Why There’s No Such Thing as a Free Bus

December 8, 2025

What Christmas Trees Say About the 2025 Economy

December 10, 2025At a bank in central Stockholm, during 2013, an aspiring bank robber was told he had selected a “cash-free” location. Sadly leaving with nothing, he asked a teller, “Where else can I go?” The answer then and now would be almost nowhere. Sweden has become increasingly cashless.

One source of our cashlessness is cbdc’s (Central Bank Digital Currencies).

Six Facts About Central Bank Digital Currencies

1. What is a cbdc?

CBDCs are virtual money. However, they are very different from bitcoin and its siblings because a country’s central bank issues and backs them. People with cbdcs sidestep the traditional banking system through their account with the government. To make a purchase, they can just open their central bank “wallet” on their phone or smart watch. Instantaneously representing how much you have to spend, the money is right there.

2. Which countries have a central bank currency?

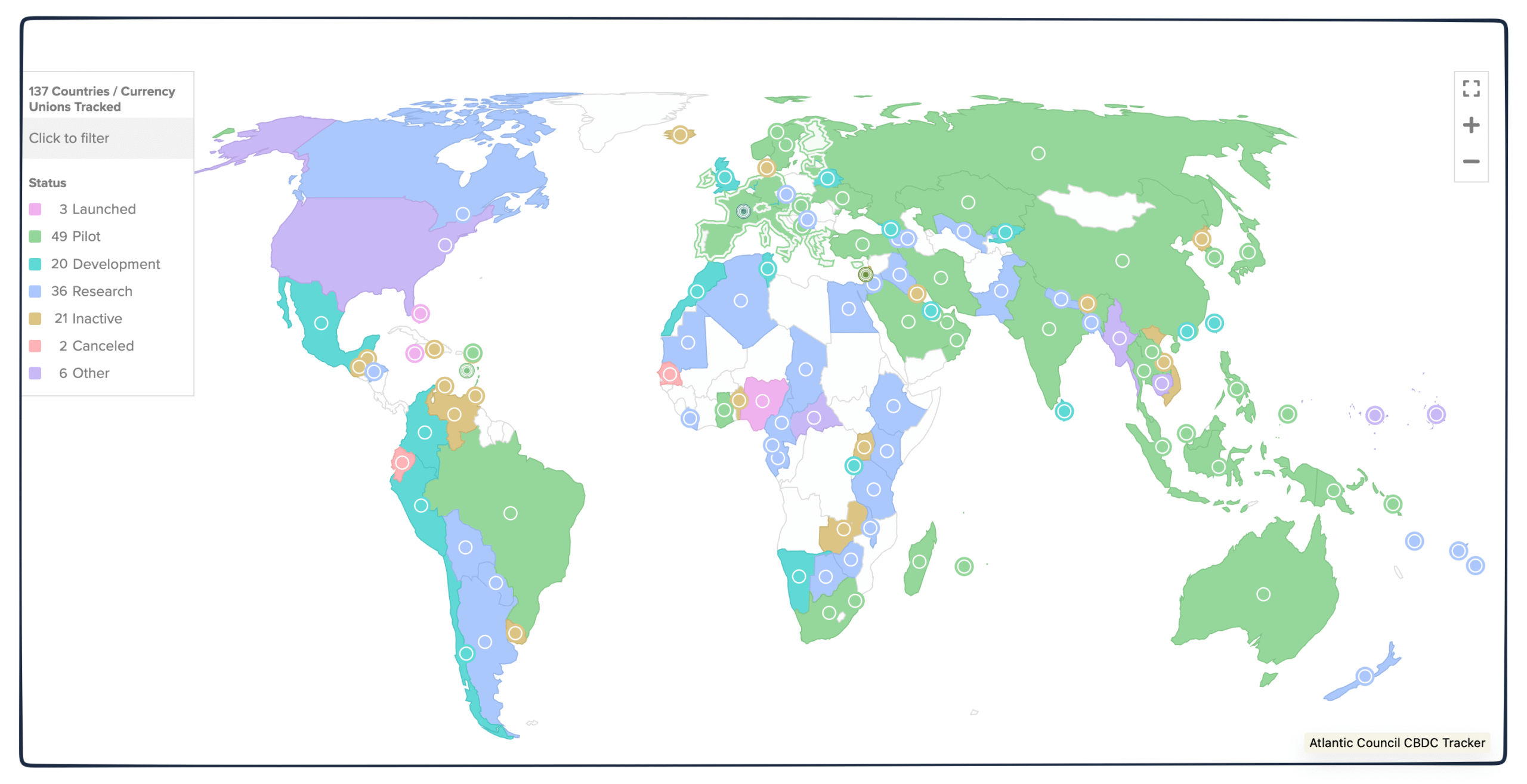

According to the Atlantic Council, while 137 countries are investigating CBDCs, only 3 have launched one. The Bahamas was first in 2020 with its Sand Dollar. Next Nigeria issued the eNaira in 2021 and Jamaica, the JAM-Dex in 2022.

3. Which countries are developing a central bank digital currency?

As for the other 134 countries, some have pilot projects, others are in the midst of development, and a third group is still doing research. The programs range from the Bahamas having launched years ago to the Trump cancellation of the U.S. program. Whereas President Trump’s executive order made the U.S. the only country to cease working on a retail CBDC, the U.S. remains a part of the collaborative Project Agorá that includes Japan, Switzerland, France, Mexico, England, South Korea.

Through its 2025 cbdc map, the Atlantic Council demonstrated how “one picture can be worth a thousand words:”

4. Which cbdc project is the largest?

As (reputedly) the largest cbdc initiative, Chinese banking authorities reported a transaction volume of a whopping 7 trillion e-CNY, the equivalent of $986 billion through 180 million wallets. To imagine it, just think of an image on your phone. Essentially, you are using a wallet that has a certain amount of “cash.” Through its digital yuan, China can see every transaction. It can detect criminal activity. It can even encourage more purchases by giving the money an expiration date.

5. What are the cbdc’s benefits? Concerns?

The benefits include lower retail and bank transaction costs. Issued by the central bank, the cbdc offsets the growing presence of non-government transactions that detract from central monetary authority. In addition, a digital wallet bypasses distortionary taxes and some believe it is safer than cash.

As you would expect, the big concern is privacy. Also, analysts cite cyberattacks and the ease of laundering money,

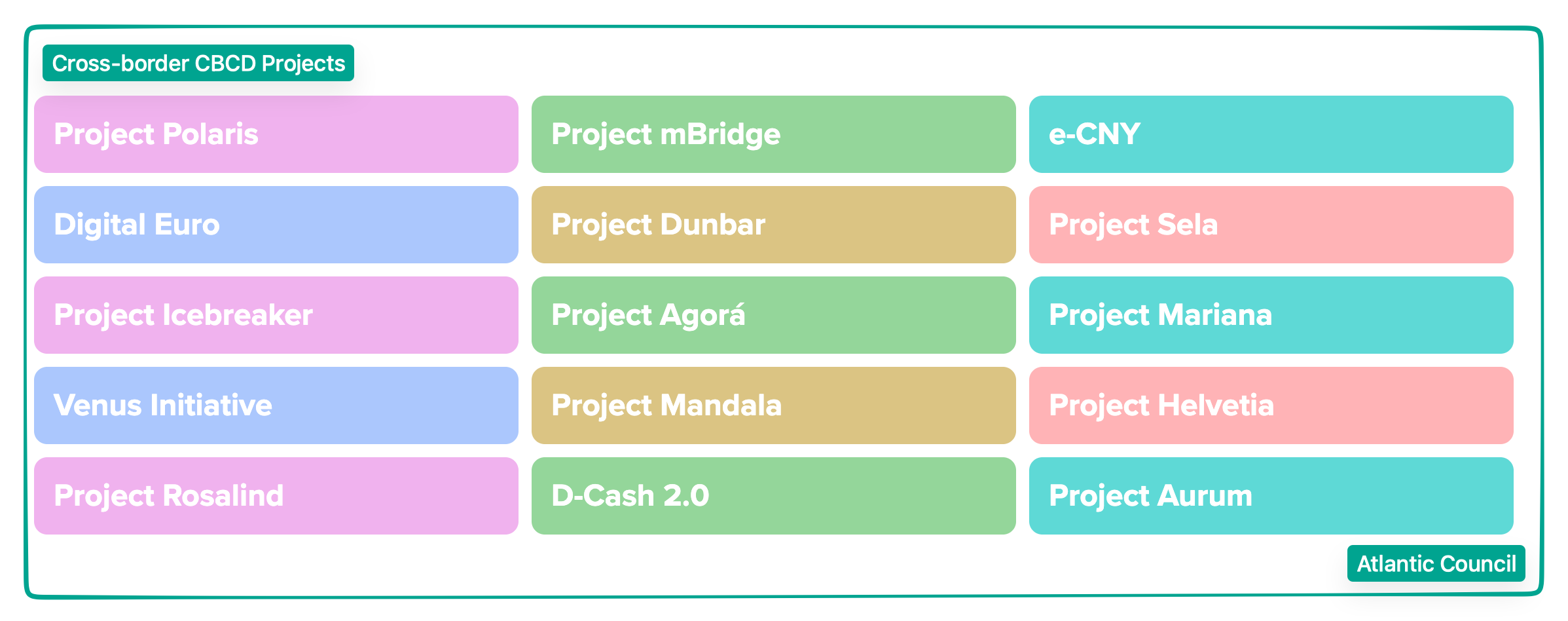

6. Beyond individual countries, where are the cbdc projects?

They exist as Cross Border Projects that could grease payments among nations.

Examples include…

- Venus Initiative: France, Luxembourg, and European Investment Bank

- Project Mandala: Bank for International Settlements Innovation Hub, Singapore Centre, Australia, South Korea, Malaysia, and Singapore.

Our Bottom Line: Friction

Just like physics, friction slows economic transactions. My favorite example of friction is the CVS message to callers. Making it tough to access a person, you wait for a hierarchy of instructions until the last one says you can talk with the pharmacy. That friction diminishes the incentive to speak with a human being.

Completely the opposite, (if it works) the CBDC reduces monetary friction.

My sources and more: An update, the Atlantic Council had it all. However FT, here and here had more analysis. But is you are still a bit puzzled, do read this letter from an IMF official to his mother.

Please note that several of today’s sentences were in a previous econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)