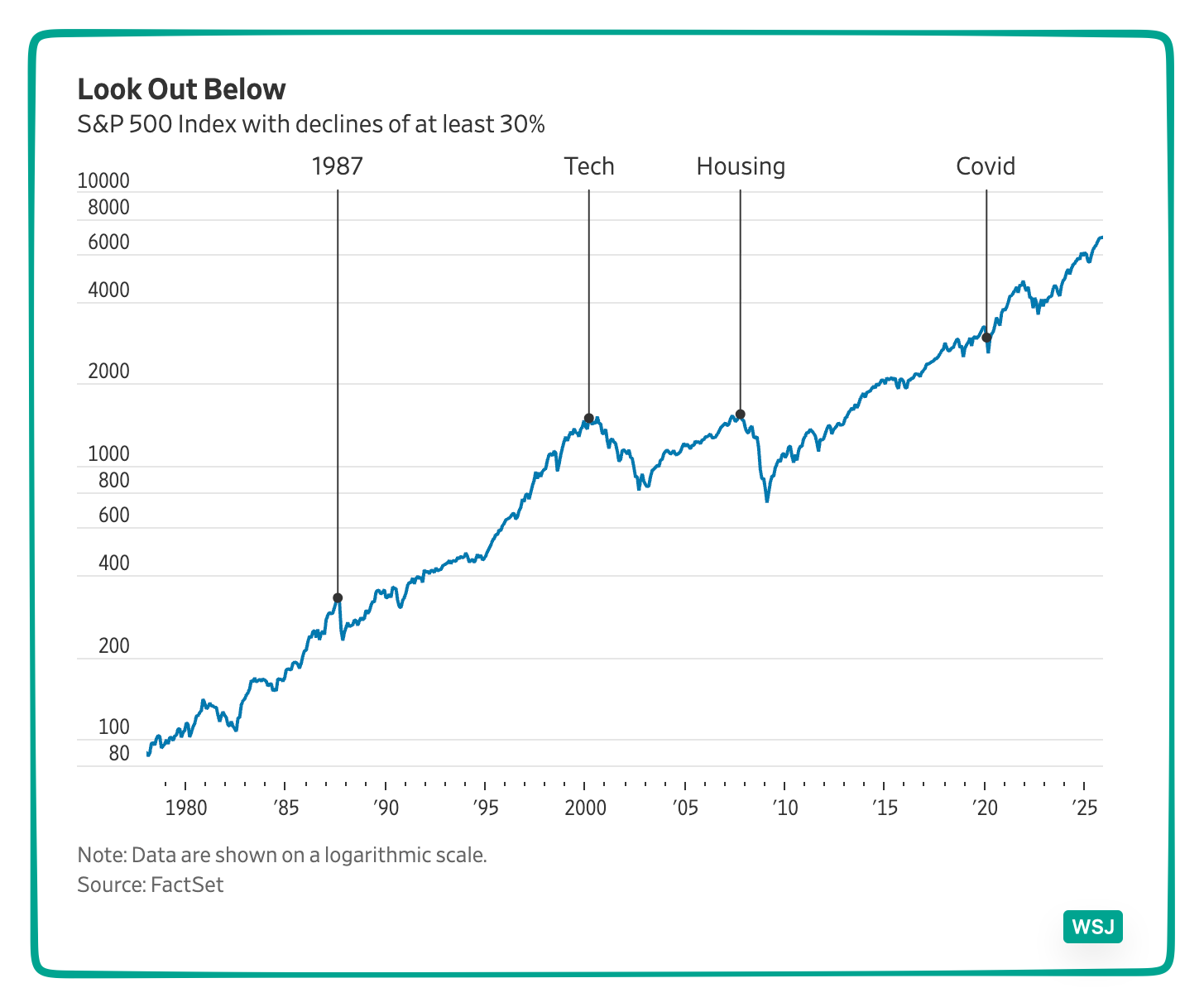

January 11, 2026WSJ recently showed us four stock market declines:

In their headline, they asked, “Will Stocks Crash in 2026?”

With a bubble defined as “…a large price decline after a large price increase, they might also have asked if a bubble will soon burst.

Bubble History

The First Global Stock Market Bubble

A legend in monetary history, John Law helped to create the first global stock market bubble from 1718 to 1720. Funding the Mississippi Company’s expansion, Law controlled a bank that could issue the money that investors then used to buy shares. When soaring demand reversed, the bubble popped.

Poultry Bubbles

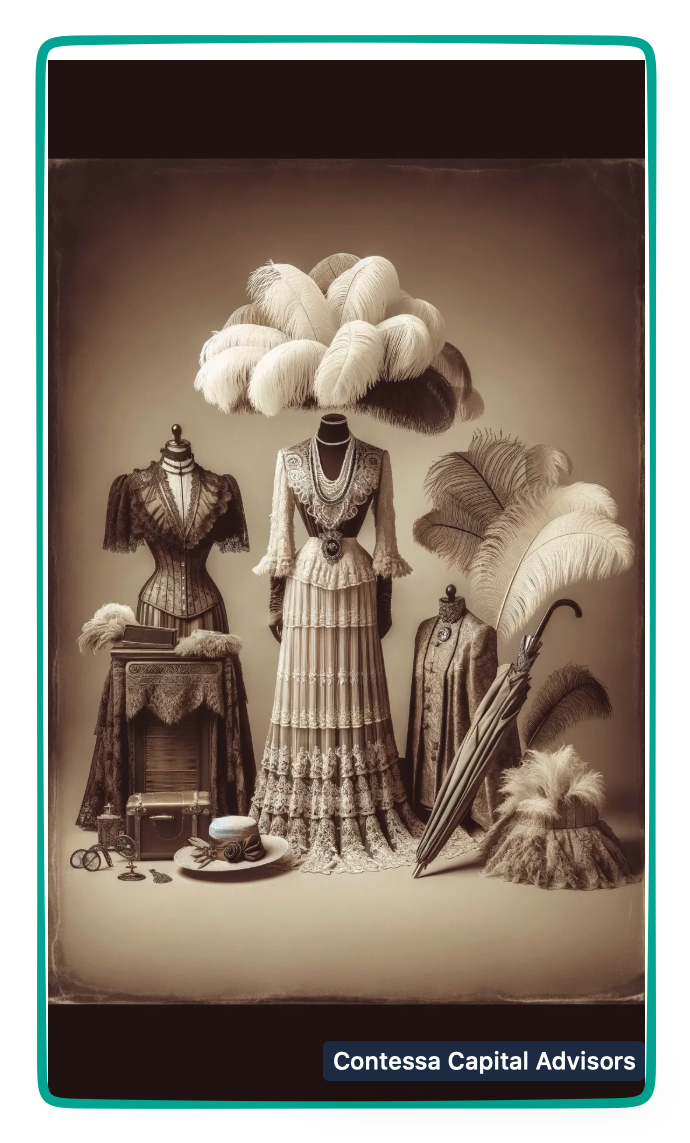

Ostrich Feathers

Rarely mentioned, 40 crates of ostrich feathers worth $2.3 million dollars (in today’s money) sunk on the Titanic in 1912. With fashionable women wearing feathered hats, the prices for the plumage soared. As a bubble, it lasted until tastes changed and the Model-T auto made feathery headgear impractical:

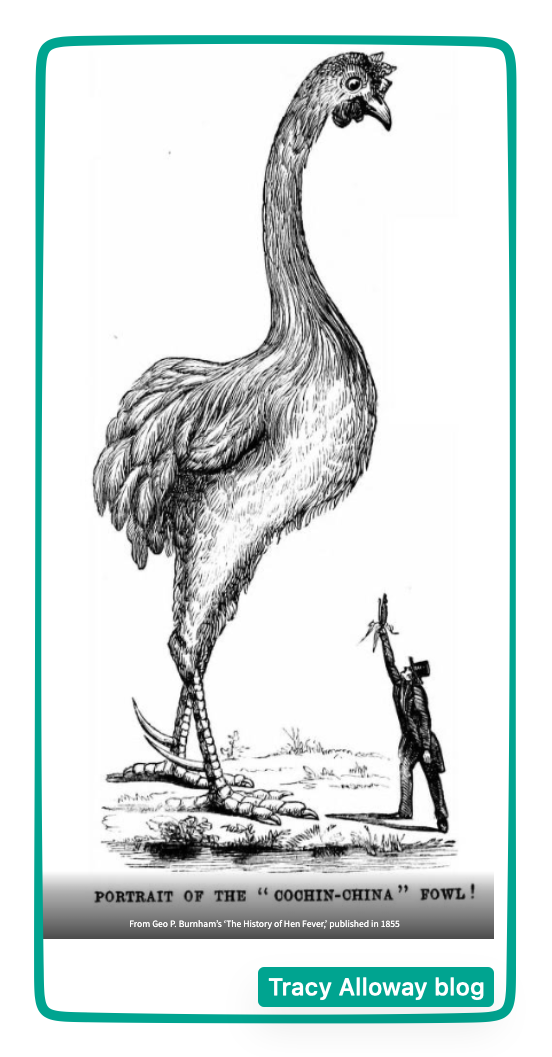

Exotic Chickens

During the mid-1800s, a newly affluent middle class in the U.S. and Great Britain, (including Queen Victoria) displayed a passion for exotic chickens. At poultry shows, breeders offered their birds for sale at highly inflated prices. With limited supply and elevated demand, their popularity grew until it ended:

Food Bubbles

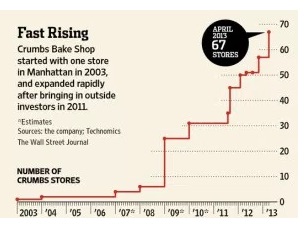

Cupcakes

In 1996 we had the first pricey cupcake. At a small NYC shop called Magnolia, the $3 gourmet cupcake was born. But it took an entrepreneur to start a chain called Crumbs for the bubble to inflate. Believing cupcake consumption was unstoppable, Crumbs’s production and prices shot skyward. They even charged $42 for a giant cupcake that fed eight people…and it sold!

The Huffington Post said we had reached “Peak Cupcake” when a Crumbs IPO let all of us join the frenzy. At first the stock was $13.10 a share during June of 2011. By June 30, 2014, it had plunged to 4 cents a share and Crumbs was closing all of its shops.

Now, reflecting the real end of the cupcake bubble, on December 31, 2025, Sprinkles, here since 2005, closed. Distinguishing Sprinkles, we could also cite the Sprinkles “A.T.M.” machines that accompanied sales with songs and a Sprinklesmobile (sounds like the Oscar Meyer Weinermobile).

Our Bottom Line: Bubble Analysis

In a 2015 NBER Working Paper, Yale Professor William Goetzmann, said we have a bubble when the market more than doubles in one year and then falls by more than a half during the next year. Then, by expanding his definition to 3 years, he included U.S. bubbles during the 1920s and 1990s. As for bubble probability, he concluded that when a market doubles in real terms in a single year, it has a 6.9% probability of halving in value during the following year. In addition, there is a 17.2% chance of halving in value over the subsequent five years. But most crucially, after more than 3500 observations, he identified only 4 crashes when the market more than doubled in one year and then fell by more than half during the next year.

As he explained, “…bubbles are booms that went bad.”

However…

“Not all booms are bad.”

My sources and more: Parts of this post were previously published at econlife. Then we’ve brought it up-to-date with this WSJ article, with Sprinkles demise, and added the feather bubble, the chicken bubble, and the Goetzmann paper.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)