How the New Panama Canal Affects Us

July 24, 2014

Our Weekly Roundup: From the Invisible Hand to Invisible People

July 26, 2014Starting at $14 a week, you can walk out of Rent-N-Roll with a complete set of tires for your van, truck or car. The catch? By the time you have finished your weekly payments and the tires are yours, you probably will have given them more than twice the retail price. But, because Rent-N-Roll’s customers do not have the credit nor the cash to pay for 4 tires, renting is their only option.

Rent-N-Roll says that during the past several years their tire rental business has grown. Because the recession eroded credit ratings and increased joblessness, fewer people had the $800 or so they needed for 4 tires. Also though, the price of tires was inflated.

And that takes us to the tire tariff.

5 years ago, the Obama administration said US jobs could be saved with a 35% tax on tires from China. The tax achieved what US tire workers wanted. It made imported tires that had been subsidized by the Chinese government so expensive that many fewer entered the US. As a result, the US tire industry added 1200 jobs and placed an extra $48 million in workers’ pockets.

Elsewhere, though, the tariff took money out of our pockets. With tires costing us $1.1 billion more in 2011 because of the tariff, we could say that each additional job cost $900,000. Furthermore, other industries lost revenue and jobs—a 2,431 job loss total according to a Peterson Institute study—because spending on tires meant we had less to spend on other goods and services. Even Tyson and Purdue were affected because the Chinese retaliated with a tax on US chicken paw exports. (I have read that our chicken paws are unusually juicy—a fascinating tale we told at econlife.)

This is where the tire tariff created a ripple of costs:

From: Peterson Institute for International Economics “U.S. Tire Tariffs: Saving Few Jobs at High Cost”

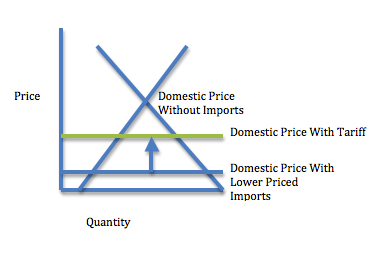

Using an economic lens, we would see that tariffs increase price by crossing the domestic supply curve at a higher point:

Our bottom line: So very charmingly, below, Nobel laureate Milton Friedman explains that tariffs can appear attractive because the job numbers they boost are visible while the costs to consumers and other industries are invisible. However, that concentrated benefit is far less than the diffuse cost.

Do watch the full 6 minutes. Dr. Friedman presents a wonderful banana example at the end.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)