In China, yogurt sales are way up. But not instant noodles.

Where are we going? To measuring what the new Chinese consumer wants.

What White Collar Workers Want

FT tells us that we have a two speed China. As their jobs move to lower wage countries like Vietnam and Bangladesh, blue collar workers are purchasing less mass market beer and instant noodles. Meanwhile, white collar service sector workers have upped their demand for yogurt, pet food and premium products.

In a March 2016 McKinsey survey of 10,000 consumers in 44 Chinese cities, the shift to premium was evident:

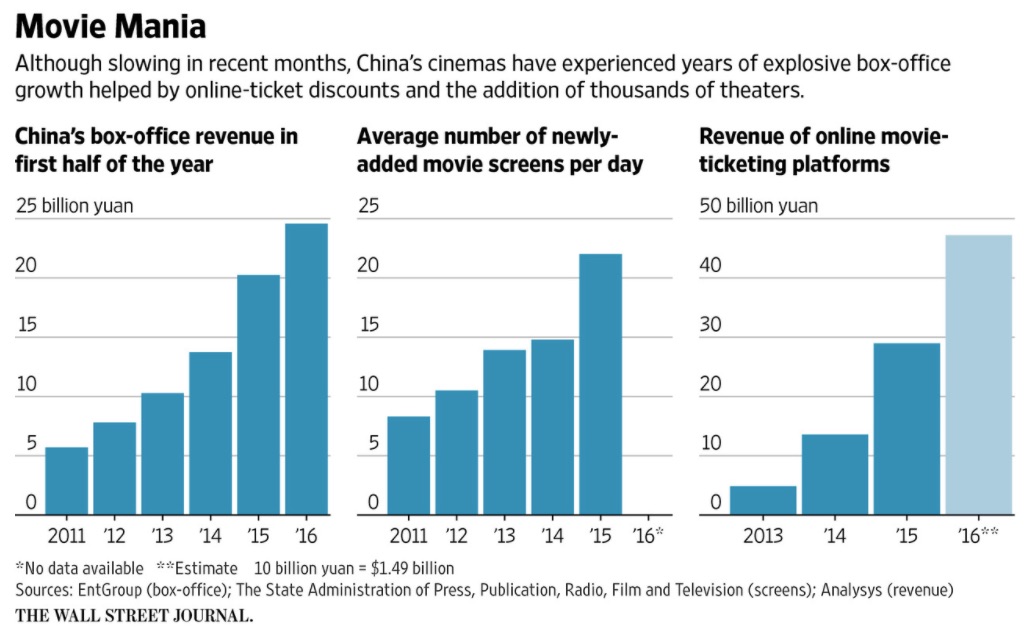

The Chinese consumer also cares more about health, travel and entertainment. Up by a 35.4% annual average from 2011 to 2015, movie going is soaring:

Our Bottom Line: Index of Services Production

China has a new index. Focusing on services production, it tracks restaurants, movies, acupuncture, theme parks and other services.

According to Bloomberg, China is moving its measurement emphasis away from steel and coal to a set of new indices. Shifting to information technology and advanced materials, the data are supposed to reflect China’s “new economy.”

It made sense for the U.S. to add R&D to our GDP. Similarly for China, as a policy tool, an up-to-date yardstick provides a more accurate economic snapshot.

China’s data shift reminds us that what we measure shows what we care about. And it tells us why even yogurt consumption can be meaningful.

My sources and more: The significance of the Chinese consumer comes across through this WSJ description of their Index of Services Production and Bloomberg’s discussion of other economic yardsticks. Then, more specifically, we can spotlight individual goods and services like yogurt and entertainment. Finally though, if you just want an overview, this McKinsey Report is ideal.