Just Ask Jenna Looks At Being Social

November 20, 2025

November 2025 Friday’s e-links: Why Bubbles Pop

November 21, 2025Concerned with a small slice of the top 1%, a California union wants a wealth tax for billionaires. Including stocks, art, and even intellectual property rights, the tax could be on the ballot after they collect 875,000 signatures.

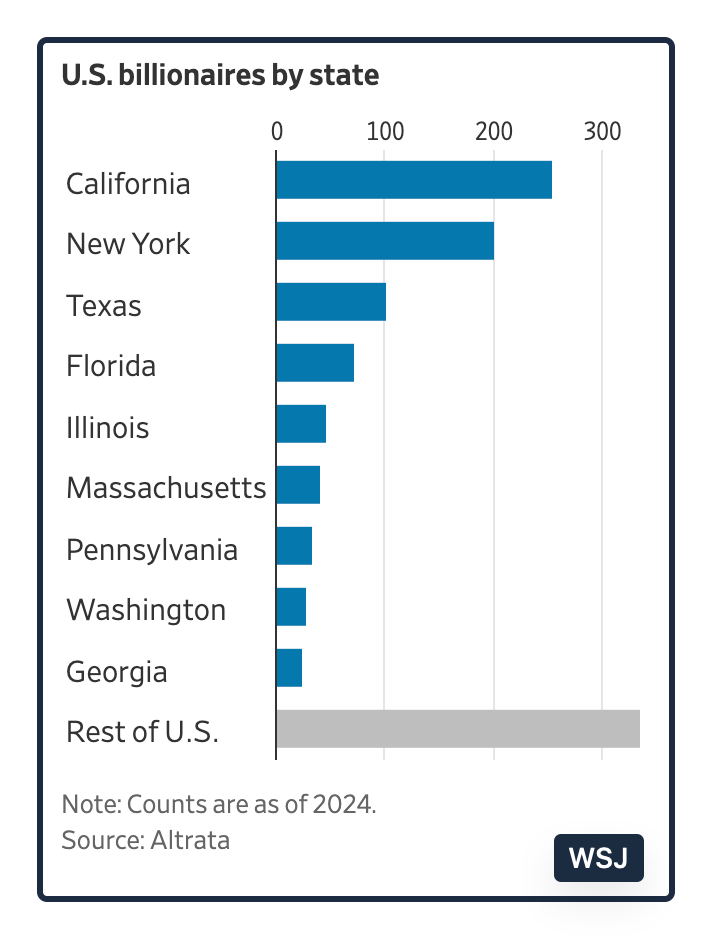

Topping the list, California has the most billionaires:

Although one economist called the initiative a “first-in-the-world-tax-like-this…,” wealth taxes have been here for a very long time.

The Wealth Tax

History

We could start our story in 15th century Italy when Florence levied its Catasto. Shifting from land related revenue to more liquid assets, the Florentine government needed more wartime funding. Through the “Law of the Catasto,” from 1427 to 1434, a government appointed 10-person commission documented city residents’ property. (Interestingly, the development of paper for bookkeeping helped to make the initiative feasible.) Sounding rather contemporary, one account included the following:

“The Florentine Catasto regulations…included evaluating multiple forms of wealth, exempting non-income-producing property, allowing deductions for family members, providing favorable treatment to productive assets, and excluding certain household members from the assessment.”

More recently, the wealth tax message is not quite as encouraging. Because of collection problems and disappointing revenue, repeals were typical:

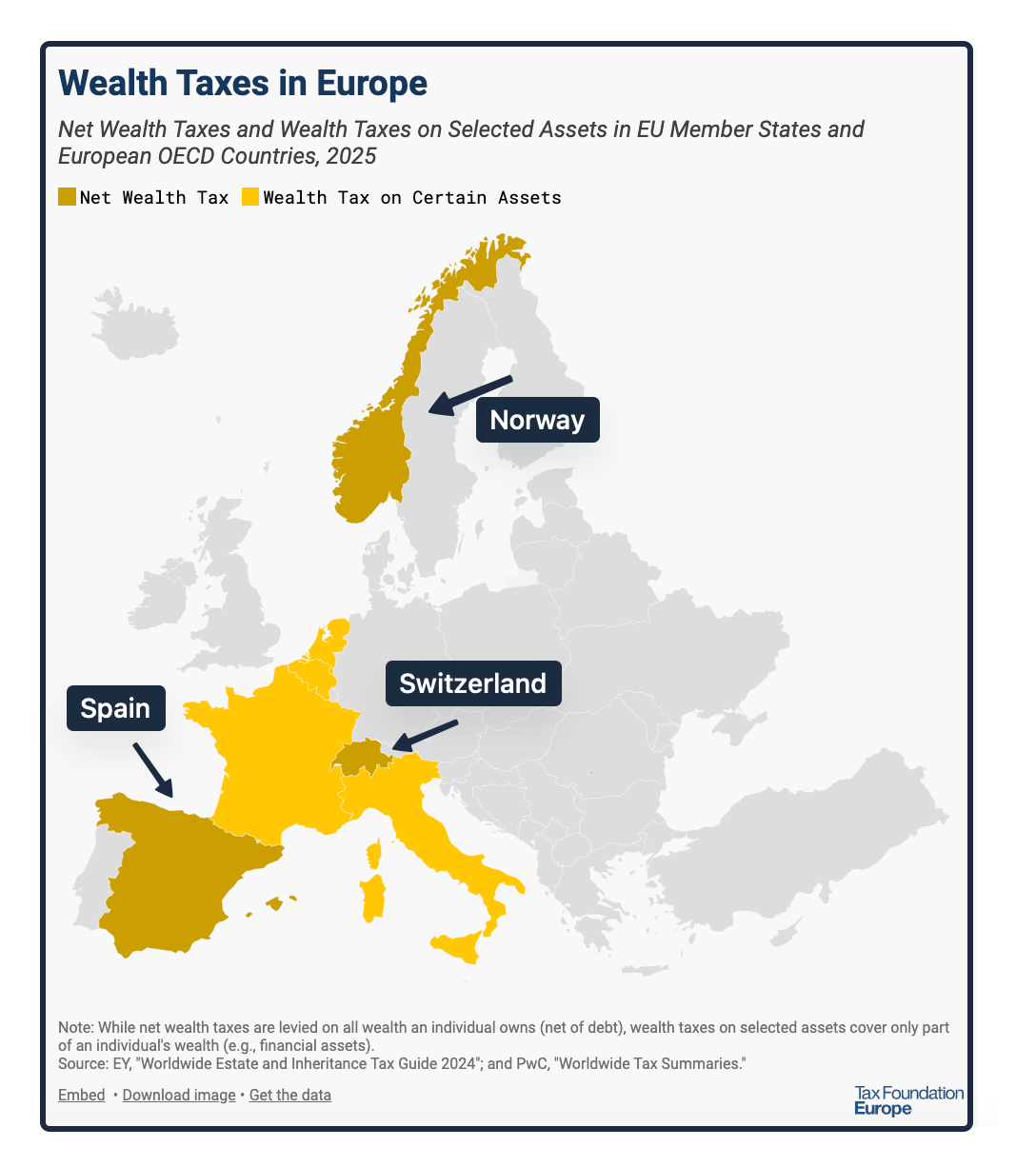

When we add Colombia to the list, we wind up with four OECD countries that currently have the net wealth tax.

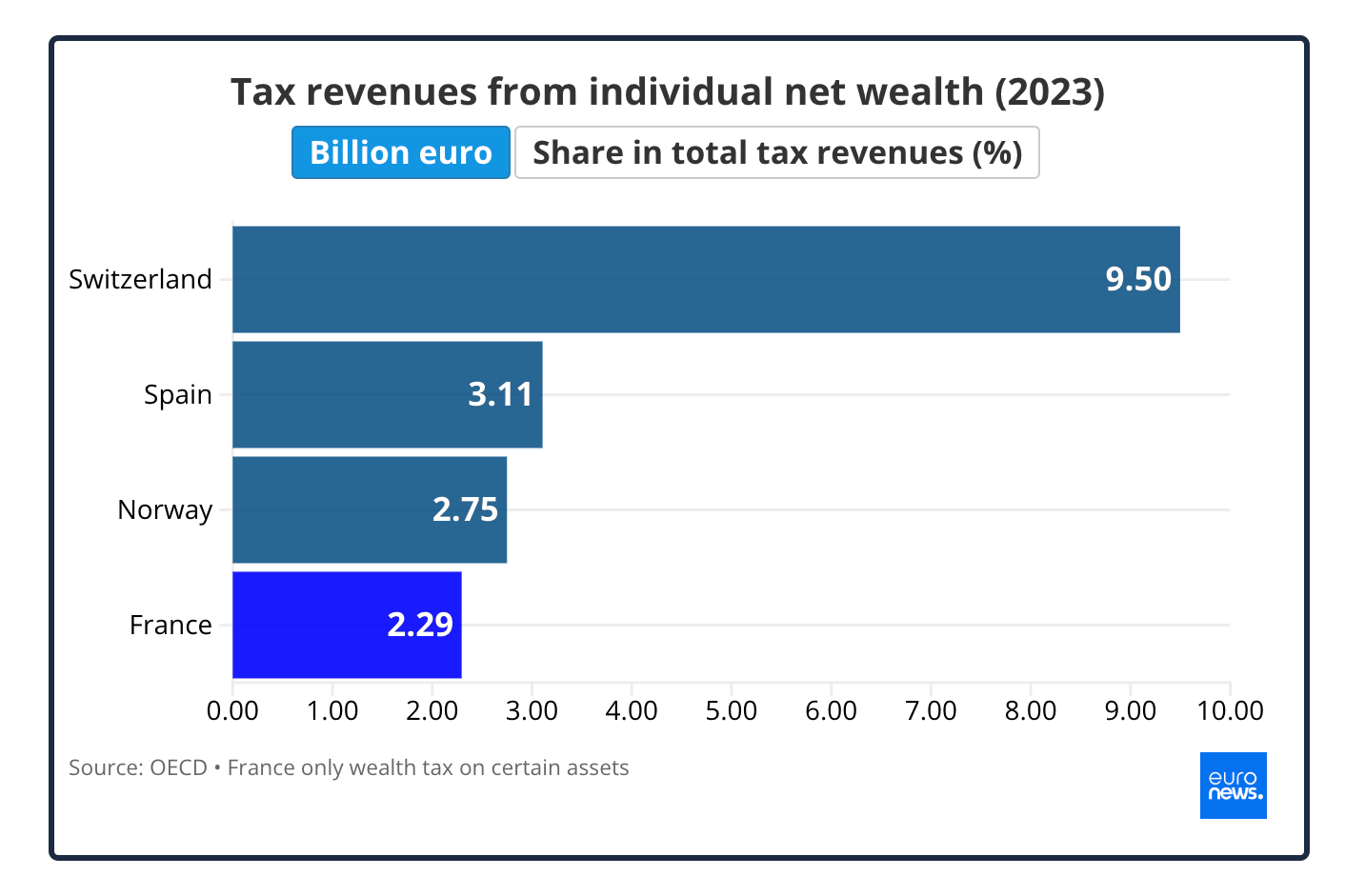

Shown below in billions of euros, at 4.3% of total tax revenue, Switzerland has had the most success. By contrast, Spain’s .6%, Norway’s 1.5%, and France’s more selective .2% make you wonder if the tradeoff was worth it:

Our Bottom Line: Inequality

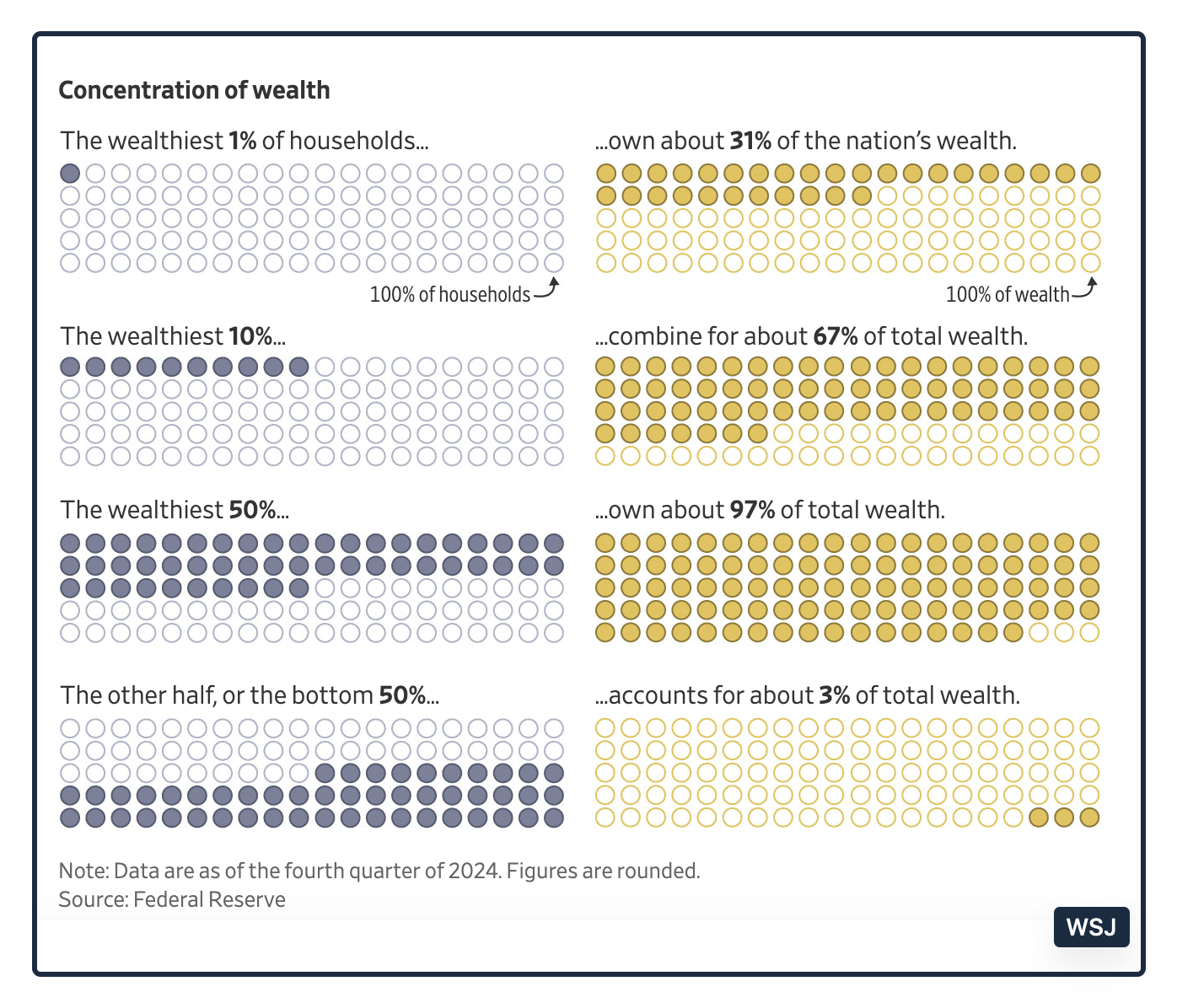

So, rather than revenue, it comes down to income distribution. Concerned with wealth concentration, supporters say we need some rebalancing:

According to the Wall Street Journal, if the California initiative passes, an individual’s $10 billion in wealth could cost $500 million. As a result, the tax nudges the affluent to move elsewhere. In addition to wealth flight, opponents worry that billionaires leaving the state would take with them a substantial chunk of California’s income tax revenue. They also point out that it can be tough to determine what is wealth, how to calculate its value, and to predict the impact of the the asset liquidation needed to pay the tax.

Discussing the issue, in 114 pages, the OECD asked if the tax could maximize efficiency and equity while minimizing administrative and compliance costs. I would add optimizing incentives as another question.

The answer?

It is complicated.

My sources and more: Thanks to this substack for reminding me to return to the wealth tax. From there, I discovered the California proposal and more about the wealth tax here, here and here. But always, my best source for tax facts has been the Tax Foundation. However, this Politifact discussion was most valuable because it explained the tax’s definitional challenges.

Please note that after publication, I edited our title to include “will.”

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)