How To Gobble 70.5 Hot Dogs

July 6, 2025

Who Wins When It’s Amazon v. Walmart?

July 8, 2025During December, 2024, the Dow Industrial Average touched a high but probably not a peak. Looking back, we would have seen the Dow with 492 all time highs between 1982 and 1999:

We could say, as did a guest on Slate Money’s Saturday podcast, that, “There’s a difference between the peak of a mountain and an all time high in markets.” A peak means you cannot go any higher. However, an all time high is a “provisional record until the next move up.”

The Dow is one of our yardsticks of those highs.

Let’s take a look.

The Dow Jones Industrial Average

As a number, the Dow Industrial Average indicates whether market participants expect its 30 components will fare well during the foreseeable future. Calculating the Dow’s numbers, they can’t just add up all of the stock prices and divide by 30. Instead, their formulas provide for continuity by accounting for an array of data fluctuations like stock splits. Then, beyond being a yardstick, as a changing list of 30 select companies, the Dow demonstrates the contemporary flavor of the economy.

Dow History

This was the first Dow Industrial Average:

After more than a century, GE, the last original member of the index, left the list during June, 2018. Replaced by the Walgreen Boots Alliance drugstore chain, the shift reflected an economy tilting to healthcare, finance, and technology:

The Current Dow

Among others, Amazon arrived during 2024 while Walgreens experienced a quick departure. Displaying additional changes, the 2025 Dow includes NVIDIA as one of its most recent additions:

Our Bottom Line: Financial Intermediaries

Acting as a financial intermediary that connects those that have money and the institutions that need it, stock markets are a process rather than a place. By determining the prices of securities and the quantities that are traded, stock markets help businesses raise money when they sell shares to the public. They also create liquidity for investors who want to trade stocks and bonds, they help governments fund their debt, and they raise money for corporations. Always though, as financial intermediaries, they link savers and borrowers.

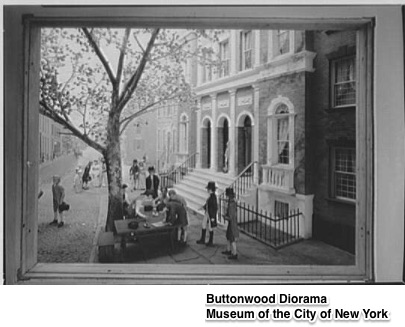

Our First Stock Market

From the beginning, even under a buttonwood tree during the 1790s, a stock market was a financial intermediary when the 24 men that had been trading government bonds and bank stocks under a Wall Street buttonwood tree made a deal. Hoping for more order, integrity, and better records, they created the New York Stock and Exchange Board through the Buttonwood Agreement. At the time, those hoping to sell stock through the exchange were asked to notify auctioneers so they could advertise beforehand. Once the auction began, the exchange president recited the listed stocks as brokers called out their bids and offers. Still, in 1865, having traded indoors for many years, they made the “calls” of stock twice a day.

The buttonwood tree (below) was toppled by a storm on June 14, 1865:

It wasn’t until the 1870s and the advent of continuous trading that they needed to signal an open and close. With continuous trading, you could buy and sell Monday through Saturday. At the time, the market opened at 10 a.m. and closed between 2 and 4 in the afternoon. Then, from 1887 to 1952, you could trade weekdays from 10 to 3, and Saturdays, 10 to noon. Next, after a series of changes that eliminated Saturdays, we wound up with today’s 9:30-4:00 trading day.

Returning to where we began, we have the Dow Industrial Average recording quantifiable fluctuations in stock market activity and, more obliquely, the composition of the economy.

My sources and more: Thanks to Slate Money for inspiring today’s post. Meanwhile, WSJ had the story of the GE departure from the Dow.

Please note that several of today’s sentences were in a past econlife post and our current list of the Dow’s components was from CNBC.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)